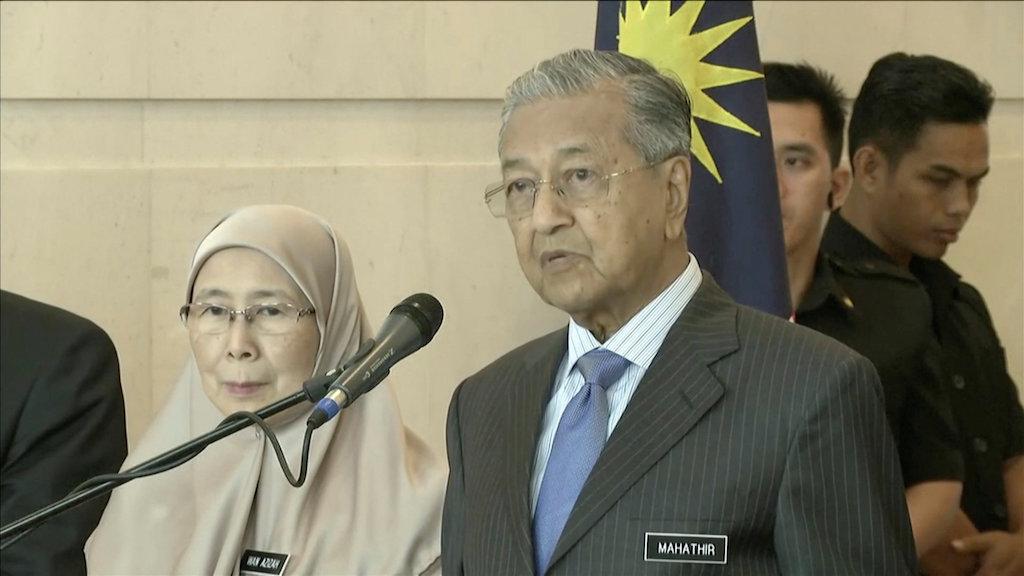

KUALA LUMPUR—Malaysian Prime Minister Mahathir Mohamad has accepted the resignation of the central bank governor, the latest in a string of departures as the 92-year-old leader purges top officials seen as close to the scandal-plagued previous government.

Angered over accusations of massive corruption, Malaysians delivered a shock election result last month by voting out a coalition that had led the country for the six decades since independence.