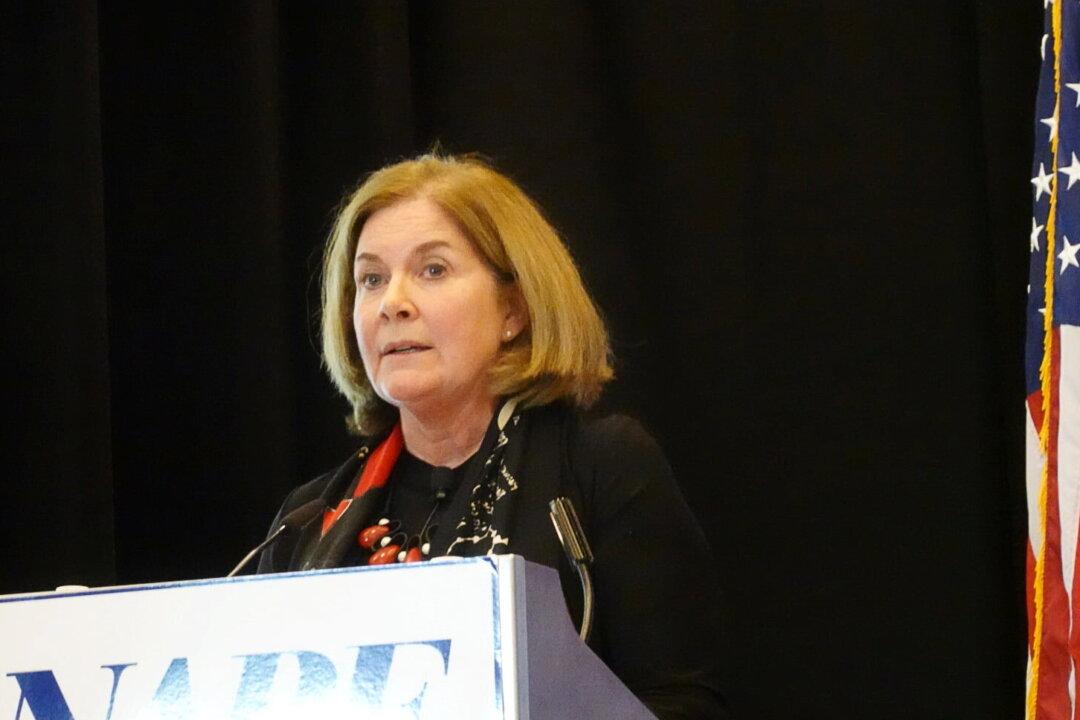

WASHINGTON—Abrupt changes to the federal funds rate could stress the economy and financial markets, with steady and well-communicated increases preferable given the uncertainty about how hard and fast rate hikes will hit business and household spending, Kansas City Fed president Esther George said on Monday.

With inflation running at a 40-year high, “the case for continuing to remove policy accommodation is clear-cut,” George said in remarks prepared for delivery to a labor-management conference in Missouri.