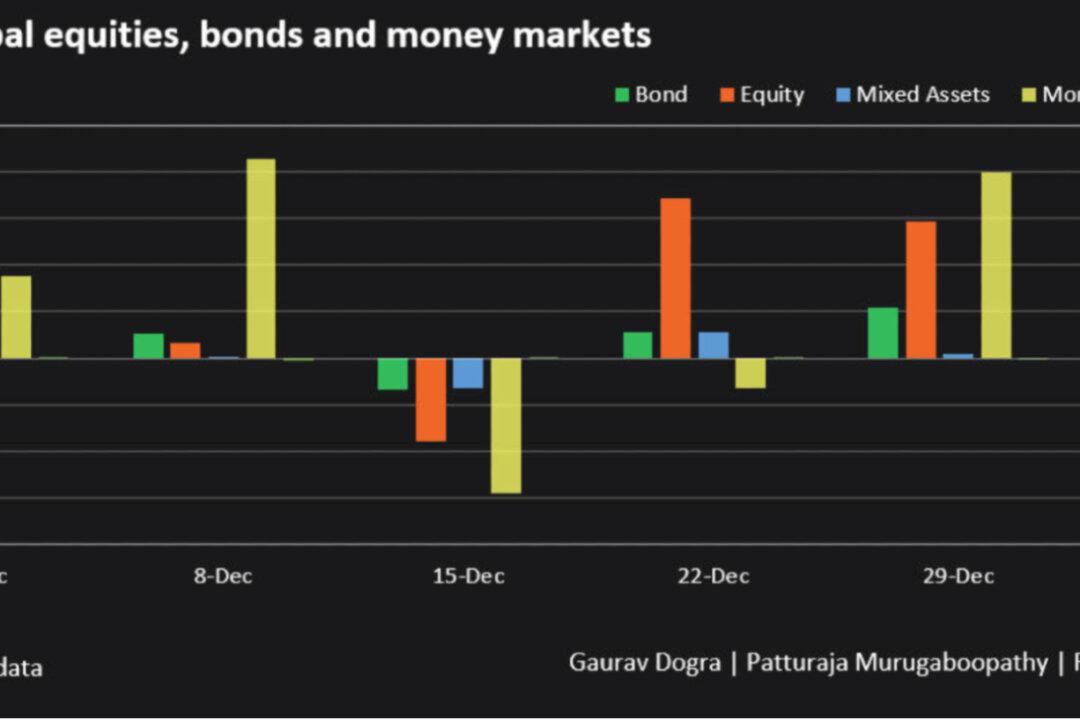

U.S. money market fund inflows have topped $280 million over the past two weeks, as many investors pull their bank deposits, according to a report.

The Financial Times reported that more than $273 billion has flooded into money market funds this month, for the biggest month of inflows since the height of the pandemic in 2020, according to data provider EPFR.