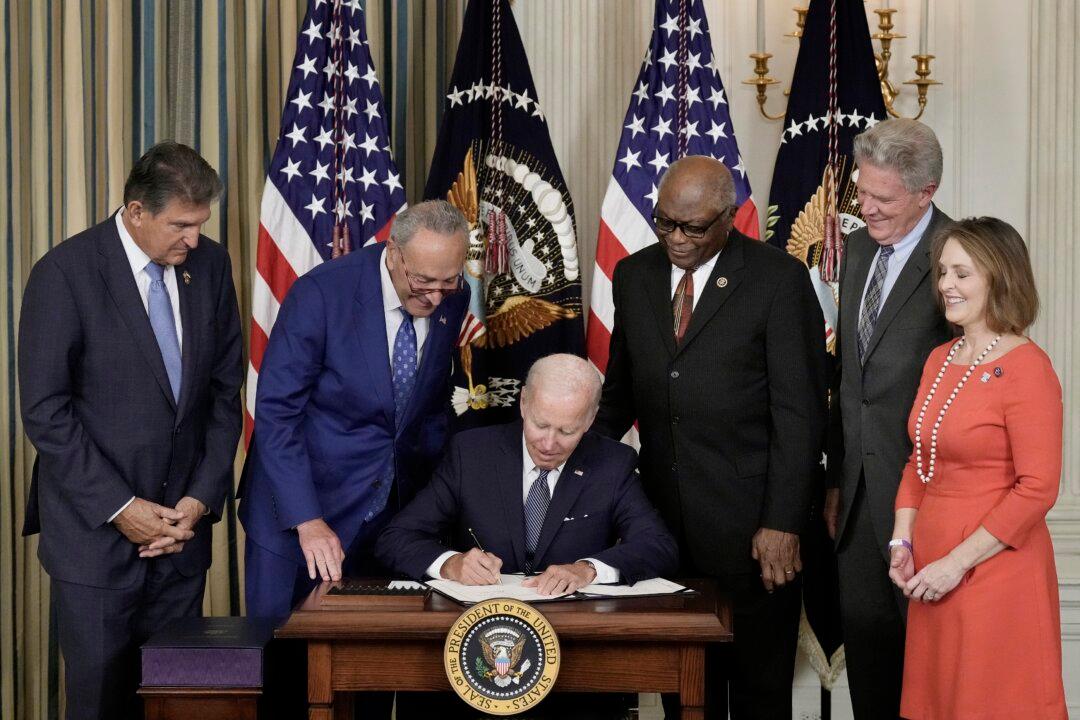

On Aug. 7, the U.S. Senate passed reconciliation bill H.R. 5376, the Inflation Reduction Act. The House of Representatives passed the reconciled bill on Aug. 12. The bill ended up being a slimmed-down version of President Biden’s $2.2 trillion “Build Back Better” bill. The original bill stressed a tightened social net and expanded green initiatives.

Swing Democrat Sens. Joe Manchin (W.Va.) and Kyrsten Sinema (Ariz.) managed to achieve concessions that limited social giveaways and some tax increases. But what’s in the bill, and how does it affect you?