NEW YORK—Groups that promote fair and equitable housing practices have identified what they called a civil rights challenge in the way that foreclosed homes are prepared for resale.

The National Fair Housing Alliance (NFHA), and other groups, released a report, “Here Comes the Bank, There Goes Our Neighborhood,” which found the curb appeal of bank owned homes in predominantly African-American and Latino homes to be significantly worse than those in white neighborhoods in three out of four areas studied.

The report documented a higher prevalence of issues like overgrown shrubbery, mail accumulation, graffiti, and unsecured doors or windows, in foreclosed homes in neighborhoods with predominantly African-American or Latino populations when compared with white neighborhoods.

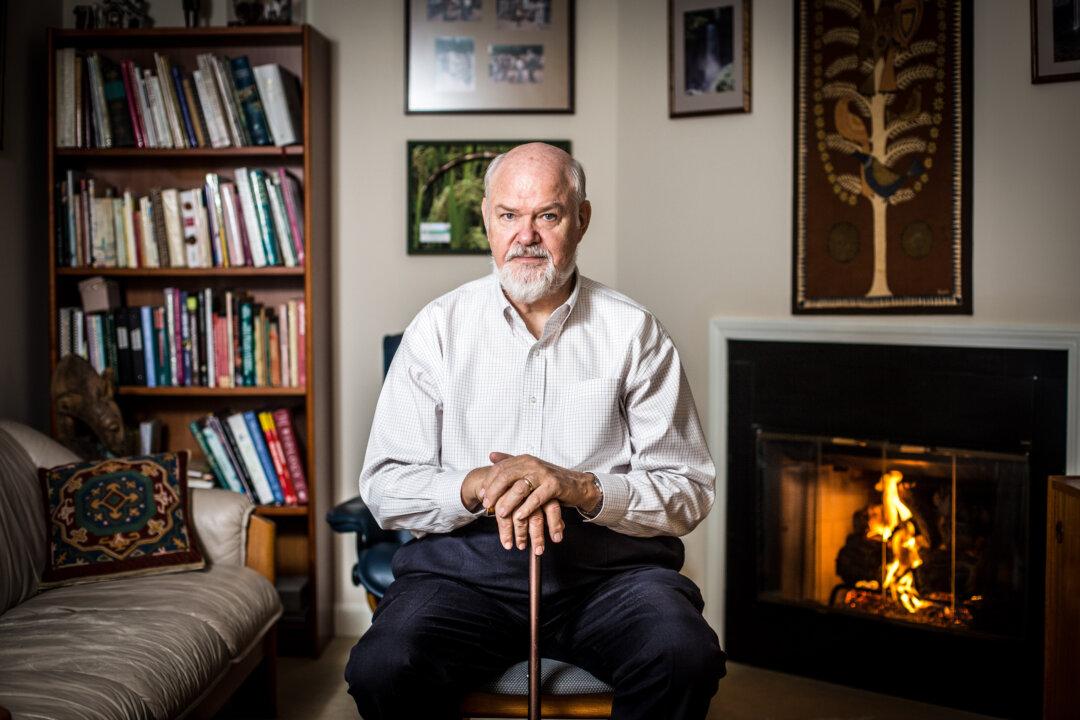

“We looked at a lot of really nice African-American neighborhoods where everybody else was taking care of their properties, and then you had this house with a dead tree in the front yard, with shutters down, ugly signs in the front, you know: auction, bank owned, warning signs. Some of them even had criminal tape around them. Just totally unnecessary and a harm to the neighborhood,” said Shanna Smith, president and CEO of NFHA.

Banks typically hire asset managers or real estate brokers to look after the maintenance and sale of foreclosed properties for them. It is in the bank’s interest to present their properties in the best possible light in order to maximize their profits, but a lack of oversight means that banks may not always be aware of what is happening out in the field.

Investigators used a 100-point scale to rate 640 homes in Maryland, Virginia, Connecticut, and Ohio. In three of the four areas, discrepancies, ranging from 8 points to 33 points, between minority and white neighborhoods were found. The Virginia study found problems across the board.

NFHA, and groups like it, have been criticizing the subprime and predatory practices of lenders for years, and it has been documented that the foreclosure crisis disproportionately affected communities of color.

This study is the largest of its kind. With its release the NFHA is hoping lenders and asset managers will understand that they are being watched, resulting in more equitable practices.

HUD regulations state that “failing or delaying maintenance or repairs of sale or rental dwellings because of race” is a prohibited action.

Under the Fair Housing Act, stakeholders may face legal action if evidence of discrimination is proven. The NFHA has been collecting detailed evidence, and is preparing legal action, mainly targeting specific asset managers.

The evidence collected by the housing alliance includes photographs of neighboring homes and the surrounding streets as a way of measuring and dealing with what can reasonably be expected from a home.

If the home wasn’t maintained to begin with, it wasn’t expected that large repairs like exterior painting would be completed by an asset manager.

This ensured that homes were assessed on their own terms, rather than the same standard being applied across the board. Care was taken by researchers to isolate the anomalies, where homes should have been maintained, but weren’t.

Researchers reviewed the homes repeatedly so as to document either improvements or lack of improvements. Most contracts require at least biweekly actions on the part of asset managers.

“We are going to continue our investigation over the next year,” said Smith.

The work of the housing alliance has been supported, and partly funded, by the largest owners of foreclosed homes in the nation: Fannie Mae and Freddie Mac.

Smith said that after some of the initial findings were communicated to the two mortgage giants, they both took immediate action.

“They pretty quickly had people go out and evaluate whether the photographs that we gave them were accurate,” said Smith.

Fannie and Freddie then reviewed the terms of contracts signed with asset managers, and requested NFHA to update training materials specifically to highlight legal requirements under The Fair Housing Act.

The new training, developed by NFHA, emphasized the importance of lenders hiring asset managers and real estate brokers with roots in the community.

Smith said the greatest source of discrimination are likely individuals who exercise personal biases against neighborhoods based on notions such as, “oh, that is a black neighborhood, I do not want to in there.”

Vacant homes that fall into disrepair can negatively affect home value in a neighborhood. Homes that languish without a sufficient effort to resell, also negatively impact local tax revenues.

NFHA is recommending that banks, federal regulators, and enforcement agencies familiarize themselves with the Fair Housing Act, and implement greater oversight of stakeholders to ensure equitable action in the sale of all foreclosed homes.

The National Fair Housing Alliance (NFHA), and other groups, released a report, “Here Comes the Bank, There Goes Our Neighborhood,” which found the curb appeal of bank owned homes in predominantly African-American and Latino homes to be significantly worse than those in white neighborhoods in three out of four areas studied.

The report documented a higher prevalence of issues like overgrown shrubbery, mail accumulation, graffiti, and unsecured doors or windows, in foreclosed homes in neighborhoods with predominantly African-American or Latino populations when compared with white neighborhoods.

“We looked at a lot of really nice African-American neighborhoods where everybody else was taking care of their properties, and then you had this house with a dead tree in the front yard, with shutters down, ugly signs in the front, you know: auction, bank owned, warning signs. Some of them even had criminal tape around them. Just totally unnecessary and a harm to the neighborhood,” said Shanna Smith, president and CEO of NFHA.

Banks typically hire asset managers or real estate brokers to look after the maintenance and sale of foreclosed properties for them. It is in the bank’s interest to present their properties in the best possible light in order to maximize their profits, but a lack of oversight means that banks may not always be aware of what is happening out in the field.

Investigators used a 100-point scale to rate 640 homes in Maryland, Virginia, Connecticut, and Ohio. In three of the four areas, discrepancies, ranging from 8 points to 33 points, between minority and white neighborhoods were found. The Virginia study found problems across the board.

NFHA, and groups like it, have been criticizing the subprime and predatory practices of lenders for years, and it has been documented that the foreclosure crisis disproportionately affected communities of color.

Affecting change

This study is the largest of its kind. With its release the NFHA is hoping lenders and asset managers will understand that they are being watched, resulting in more equitable practices.

HUD regulations state that “failing or delaying maintenance or repairs of sale or rental dwellings because of race” is a prohibited action.

Under the Fair Housing Act, stakeholders may face legal action if evidence of discrimination is proven. The NFHA has been collecting detailed evidence, and is preparing legal action, mainly targeting specific asset managers.

The evidence collected by the housing alliance includes photographs of neighboring homes and the surrounding streets as a way of measuring and dealing with what can reasonably be expected from a home.

If the home wasn’t maintained to begin with, it wasn’t expected that large repairs like exterior painting would be completed by an asset manager.

This ensured that homes were assessed on their own terms, rather than the same standard being applied across the board. Care was taken by researchers to isolate the anomalies, where homes should have been maintained, but weren’t.

Researchers reviewed the homes repeatedly so as to document either improvements or lack of improvements. Most contracts require at least biweekly actions on the part of asset managers.

“We are going to continue our investigation over the next year,” said Smith.

Fannie and Freddie on Board

The work of the housing alliance has been supported, and partly funded, by the largest owners of foreclosed homes in the nation: Fannie Mae and Freddie Mac.

Smith said that after some of the initial findings were communicated to the two mortgage giants, they both took immediate action.

“They pretty quickly had people go out and evaluate whether the photographs that we gave them were accurate,” said Smith.

Fannie and Freddie then reviewed the terms of contracts signed with asset managers, and requested NFHA to update training materials specifically to highlight legal requirements under The Fair Housing Act.

The new training, developed by NFHA, emphasized the importance of lenders hiring asset managers and real estate brokers with roots in the community.

Smith said the greatest source of discrimination are likely individuals who exercise personal biases against neighborhoods based on notions such as, “oh, that is a black neighborhood, I do not want to in there.”

Vacant homes that fall into disrepair can negatively affect home value in a neighborhood. Homes that languish without a sufficient effort to resell, also negatively impact local tax revenues.

NFHA is recommending that banks, federal regulators, and enforcement agencies familiarize themselves with the Fair Housing Act, and implement greater oversight of stakeholders to ensure equitable action in the sale of all foreclosed homes.