Greenlight Capital dropped its lawsuit against Apple on Thursday. The lawyers for the hedge fund submitted a filing to the federal judge in New York to withdraw all charges regarding the distribution of Apple’s cash reserves.

“Apple is a phenomenal company filled with talented people creating iconic products that consumers around the world love,” David Einhorn, manager of Greenlight, said on Feb. 7, when details of his lawsuit were revealed. “However, like many other shareholders, Greenlight is dissatisfied with Apple’s capital allocation strategy.” Einhorn’s fund owns 1.3 million Apple shares.

David Einhorn wanted Apple to create a new class of shares. The “iPrefs” as they could be called are preferred shares which pay a quarterly dividend for life. Earlier this week, he calculated the worth of the permanent preferred shares at $50 and the yearly dividend at $2. Distributing Apple’s wealth this way would substantially increase shareholder faith in the company, he claimed.

Meanwhile Apple decided to ask its investors to vote on whether it should change its corporate charter so that any issuance of “preferred” shares would require the approval of shareholders and not just management. But they put the proposal on a ballot which included four unrelated issues for which the shareholders could not vote separately.

Einhorn contended and won when he claimed that the move violated the Securities and Exchange Commission rules on shareholder votes. The “iPrefs” issue was still outstanding.

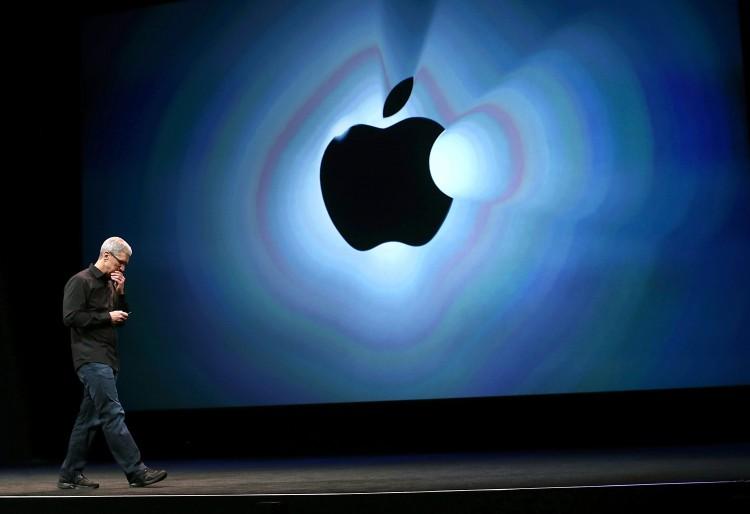

Einhorn sounded optimistic this week that Apple would carefully consider his proposal. But, Apple strongly resisted his overtures and even removed the topic from discussion in the shareholders’ meet last Wednesday. Apple CEO Tim Cook earlier derided the lawsuit as a “silly sideshow” and suggested that Einhorn and others disputing the subject should donate their money to charity instead.

Tim Cook told in the shareholders meeting last Wednesday that the company is still exploring all possibilities of efficiently spending its cash resources.

Shareholders’ Meeting

Shareholders’ dissatisfaction were also roused in the case of increasing executive pay. One third of them opposed proposal to increase Tim Cook’s salary by 51% to $1.4 million with an additional $4.17 million to be paid in compensation. Cook currently holds Apple stock worth $387 million.

Apple’s share has fallen from an all-time high of $705.07 five months ago, when the iPhone 5 was launched. It slumped to a 52-week low of $429.98 on Friday. This has wiped out nearly $260 billion of the company’s market value.

In another setback Friday, a federal judge in San Jose lowered Samsung’s bill to $599 million from the $1 billion that it had initially awarded Apple last year as damages in a patent infringement case.

The company’s shareholder meeting was met with a lukewarm response from the investors mainly due to the decline in stock prices and the delay in launching new products. There has been no new product launch since the current CEO took office. But Cook has reassured investors, “The company is working as hard as ever, and we have some great stuff coming” without revealing any concrete ideas or products.