NEW YORK—Daniel Mudd, the former chief executive officer of Fannie Mae, said on Wednesday that he would take a leave of absence from his current role as CEO of hedge fund Fortress Investment Group LLC.

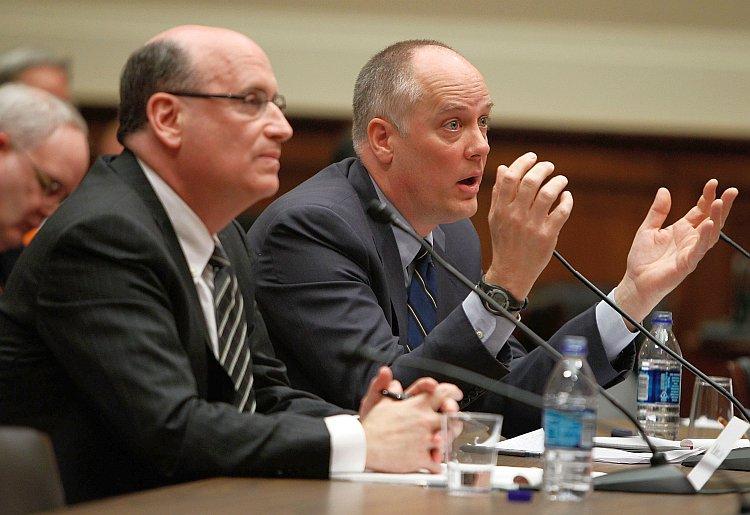

Mudd, along with former Freddie Mac CEO Richard Syron, was sued by the U.S. Securities and Exchange Commission (SEC) last Friday for allegedly misrepresenting billions of dollars worth of subprime mortgage-based assets held by their firms.

Mudd said in a statement: “I have requested a leave of absence from my position as chief executive officer to ensure that any time or attention I need to focus on matters outside of Fortress will not affect the business or operations of the company.”

Mudd joined the company in the fall of 2009, several months after stepping down from his previous role at Fannie.

Randal Nardone will take over as interim CEO of New York-based Fortress, which runs multiple private equity and hedge funds.

Lawsuits Against Mortgage Giants

In a press release, the SEC said that both Fannie and Freddie’s CEOs “knew and approved of misleading statements claiming the companies had minimal holdings of higher risk mortgage loans, including subprime loans.”

Such subprime loans, which were one of the causes of the recent financial crisis, collapsed as the housing bubble burst and led to Fannie and Freddie being put under federal conservatorship after massive taxpayer bailouts. In addition, the resulting turmoil in the financial markets sank investment bank Lehman Brothers Holdings Inc. and pushed insurance giant American International Group (AIG) to the brink of bankruptcy before federal bailouts.

Fannie and Freddie, both based in Washington, D.C., were created as government-sponsored enterprises by the federal government to encourage home ownership. The companies, combined, guarantee roughly half of all U.S. mortgages, making it easier for consumers to acquire loans by lowering their interest rates due to the guarantee. The firms, while publicly traded, were implicitly backed by the U.S. federal government.

A total of six executives from Fannie and Freddie were named as defendants in the SEC lawsuit.