Federal Budget Proposal Suggests Raising Taxes on Wealthy

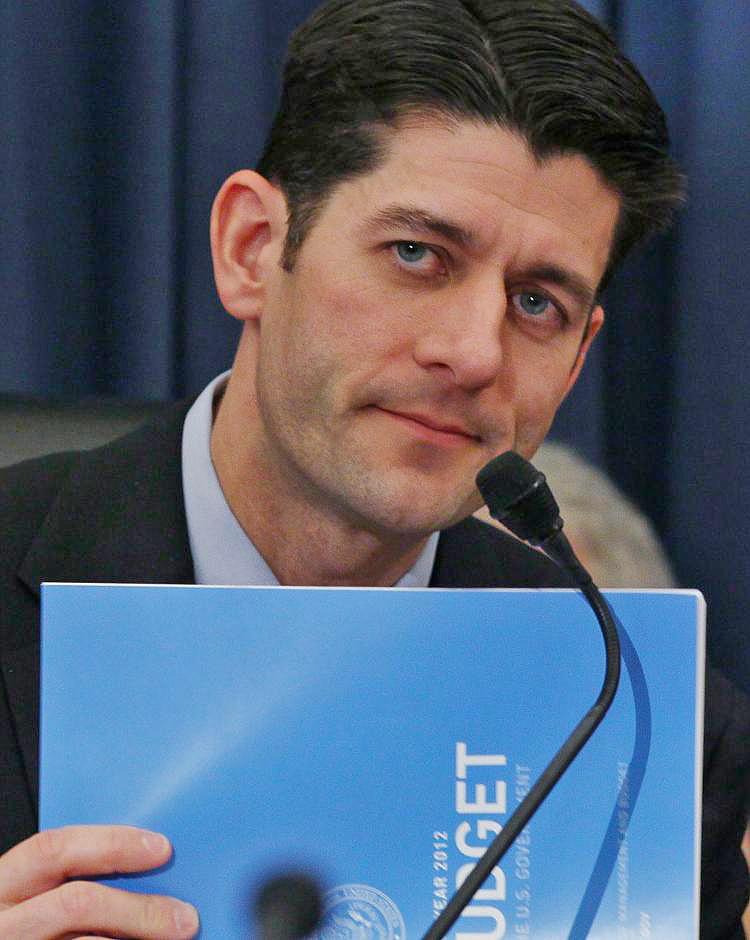

While Republican Paul Ryan and President Obama face off in the budget debate, another proposal, offers a hard-to-ignore solution that lowers the debt faster than the others, and has traction with the public. It is called the People’s Budget.

|Updated:

Reporting on the business of food, food tech, and Silicon Alley, I studied the Humanities as an undergraduate, and obtained a Master of Arts in business journalism from Columbia University. I love covering the people, and the passion, that animates innovation in America. Email me at andrea dot hayley at epochtimes.com

Author’s Selected Articles