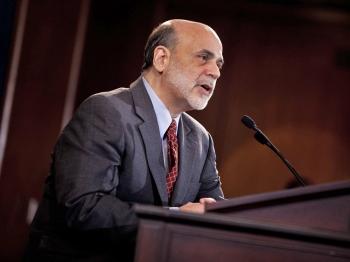

Fed Chairman Defends Decisions, Offers Rare Words on Budget Debate

In a historic first news briefing from the U.S. Federal Reserve, Chairman Ben Bernanke gave some much-needed color to talk of inflation and interest rates

Federal Reserve Chairman Ben Bernanke speaks during his first news briefing at the Federal Reserve's Board of Governors building April 27, 2011 in Washington, DC. Brendan Smialowski/Getty Images

|Updated:

Reporting on the business of food, food tech, and Silicon Alley, I studied the Humanities as an undergraduate, and obtained a Master of Arts in business journalism from Columbia University. I love covering the people, and the passion, that animates innovation in America. Email me at andrea dot hayley at epochtimes.com

Author’s Selected Articles