Thousands of volunteers brought together by former premier Bill Vander Zalm have fanned out across British Columbia to gather petition signatures with the aim of killing the controversial Harmonized Sales Tax, set to go into effect on July 1.

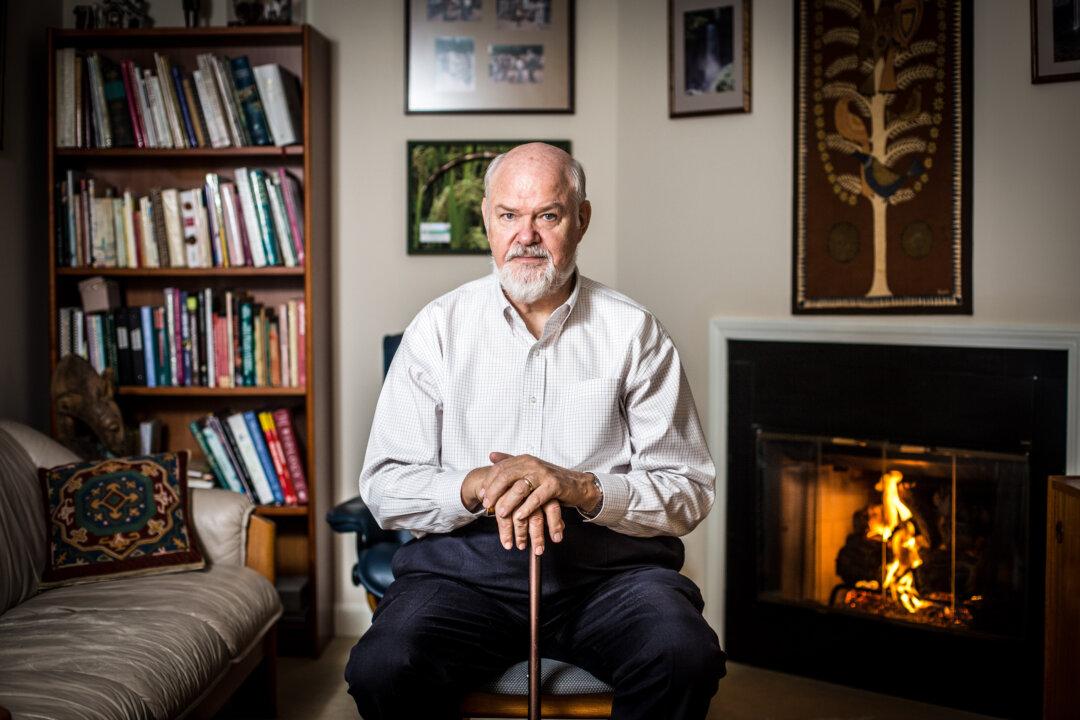

Seventy-five-year-old Vander Zalm, who has said the HST is “the wrong tax at the wrong time for the wrong reasons,” is attempting to take advantage of The Recall and Initiative Act, a piece of legislation he helped draft back in the early 1990s.

Under the act, in order to oppose a piece of government legislation, petition signatures must be collected from 10 percent of the registered voters in each of B.C.’s 85 electoral districts within exactly 90 days.

That amounts to about 300,000 signatures in all, although Fight HST lead organizer Chris Delaney says they’re aiming for more.

“We’re going for 15 percent so we’ll probably be in the neighbourhood of 450,000 signatures, just so that we’ve got a buffer zone in case there are signatures that aren’t correct and any of a number of things.”

Delaney says the response to the campaign, which began in Premier Gordon Campbell’s Point Grey riding on April 6, has been “absolutely overwhelming.”

By then the well-organized machine already had leaders and volunteer teams working in every one of B.C.’s ridings, holding rallies in areas previously visited by Vander Zalm, setting up petition signing centres and going door knocking, all while recruiting more volunteers along the way.

On the first day in Fort St. John, more than half the required signatures, 1,820 in total, were collected. Donations are also starting to pour in, including from businesses that are beginning to realize that the HST could negatively affect their bottom line, Delaney said.

The tax, which combines the GST with the PST, will be applied to everything the GST covered, including hundreds of items previously exempt from the PST such as restaurant meals, new homes, taxi fares, admission fees, energy bills, and cable.

There lies the rub for British Columbians, who are already paying yearly increasing gas prices thanks to Canada’s only carbon tax. An Ispos Reid poll last summer found that 85 percent of B.C. residents oppose the HST, with 71 percent strongly opposed.

Recognizing that the hardest hit will be lower income families and individuals and seniors living on a fixed income, the province is offering rebates to these groups. New homebuyers will also get a rebate, as will energy bills. The government says the HST will save taxes for businesses, resulting in more investment and jobs for British Columbians.

Restaurant owners are seeking an exemption from the tax because the extra 7 percent could come directly from their bottom line, according to Ian Tostenson, president and CEO of the B.C. Restaurant and Foodservices Association.

Initially looking for a concession during the budget earlier this year but not getting one, the association has launched its own petition which has so far received over 200,000 signatures.

If the Fight HST campaign succeeds and the petition is deemed valid by Elections B.C., the government would be forced to either introduce legislation into the house repealing the tax, or put the issue to a province-wide referendum.

Seventy-five-year-old Vander Zalm, who has said the HST is “the wrong tax at the wrong time for the wrong reasons,” is attempting to take advantage of The Recall and Initiative Act, a piece of legislation he helped draft back in the early 1990s.

Under the act, in order to oppose a piece of government legislation, petition signatures must be collected from 10 percent of the registered voters in each of B.C.’s 85 electoral districts within exactly 90 days.

That amounts to about 300,000 signatures in all, although Fight HST lead organizer Chris Delaney says they’re aiming for more.

“We’re going for 15 percent so we’ll probably be in the neighbourhood of 450,000 signatures, just so that we’ve got a buffer zone in case there are signatures that aren’t correct and any of a number of things.”

Delaney says the response to the campaign, which began in Premier Gordon Campbell’s Point Grey riding on April 6, has been “absolutely overwhelming.”

By then the well-organized machine already had leaders and volunteer teams working in every one of B.C.’s ridings, holding rallies in areas previously visited by Vander Zalm, setting up petition signing centres and going door knocking, all while recruiting more volunteers along the way.

On the first day in Fort St. John, more than half the required signatures, 1,820 in total, were collected. Donations are also starting to pour in, including from businesses that are beginning to realize that the HST could negatively affect their bottom line, Delaney said.

The tax, which combines the GST with the PST, will be applied to everything the GST covered, including hundreds of items previously exempt from the PST such as restaurant meals, new homes, taxi fares, admission fees, energy bills, and cable.

There lies the rub for British Columbians, who are already paying yearly increasing gas prices thanks to Canada’s only carbon tax. An Ispos Reid poll last summer found that 85 percent of B.C. residents oppose the HST, with 71 percent strongly opposed.

Recognizing that the hardest hit will be lower income families and individuals and seniors living on a fixed income, the province is offering rebates to these groups. New homebuyers will also get a rebate, as will energy bills. The government says the HST will save taxes for businesses, resulting in more investment and jobs for British Columbians.

Restaurant owners are seeking an exemption from the tax because the extra 7 percent could come directly from their bottom line, according to Ian Tostenson, president and CEO of the B.C. Restaurant and Foodservices Association.

Initially looking for a concession during the budget earlier this year but not getting one, the association has launched its own petition which has so far received over 200,000 signatures.

If the Fight HST campaign succeeds and the petition is deemed valid by Elections B.C., the government would be forced to either introduce legislation into the house repealing the tax, or put the issue to a province-wide referendum.