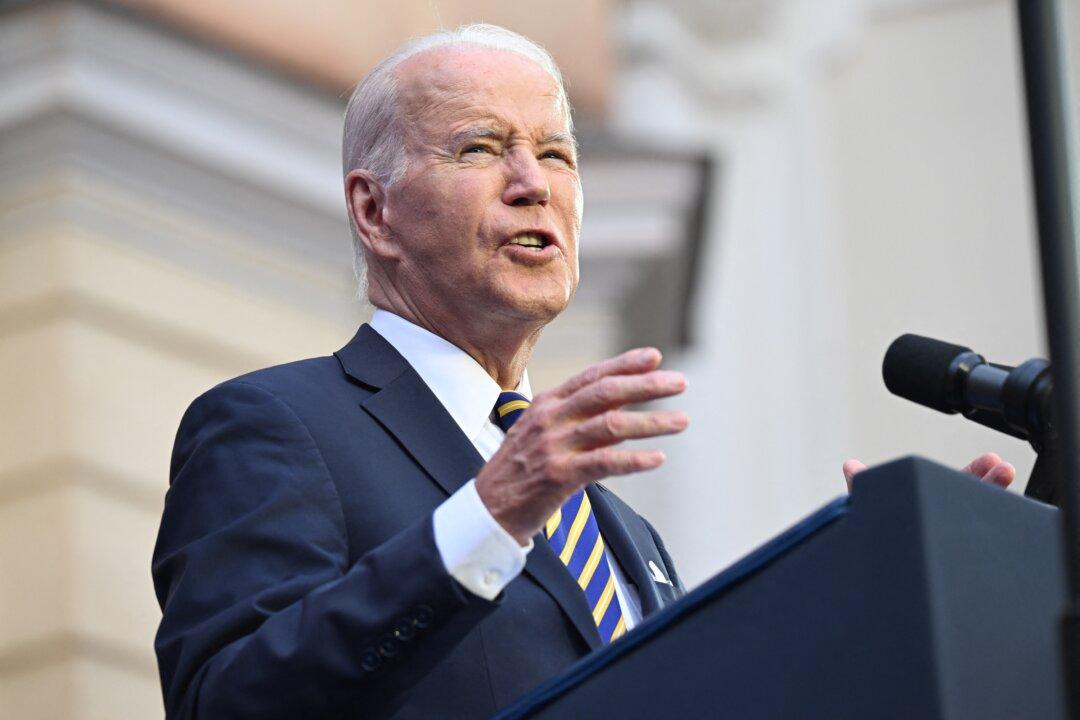

The Biden administration recently announced a $39 billion student loan forgiveness program aimed at individuals who have taken certain federal loans and are paying them back under the Income-Driven Repayment (IDR) plan.

The loan forgiveness is only applicable on loans that were made under the IDR plan provided the borrowers have made 240 or 300 monthly payments, which is equivalent to 20 to 25 years, according to a July 14 press release by the U.S. Department of Education (DoE). An IDR plan sets the monthly repayment at an amount aimed to be affordable for the borrowers based on their income and family size.