Economists: Bankers Play Down Economic Impact of Japan Disaster

Japan operations of the Bank of America, Merrill Lynch, Bank of New York, Citigroup, Goldman Sachs, and J.P Morgan are all okay.

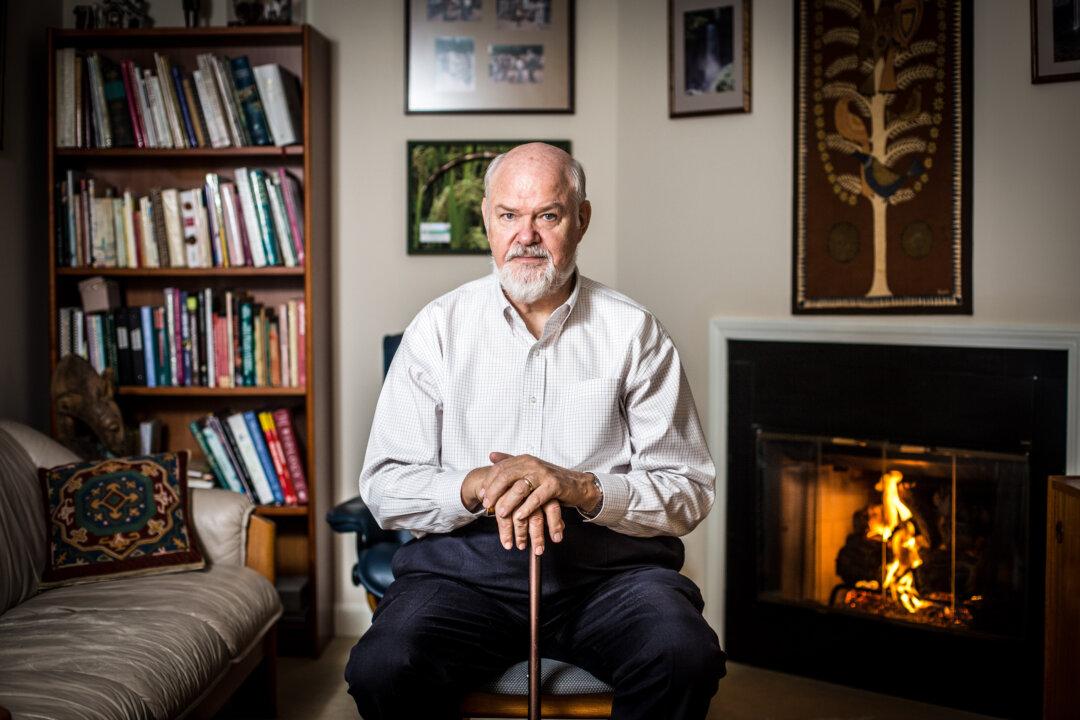

Japanese Prime Minister Naoto Kan speaks at a press conference at the prime minister's official residence in Tokyo on March 15, 2011. Kan told people living up to 10km outside a 20km exclusion zone around a quake-hit nuclear plant to stay indoors. STR/AFP/Getty Images

|Updated: