No matter how much politicians and Western observers want the Chinese economy to run on services and forget about manufacturing, we are a long way away from it.

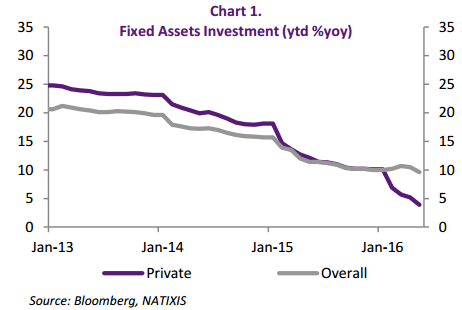

Case in point: In order to keep GDP from collapsing entirely in the second quarter, Chinese state enterprises boosted overall fixed asset investment to 9.6 percent growth over the year while investment by private companies languished at 3.9 percent.

Private investment is the lowest it has been in decades and the divergence between state and private is also striking.

Natixis