Now in 2023, China is again the focus of the economic outlook. Most forecasts, whether from the public or private sector, believe China will continue to be the key growth engine worldwide. Admittedly, China is producing a very high growth number compared to many other large economies. However, the 4-5 percent real GDP (year-over-year) growth rate corresponds to a composite Purchase Management Index (PMI) of 50, the boom-bust split. The Chinese government never explains why such markup exists, and not many in the market have ever questioned such an anomaly in forecasting.

Apart from this, everyone seems to believe without a doubt in the Chinese Communist Party’s assertion that the economy can be “restarted” at any time in any form at their wish. However, this works only on the supply side but not the demand side. For supply, it is always easier to pay the workers and turn on the machines. Yet demand depends on income and/or profits prospects as well as overall sentiment; the formers are economical, while the latter is psychological. Unfortunately, neither is favorable, given both housing and debt markets are deleveraging simultaneously.

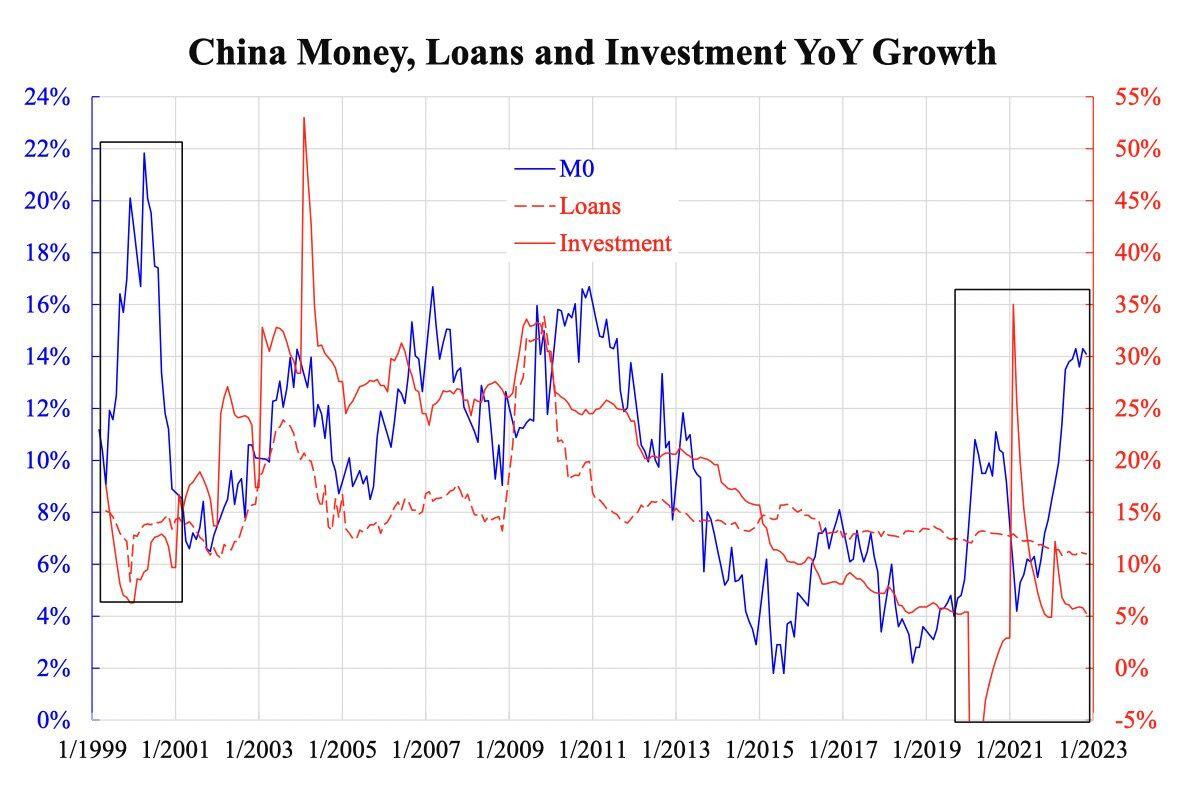

This can be verified from the behavior of monetary boost and the resulting real response. The key monetary policy tool is money creation which can be reflected by M0, the narrowest money definition; alternatively, a policy rate cut merely provides guidance to print more money to achieve a lower rate. Ideally, this should boost lending, which is mostly needed by investment. Investment is usually the key driver of GDP growth because of its relatively high volatility compared to consumption. Thus, the logic should be “money-lending-investment.”

Knowing which set of data to look at, it is easy to judge the effectiveness. The above chart shows all three together. The M0 series is smoothed out by removing abnormal movements due to the varying year-on-year date of the Lunar New Year. The M0 growth since late 2018 has been edging higher and higher, while the growth trends of loans and investment have remained sluggish. Any policy effect delay can be up to two years but not as long as three or four.

The period is quite similar to the episode of the end-1990s, where money creation was crazy while actual activities remained intact. Monetary policy cannot solve supply-side problems, as we have all experienced over the past two years. So, the failure of this monetary policy means demand weakness given the liquidity trap (i.e., zero interest rate) has not been reached.

Demand is never easy to boost because of the psychological component. Added that there have been a series of lockdown measures distorting the full population’s economic behavior. The longer or more serious the distortion, the longer it will take to normalize. And with a down cycle ahead, unemployment and business closures will worsen the situation.

Boosting demand is not as easy as boosting supply. Policies boosting only the latter will lead to excess supply, which means waste and disinflation (or even deflation).