The Chinese Communist Party’s announcement of new state controls that restrict exports of gallium and germanium on July 3 is retaliation for the West’s chip sanctions on the regime, according to a Taiwan-based defense expert.

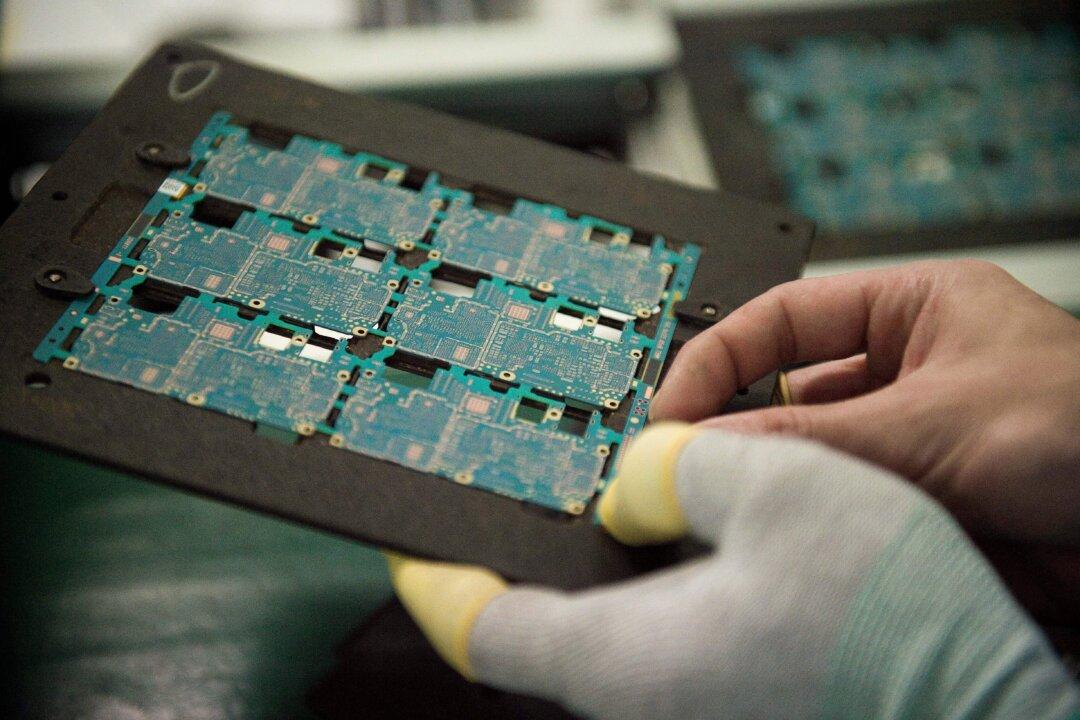

Su Tzu-yun, director of the Institute for National Defense Security Research in Taiwan, said that the move by China’s Ministry of Commerce and Customs related to the key rare earth metals used in making semiconductors is only symbolic in nature, as it will have a limited effect on the global chip industry. He said that the Chinese Communist Party’s (CCP) retaliation, effective on Aug. 1, will only accelerate the “de-risking” priorities of the United States and Europe, which may see China lose its current dominant position in the rare metal industry.