The People’s Bank of China (PBoC) cut the required reserve ratio (RRR) by 25 basis points (bps) for all financial institutions. The mouthpiece claimed a release of 500 billion yuan (or over 70 billion U.S. dollars) in just one cut, but if this had been the case, then the trillion-debt crisis would have been resolved easily with a series of few more cuts. RRR cut is nothing but the removal of banks’ lending limits. Nevertheless, the problem now is not hitting the lending ceiling, that is, not a lack of loan supply; rather, it is the loans demand that has been too weak.

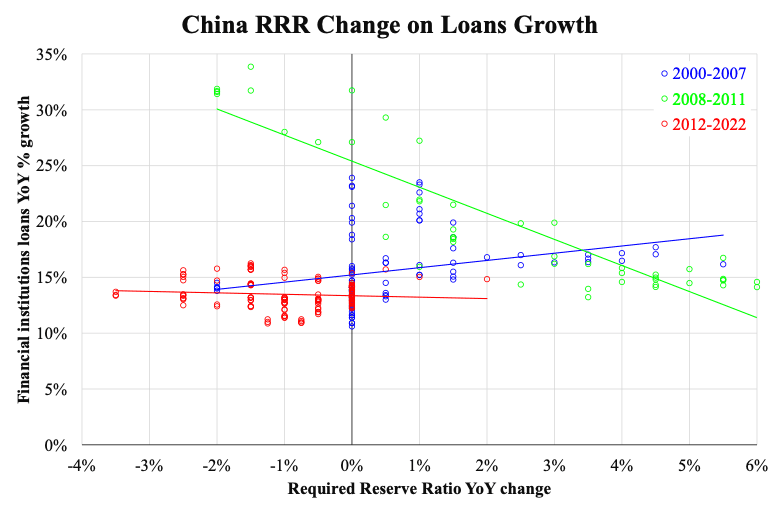

The best way to see this is to examine the direct relationship between RRR and loans by financial institutions. The accompanying chart shows the scatter plot of them where both are in year-over-year (YoY) growth. If RRR were an effective tool, we should see a negative relationship between its cut and loan growth. Yet this is not always the case; from the beginning of loan growth data from mid-1999 to now, only four years out of this 23-year period display a negative relationship.

The financial tsunami was a hard hit on the U.S. but never on China. Although China’s stock market indexes dropped 80 percent over time, the economy was not much affected. This was evidenced by the double-digit GDP growth seen before 2007 and right after the 2011 crisis, where housing prices did not correct by much. Without experiencing a truly negative shock, the strong boost from a sharp cut of RRR around 2008 did happen as expected. Loans growth surged to over 30 percent a year after the policy stimulus. What happened to the rest of the period, then?

Before the financial tsunami, the relationship between them was slightly positive. That was the period of China’s boom right after joining World Trade Organisation. The story was simple, and the logic was the other way around: it was the lending boom that led the PBoC to raise RRR to curb the overheating. Therefore, a positive co-movement of both going up was observed.

After the financial tsunami, China was declining, and GDP growth fell from double-digit to low single-digit. However, the decline was prolonged and continues until now, albeit a so-called soft landing has been achieved so far. Investors (sellers) and consumers (buyers) have both lost patience, and their behaviour is by now not much altered by monetary policy. Accordingly, loan growth remained at a similar level regardless of the change in RRR, as is shown by the red circles and trendline. Mainlanders term this as “lying down.”