NEWS ANALYSIS

China’s manufacturing and export sectors are getting clobbered by U.S. tariffs. But the ruling communist regime is trying to keep the economy from decelerating by encouraging debt-fuelled growth.This may smooth out hiccups in the short term, but it is not a cure-all and can create bigger headaches in the long run. Also worrisome for Chinese authorities is that it suggests the narrative of China moving from an investment-driven economy to a domestic consumption-driven economy is not happening.

The CBB is a research service that speaks to thousands of companies and bankers on the ground in China every quarter. Its Early Look Brief, released on Sept. 23, is based on its full quarterly results for 2018’s third quarter.

“There are parallels with mid-2015—alarming parallels, given how poorly that year ended and 2016 began,” the CBB’s brief said.

The late summer of 2015 saw a shock devaluation of the yuan as capital outflows mounted, debt surged, and companies defaulted. Chinese stock markets also plummeted.

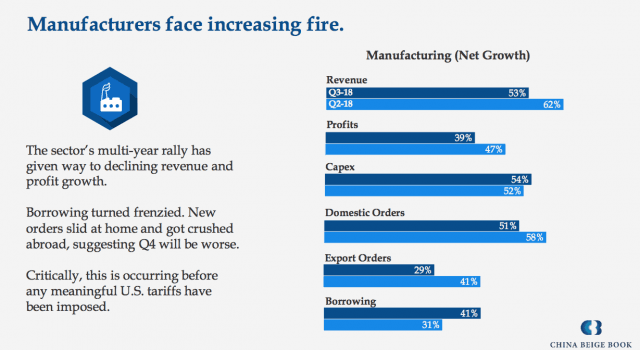

Manufacturing has been on a tear over the last two years, but the past two quarters have been difficult. Tariffs are exacerbating the situation and pushing manufacturers to borrow, explains CBB economist Leyton Nelson. The CBB reports that, not only did 40 percent of manufacturers borrow in the third quarter, but over half that borrowed said the loan amounts were more than last quarter.

Chinese banks aren’t charging more interest despite greater demand for loans—and potentially weakening credit risk.

One has to question the longer-term implications this has for the banking sector, aside from the health of manufacturers as tariffs broaden.

“Critically, manufacturing’s plight is occurring before any meaningful American tariffs have been imposed,” the CBB said.

Chinese policymakers know manufacturers face considerable headwinds and need access to cheap credit. Revenue, profits, and orders are all down, while borrowing is up.

“If China’s economy continues to see slowing growth, what we could see is a return to a level of credit stimulus that we haven’t seen in years. Q3 may already be a start to that,” said Nelson in an email.

Overall, loan applications were the highest since 2013, with record lows for rejections for state-owned enterprises and in retail and services.

Nelson explains that for the last several years, changes to China’s financial markets have incorrectly been interpreted as deleveraging. The authorities are trying to crack down on the shadow-banking sector, tighten credit, implement risk controls, and make borrowing more expensive.

“These are all good changes, but they’re not the same as deleveraging,” he said.

Deleveraging won’t happen unless companies stop borrowing and pay down debt, which isn’t happening when certain sectors like manufacturing and exports face serious challenges.

“Now we’re seeing the inevitable slowdown [in manufacturing],” Nelson added.

China’s industrial northeast is being hit the hardest. “Every sector there slowed substantially; profits, investment, and hiring became less widespread,” the CBB said.

The impacts on Chinese inflation are mixed. The CBB reports wage and pricing growth are steady, but input (supply-side) inflation is quickening.

The CBB also reported that third-quarter export orders tanked, when compared with the second quarter and 2017.

“Domestic orders have slowly faded from their peaks, indicating the domestic market won’t come to the rescue,” the CBB said.

With the bright spots for the third quarter being investment spending, the narrative of China moving to a consumption-based economy appears to be on hold for the time being.

And the fourth quarter of 2018 looks even worse.