Commentary

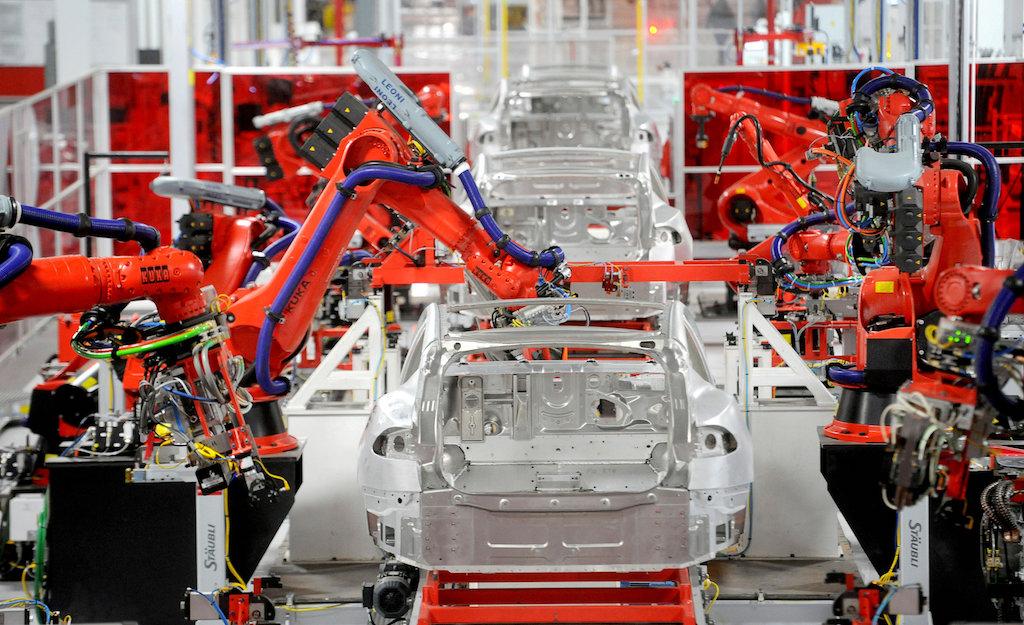

The manufacturing sector in California is expected to be fully healed by the end of June, according to a recently released survey of California Purchasing Managers.

The manufacturing sector in California is expected to be fully healed by the end of June, according to a recently released survey of California Purchasing Managers.