Tens of thousands of concerned investors have flooded Congress with letters demanding answers to what exactly happened surrounding Meta Materials Series A preferred shares, also known as MMTLP.

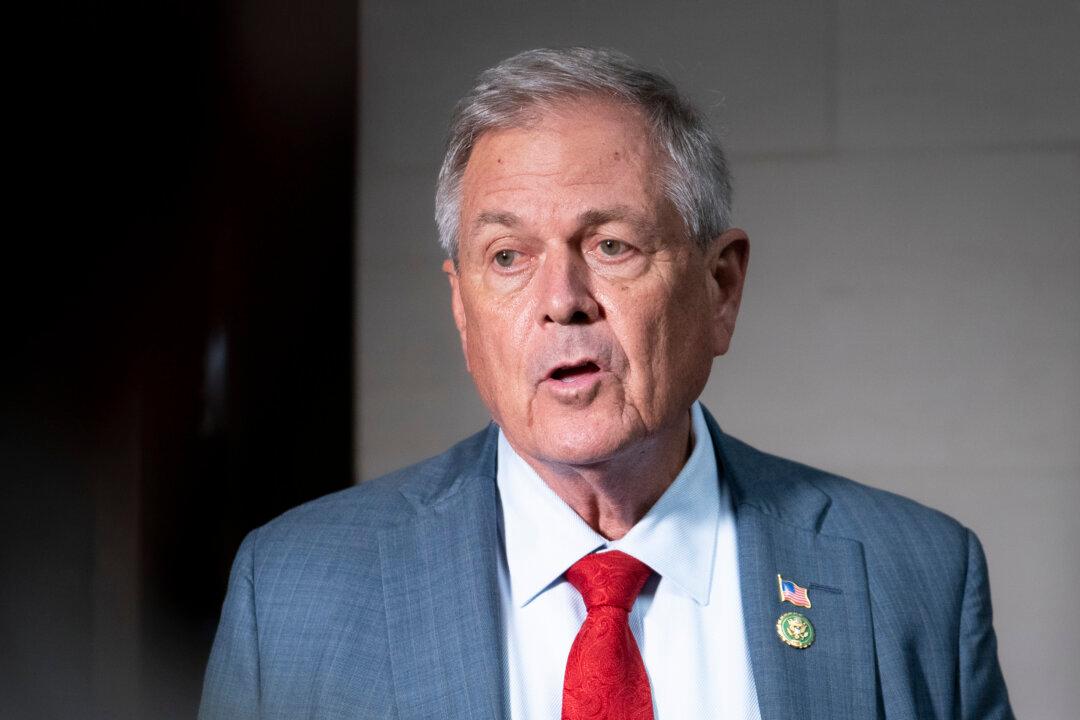

Dozens of congressional representatives, including Rep. Ralph Norman (R-S.C.), penned a letter to Securities and Exchange Commission (SEC) Chair Gary Gensler and Financial Industry Regulatory Authority (FINA) president and CEO Robert Cook, requesting that they review the circumstances regarding the merger between Meta Materials and Torchlight Energy Resources and the subsequent spinoff of a new company called Next Bridge Hydrocarbons.