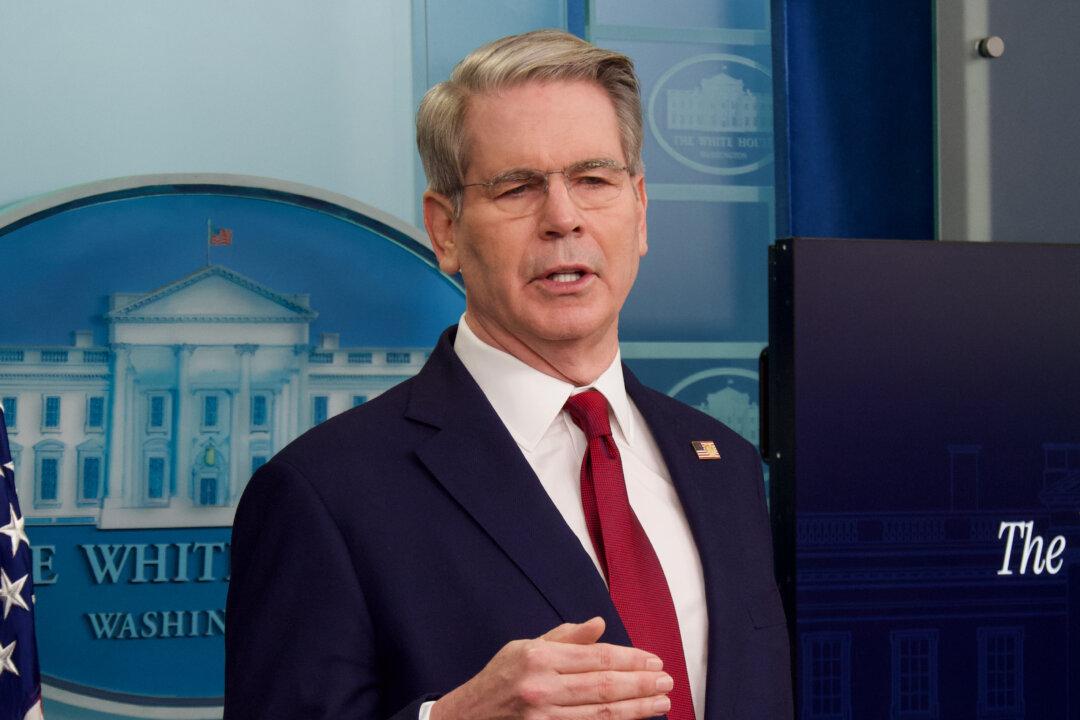

Interest rates will come down if the Trump administration can remove the U.S. government’s credit risk, says Treasury Secretary Scott Bessent.

In a May 5 speech at the Milken Institute Global Conference, Bessent touted President Donald Trump’s economic agenda, saying it will deliver a “golden age economy.”