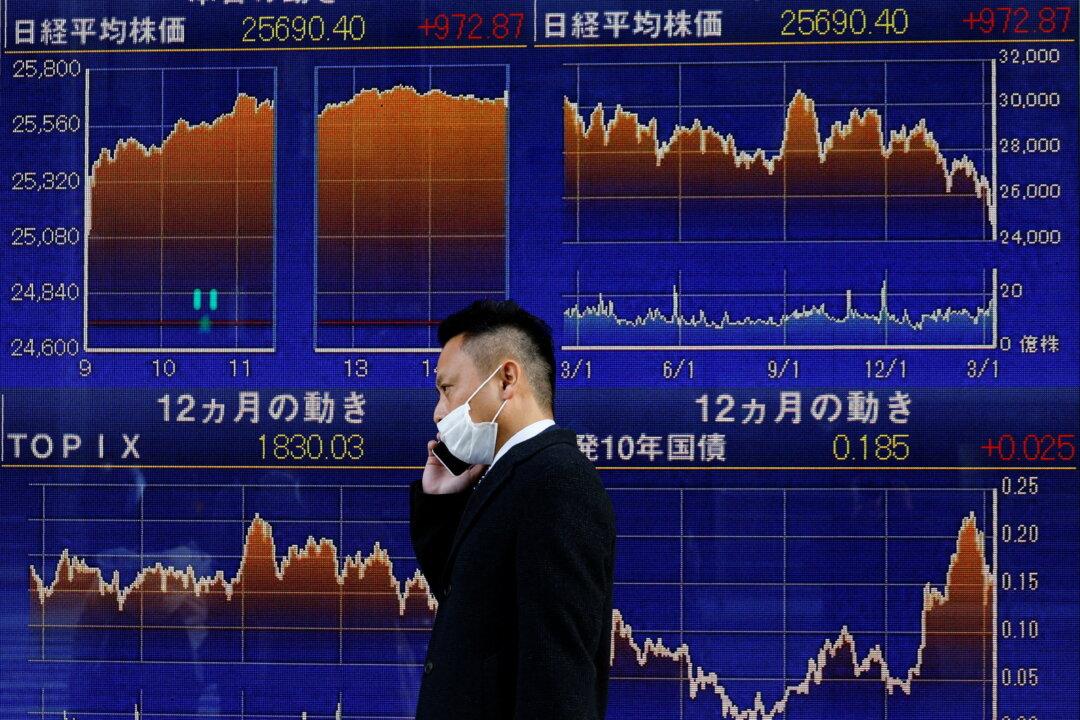

LONDON—World stocks fell for a fourth consecutive session on Tuesday as a combination of rising COVID-19 cases in China, the war in Ukraine, and worries about the Federal Reserve raising interest rates this week for the first time since 2018 hit confidence.

Though oil prices tumbled more than 5 percent with Brent crude back below $100 a barrel, spelling some relief for battered European stock markets and the euro currency, the market rebound signalled that sentiment was fragile.