Financial markets are always adjusting to the new reality. Sometimes they get ahead of themselves and then they retrace. Case in point: reacting to the election of Donald Trump.

The U.S. 10-year bond yield surged, along with stock markets, after Trump’s win and reached a peak of about 2.60 percent in mid-December. It hung in a range of roughly 30 basis points (0.3 percent) before starting to fall sharply in mid-March.

Now many market observers are calling for the 10-year yield to hit 2.00 percent, a level not seen since around the U.S. election last November.

The so-called “reflation trade”—higher economic growth and inflation as a consequence of Trump’s victory—is certainly unwinding given the diminishing hopes and/or increasing delays of growth-supporting fiscal measures.

Rally Built on Hope

“Soft” economic data like surveys and sentiment indicators shot up after Trump’s election victory. “Animal spirits” were back.

However, “hard” economic data has started to weaken. While the headline figure for the March jobs report was just 98K, April 14th’s weaker than expected inflation and retail data are more worrisome for the Trump reflation trade.

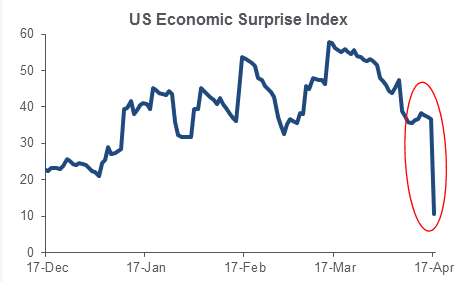

Citi’s economic surprise index (ESI) dropped sharply after the data was released. The ESI, which had been pushing higher in positive territory, indicates that U.S. economic data—driven by soft data—had been coming in stronger than expected. The ESI move is the sharpest since November.