WASHINGTON—Suze Orman, personal finance adviser, best-selling author, and one of today’s top motivational speakers, advises people who are mired in debt and don’t know where to turn. In her People First movement, Orman takes on the creditors and banks she regards as unsympathetic and exploitative, and accuses them of seemingly arbitrary high fees and an unwillingness to bend.

The longtime financial crusader and television personality hopes she has found a way to help people obtain more control over their financial lives.

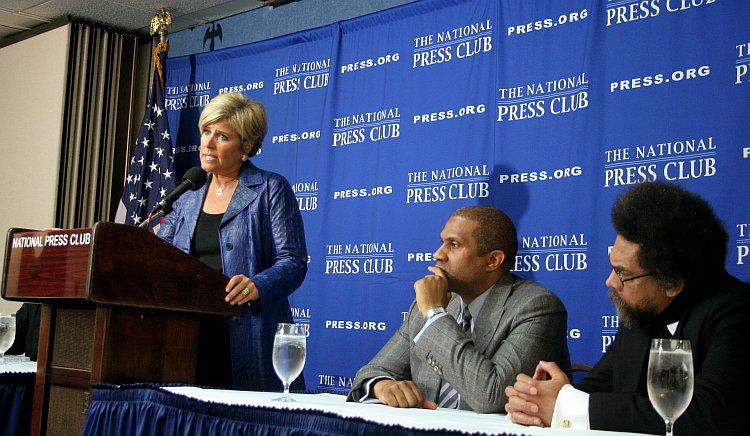

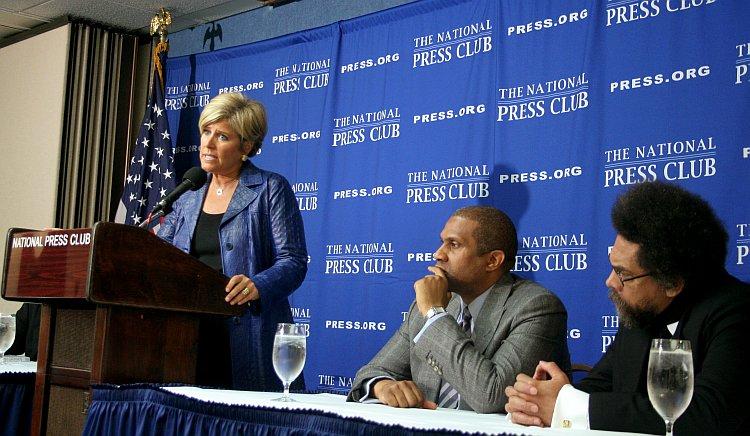

At the National Press Club on Jan. 12, Orman rolled out her debit card, which she says is designed to “change the way people think about and use their cash,” according to her press release. She was joined by radio and TV talk show host Tavis Smiley, and Dr. Cornel West, both of whom regard Suze Orman’s debit card as a first step toward eradicating poverty.

For people who repeatedly make poor decisions in managing their money, Orman has “created”—not just endorsed—The Approved Prepaid MasterCard. With any prepaid card, one can’t spend money one doesn’t have.

Orman’s card fees are low and transparent, she says, and she claims it has no hidden fees. The Approved Card cost its users $3/month. The user can make unlimited cash withdrawals when at least $20 direct deposit or electronic transfer is made during the same month.

The Approved Card is the first time a prepaid card has involved one of the three major U.S. credit bureaus, TransUnion.

Orman is incensed that one’s credit report does not reflect debit card spending behavior, and she wants that changed. Presently, if a consumer doesn’t use credit cards or take out any loans, he or she might not be able to get a mortgage or a car loan, and will probably have to pay a higher interest rate. Banks rely on credit reports or FICO scores to ascertain credit risk.

TransUnion will be assessing whether prepaid card transaction data could be included in credit reports.

Keeping Track of Spending

A problem for consumers is that most don’t know how much money they have in their checking account. According to economist Mike Moebs, the CEO of Moebs Research Service, 87 percent of Americans do not balance their checkbooks. A lot of fees can result from overdrafts.

Orman’s card addresses the distaste or inability to balance a checkbook. The card can be set up to text the consumer every time the card is debited and send the balance statement every morning. One can also check the balance and transactions any time by phone or online.