The United States has thrown down the gauntlet with its Inflation Reduction Act (IRA), putting Ottawa under pressure to respond and avert further flow of business investment south of the border, particularly that impacting its green initiatives. But the feds are hampered by their ideology, an economist says, noting that more government-directed investment with its poor track record isn’t going to work.

“It’s a very selective decision that we’re going to follow the U.S. lead when it agrees with our ideology—which is green energy, and climate change—and we’re going to ignore the U.S. competitiveness, when it involves things like lower taxes or reduced regulation,” Philip Cross, Munk senior fellow at the Macdonald-Laurier Institute and former chief economic analyst at Statistics Canada, told The Epoch Times.

“When you exclude oil and gas, we’re running at less than half the trend of business investment [as the United States]. Why don’t we focus on that? … How come that never bothered us before?” he said.

“And then suddenly, the IRA comes along, and all of a sudden we’re going to follow the supposed U.S. model of economic development?”

Cross points out that the U.S. model of economic development is based on business investment writ large, not just renewable energy investment.

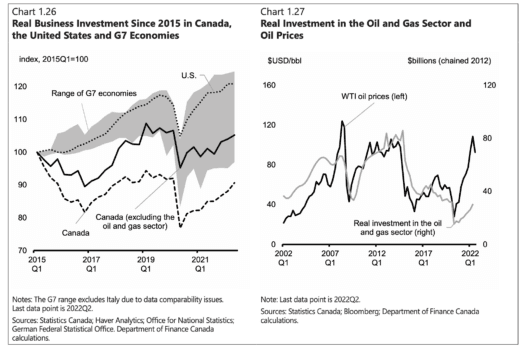

A key chart in the government’s 2022 Fall Economic Statement (FES), released Nov. 3, shows how business investment in Canada—especially when excluding the oil and gas sector—substantially lags the United States and other G7 nations. Even when including investment from the oil and gas industry, Canada noticeably lags the United States and is below average among the G7.

A key chart in the government’s 2022 Fall Economic Statement (FES), released Nov. 3, shows how business investment in Canada—especially when excluding the oil and gas sector—substantially lags the United States and other G7 nations. Even when including investment from the oil and gas industry, Canada noticeably lags the United States and is below average among the G7.

“The oil and gas industry is regularly told … you’re not part of our future. The future in this country is green energy,” Cross said.

The IRA is thus seen as another watershed moment where one of Canada’s weaknesses, business investment—which leads to greater productivity, more robust economic growth, and job creation over the long run—is expected to be even harder to attract going forward.

Ottawa Reacts to ‘Game-Changer’

The IRA is a “game changer for climate transition” and a “gravitational black hole to attract capital,” a senior government official told reporters at an embargoed briefing prior to the release of the FES.

Ottawa took some initial steps in the FES, such as an investment tax credit for hydrogen and a refundable tax credit of up to 30 percent on the cost of certain types of capital investments. The feds said Budget 2023 will do more in response to the IRA.

In the meantime, parliamentarians are working to understand the business community’s concerns about the IRA. On Nov. 1, automotive and manufacturing groups told the Standing Committee on International Trade that the IRA is a major threat to competitiveness and that Ottawa must do something to restore some competitive balance.

“While the IRA has been presented in many quarters as key legislation to fight climate change, in reality it is an act of trade protectionism, forcing the on-shoring of future powertrain production within the borders of the United States at the expense of all other countries, including Canada,” Scott MacKenzie, director of corporate and external affairs at Toyota Canada, told the committee.

Committee witnesses testified that Canada obviously can’t match the IRA dollar-for-dollar, but said Canada needs an industrial strategy of its own.