ADP Jobs Report Surprising, Fed Stands Pat

A report released Wednesday shows that the U.S. economy added 110,000 private-sector jobs last month, higher than estimated.

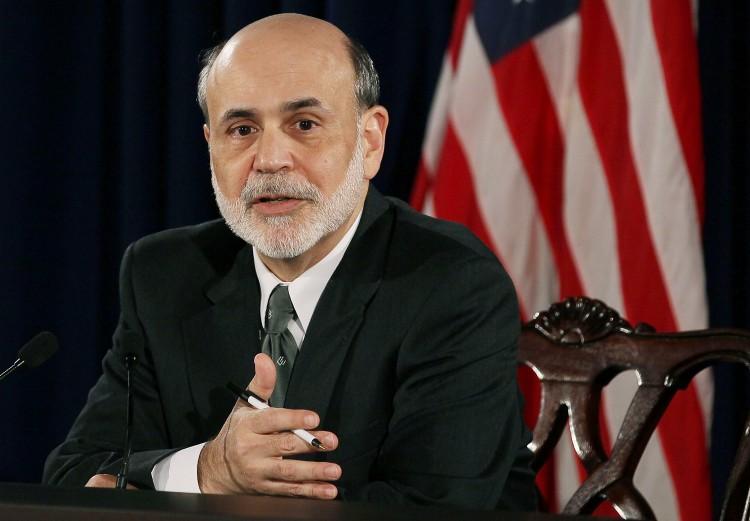

Federal Reserve Chairman Ben Bernanke speaks during a press briefing at the Federal Reserve building, on Nov. 2 in Washington. Mark Wilson/Getty Images

|Updated: