SPECIAL COVERAGE

Read More

Read More

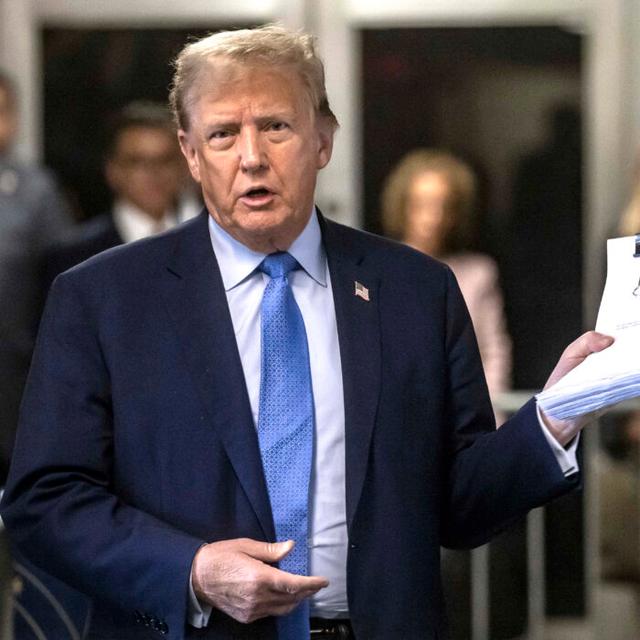

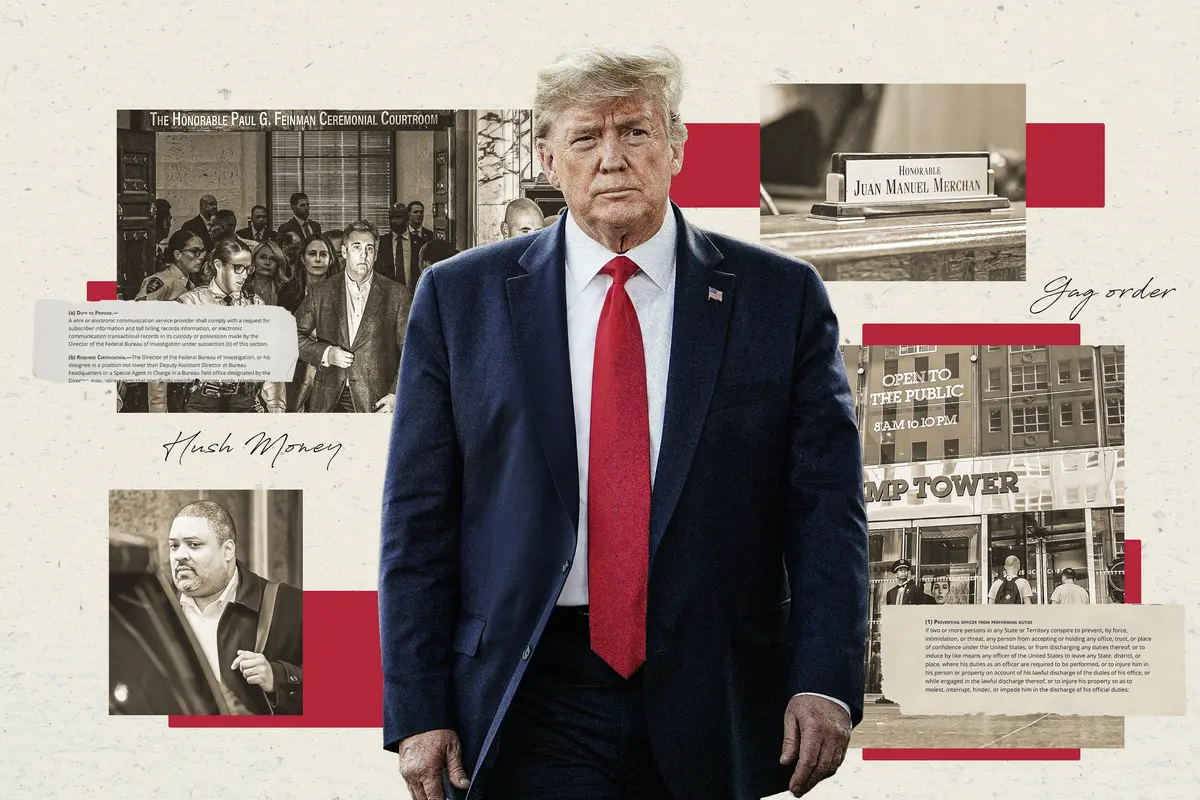

Key Takeaways From Week 2 of Trump Trial in New York

Trump has been charged with 34 counts of falsifying business records.

Key Takeaways From Week 2 of Trump Trial in New York

Trump has been charged with 34 counts of falsifying business records.

Top Premium Reads

Top Stories

Most Read

What’s Next in Congress After Passage of Foreign Aid Package

The House is scheduled to take up several bills, with the most notable being legislation to combat anti-Semitism on college and university campuses.

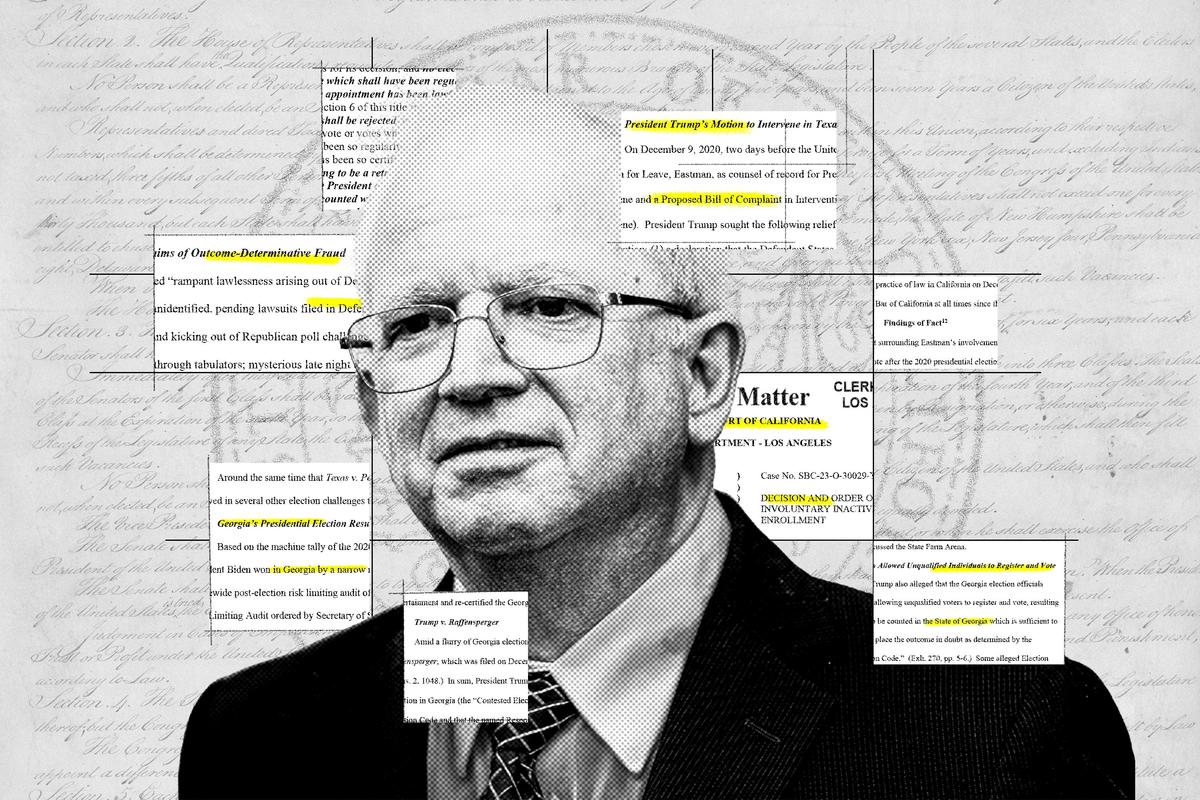

Names of 5 Additional Defendants Revealed In Arizona’s ‘Fake Electoral’ Case

Arizona Republicans released a statement denouncing the charges as ’suspiciously convenient and politically motivated' given their timing.

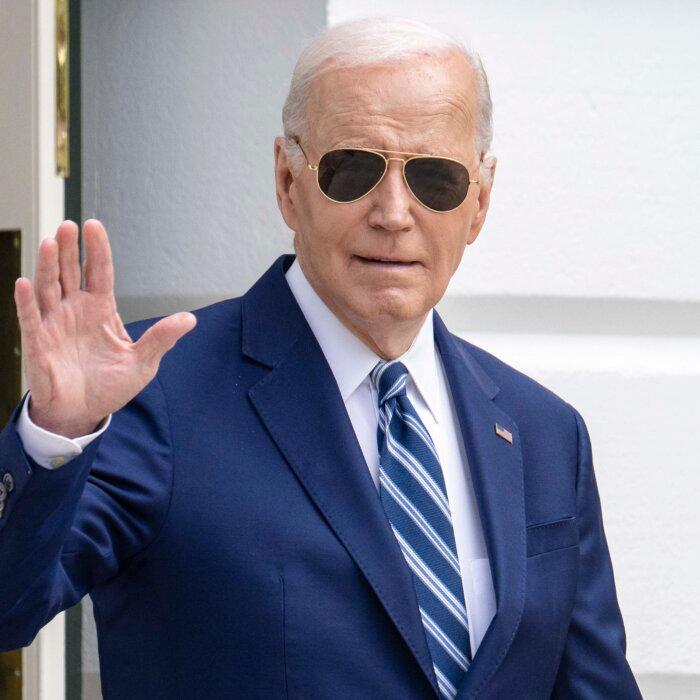

Biden Admin Announces $6 Billion in New Security Funding for Ukraine

The security package includes Patriot missiles, High Mobility Artillery Rocket Systems (HIMARS), and 155mm artillery rounds among other things.

Biden Administration Delays Decision on Menthol Cigarette Ban

Roughly 81 percent of black adults who smoke cigarettes use menthol varieties, according to the U.S. Centers for Disease Control and Prevention.

Suppression of Faith Has Backfired on CCP: Researcher

‘Even with all this brutality, even with all the billions of dollars, the CCP hasn’t been able to’ change people’s beliefs, said China expert Sarah Cook.

Scenes From Chaos: A Journalist Recounts Her Escape From Kabul

Indian journalist Nayanima Basu recalls a harrowing adventure in her newly-released book.

NYC Councilman on Israel–Palestinian Campus Protests: I Never Dreamed There‘d Be a US ’Movement to Back Terrorists’

‘Many of them are products of our universities. And that’s, that’s distressing, to say the least,’ said Democrat New York City Councilman Robert Holden.

Indo-Pacific Bill Could Allow Biden to Send More Weapons to Israel, Ukraine: Lawmakers

‘If the money were truly intended for Taiwan, Congress could directly appropriate it as such,’ said Rep. Harriet Hageman.

Can California Cities Clear Homeless Camps? Depends on Supreme Court Ruling

Justices heard arguments that laws against camping violate the Constitution’s ban on ‘cruel and unusual’ punishment. Cities hope for clarity.

Editors' Picks

Supreme Court Seems Open to Allowing Some Presidential Immunity, May Delay Trump Trial

Justices wrestled with how to define a president’s ‘official’ versus ‘private’ acts. A decision may delay President Trump’s trial, which would hand him a win.

Trump ‘Hush-Money’ Witness Admits to Inconsistencies in Testimony, FBI Report

A witness revealed inconsistencies regarding an FBI report in the case.

Group Issues Major Warning on Federal Agency’s Proposed Tax Increase

A policy group this week warned that the U.S. Department of Treasury’s proposed budget could significant increase taxes for certain Americans.

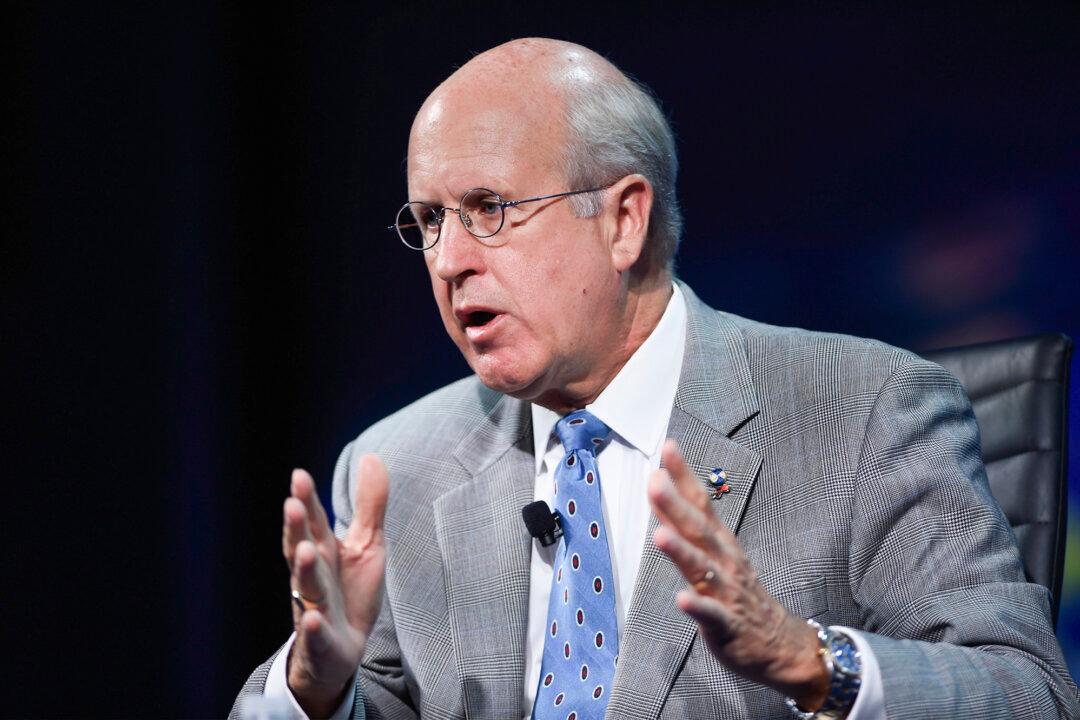

Washington’s Fiscal Mess Is Irresponsible, Unethical, Immoral: Former US Comptroller General

‘We’ve lost our sense of stewardship,’ David Walker said.

‘Nowhere Special’: A Father and Son Tale for the Ages

A dad in his last days searches for the best future for his little boy.

‘Nowhere Special’: A Father and Son Tale for the Ages

A dad in his last days searches for the best future for his little boy.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

The ‘Fast and Furious’ Actor Who Left Hollywood for a Traditional Lifestyle

Lucas Black, who stars in the new film ‘Unsung Hero,’ takes his sons fishing and hunting, while instilling in them confidence and a sense of responsibility.

Special Coverage

Special Coverage

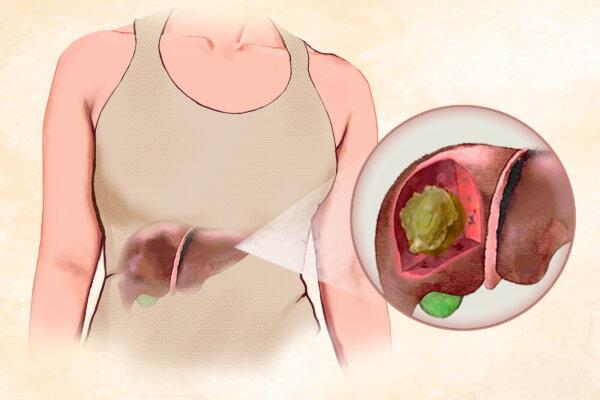

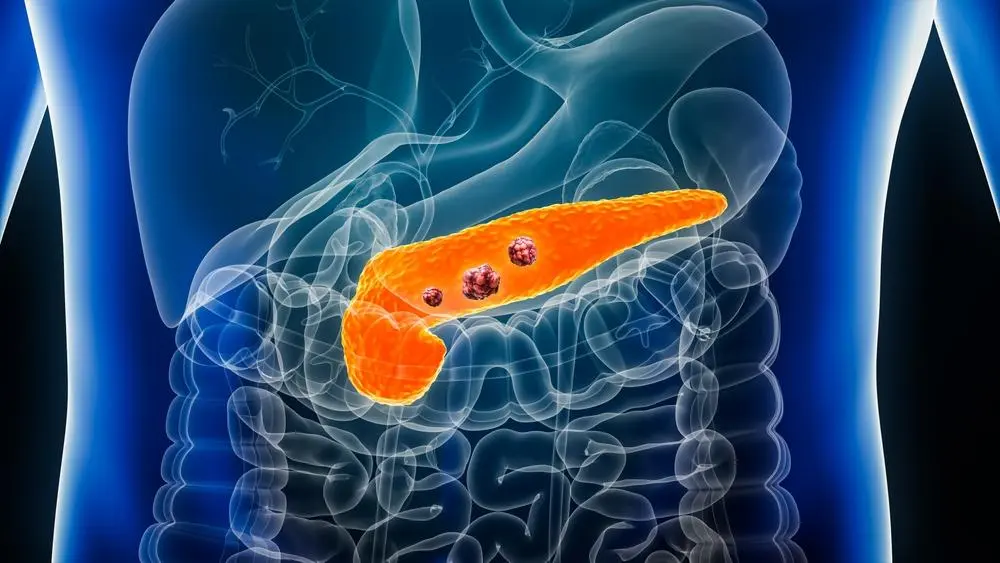

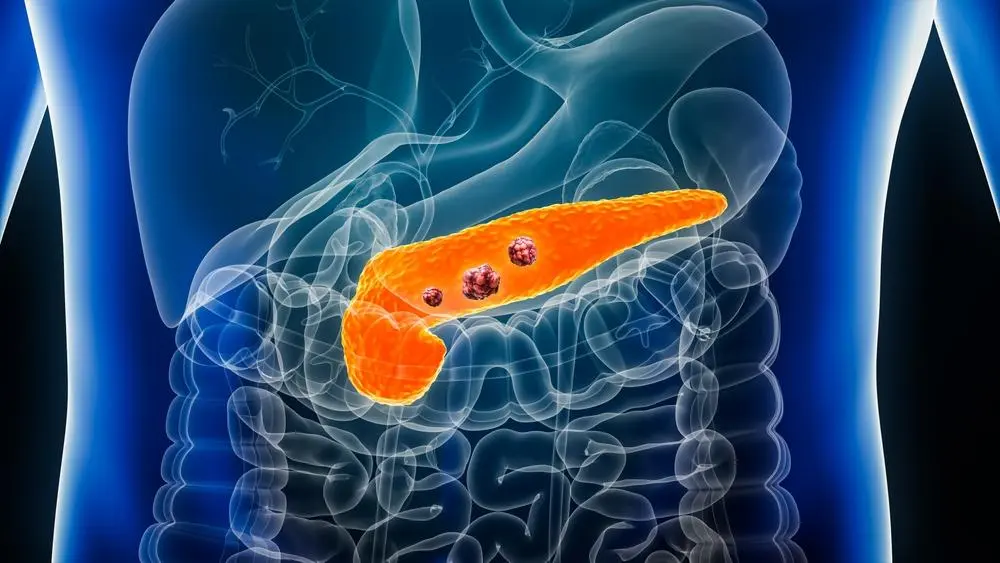

Potential Early Signs of Pancreatic Cancer: Insights From Clinical Cases

Pancreatic cancer can present with symptoms often associated with other illnesses—following the trail of such signs early on could help with early diagnosis.

Potential Early Signs of Pancreatic Cancer: Insights From Clinical Cases

Pancreatic cancer can present with symptoms often associated with other illnesses—following the trail of such signs early on could help with early diagnosis.

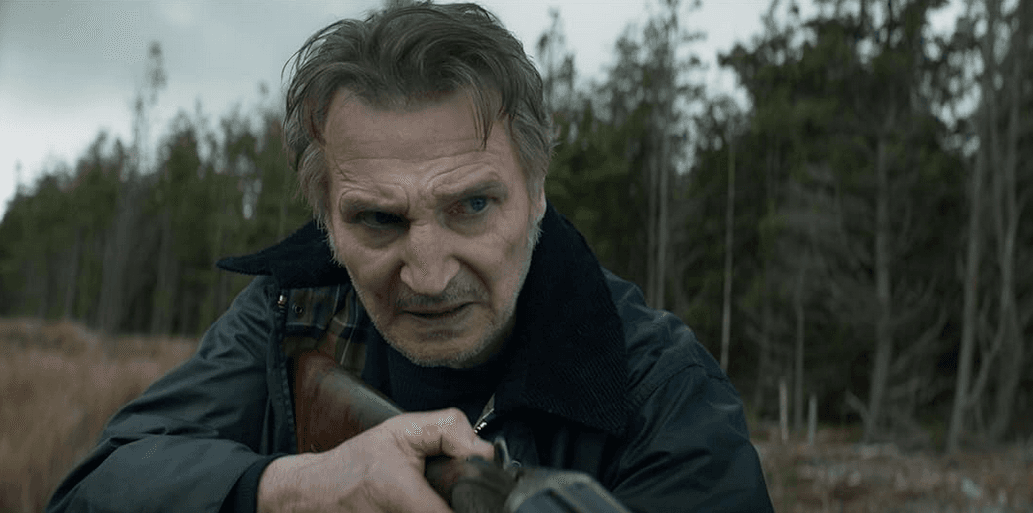

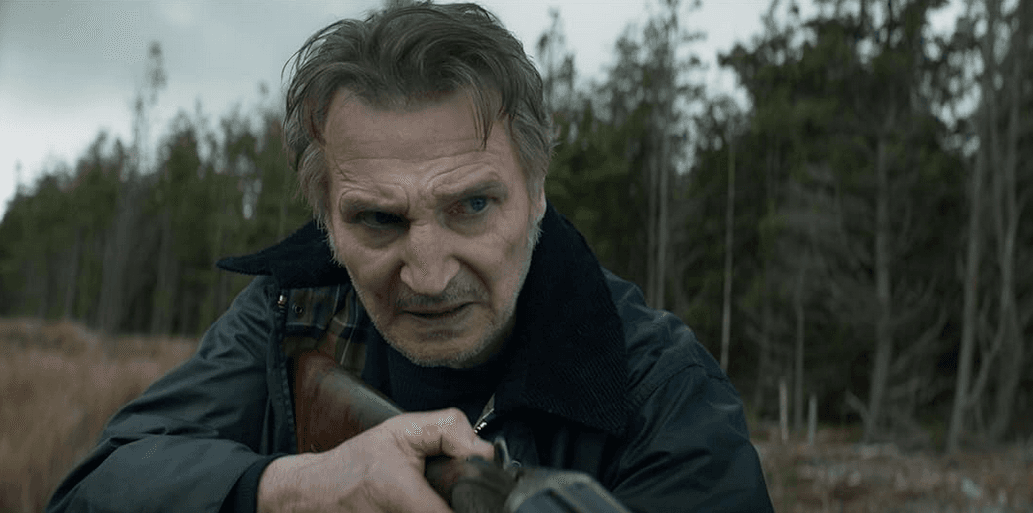

‘In the Land of Saints and Sinners’: A Powerful Irish Tale

Like Brad Pitt’s line in ‘The Devil’s Own’: ‘It’s not an American story—it’s an Irish one,’ ‘Saints and Sinners’ features an all-Irish cast doing IRA things.

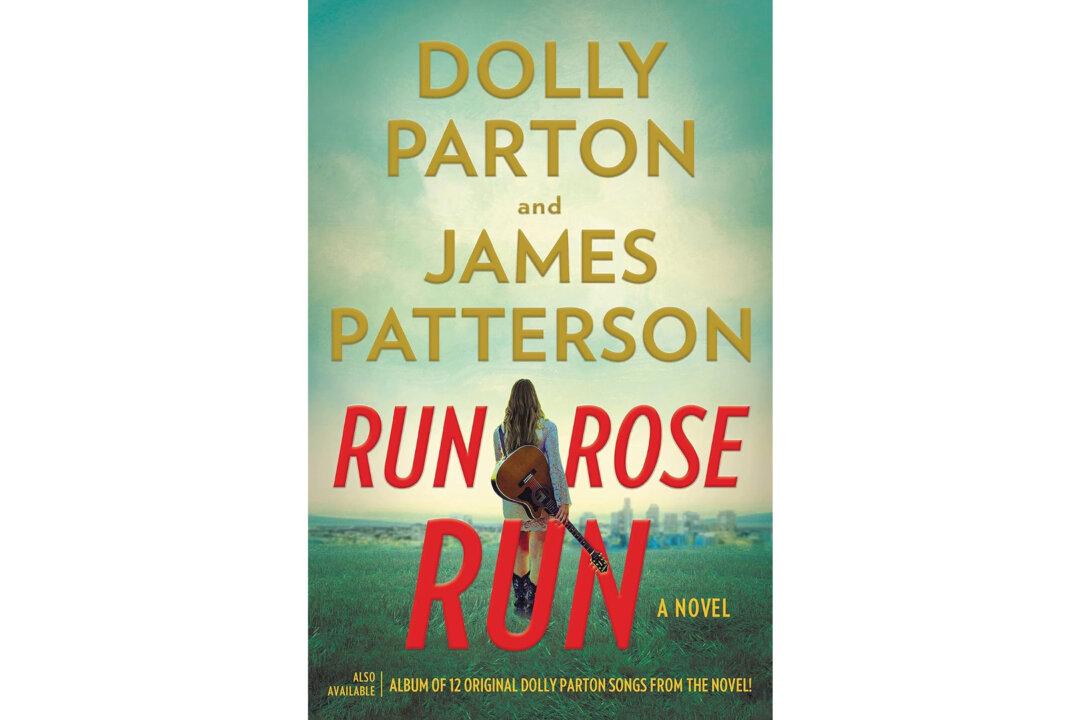

‘Run, Rose, Run’: Run Away With Dolly Parton and James Patterson

Set against Nashville’s vibrant music scene, this collaborative novel is a gripping tale of secrets, ambition, and the pursuit of a dream at all costs.

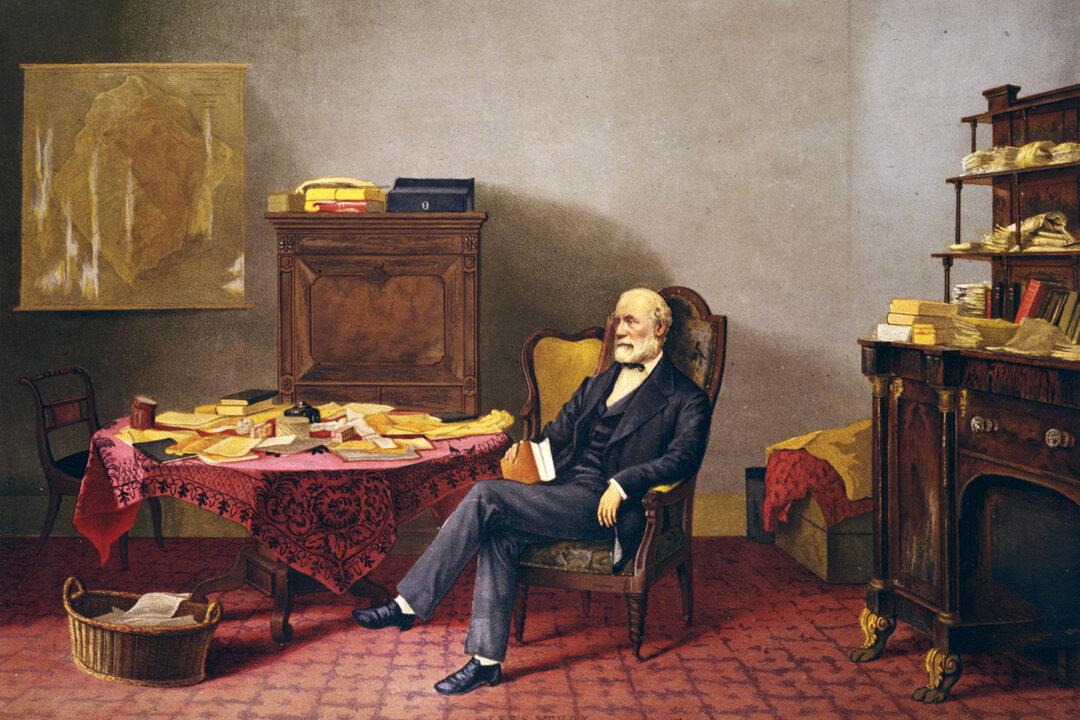

The Two Reputations of Robert E. Lee

While those in the past saw Lee’s stellar qualities, today, some cannot see that he was a man defined, like all of us, by his time.

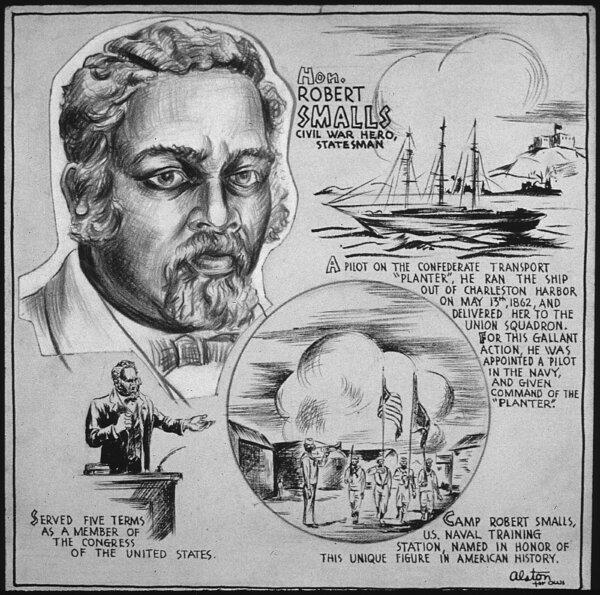

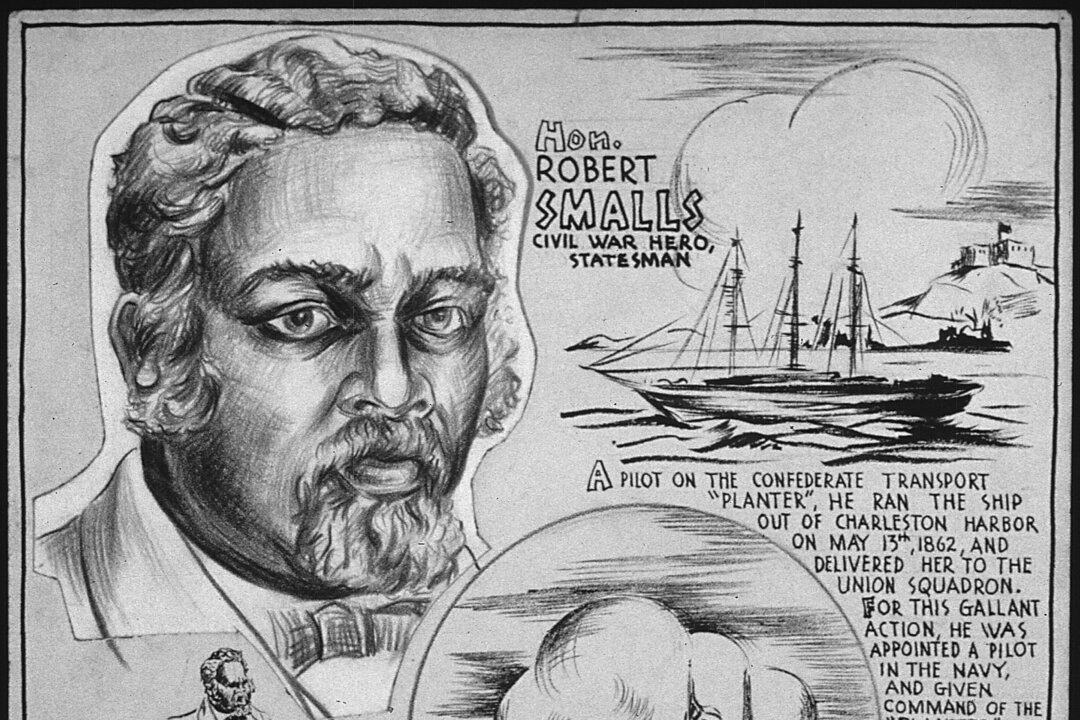

Robert Smalls: Navy Captain and Reconstruction-Era Politician

This former slave would not let anything stop him on the road to freedom.

‘In the Land of Saints and Sinners’: A Powerful Irish Tale

Like Brad Pitt’s line in ‘The Devil’s Own’: ‘It’s not an American story—it’s an Irish one,’ ‘Saints and Sinners’ features an all-Irish cast doing IRA things.

What We Can Learn From the Greek Island Where People Live to 100

Greek food expert Diane Kochilas, who has run a cooking class from her family home on Ikaria for two decades, shares how to eat and live the Ikarian way.

Michigan Lawmakers Try to Put Brakes on Mackinac Island’s E-bike Riders

Mackinac Island doesn’t have cars but the speed of e-bikes are becoming a problem.

Taking the Kids: To the Smithsonian Museums

The Smithsonian Institution is the world’s largest museum, education and research complex.

Airbnb Rentals Could Be Harder to Come by in Hawaii. Here’s Why and When That Might Happen

New bills will give counties the power to limit short-term rentals amidst housing shortages.

Michigan Lawmakers Try to Put Brakes on Mackinac Island’s E-bike Riders

Mackinac Island doesn’t have cars but the speed of e-bikes are becoming a problem.