SPECIAL COVERAGE

Read More

Read More

Philadelphia-Based Republic First Bank Collapses in First Bank Failure of 2024

The FDIC entered into an agreement with Fulton Financial to assume the deposits and assets of the failed bank.

Philadelphia-Based Republic First Bank Collapses in First Bank Failure of 2024

The FDIC entered into an agreement with Fulton Financial to assume the deposits and assets of the failed bank.

Trending Videos

Top Premium Reads

Top Stories

Most Read

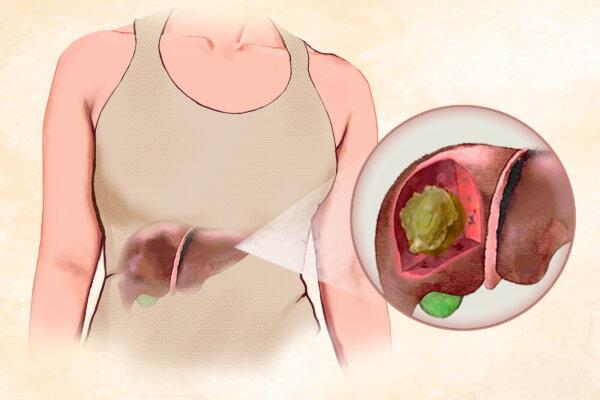

‘I’m Not Done’: Arizona Lawmaker Commits to Combating Forced Organ Harvesting After Bill Veto

The bill made it through both chambers of the state Legislature with health insurers on board—only to be killed on the governor’s desk.

Los Angeles’s Transit System Declares Public Safety Emergency Amid Escalating Violence

Drug abuse, mental illness, and repeat offenders plaguing L.A.’s trains and buses.

Audit Finds Oklahoma Officials Mismanaged Millions in COVID Relief Funds

State Auditor and Inspector, and Attorney General claim state agency ignored competitive bidding law, steered contracts to at least one family member’s firm

Chattanooga Volkswagen Workers Embrace Union in Historic Vote as UAW Sets Its Sights on the South

Younger workers, UAW leadership change cited as major factors in Volkswagen unionization success.

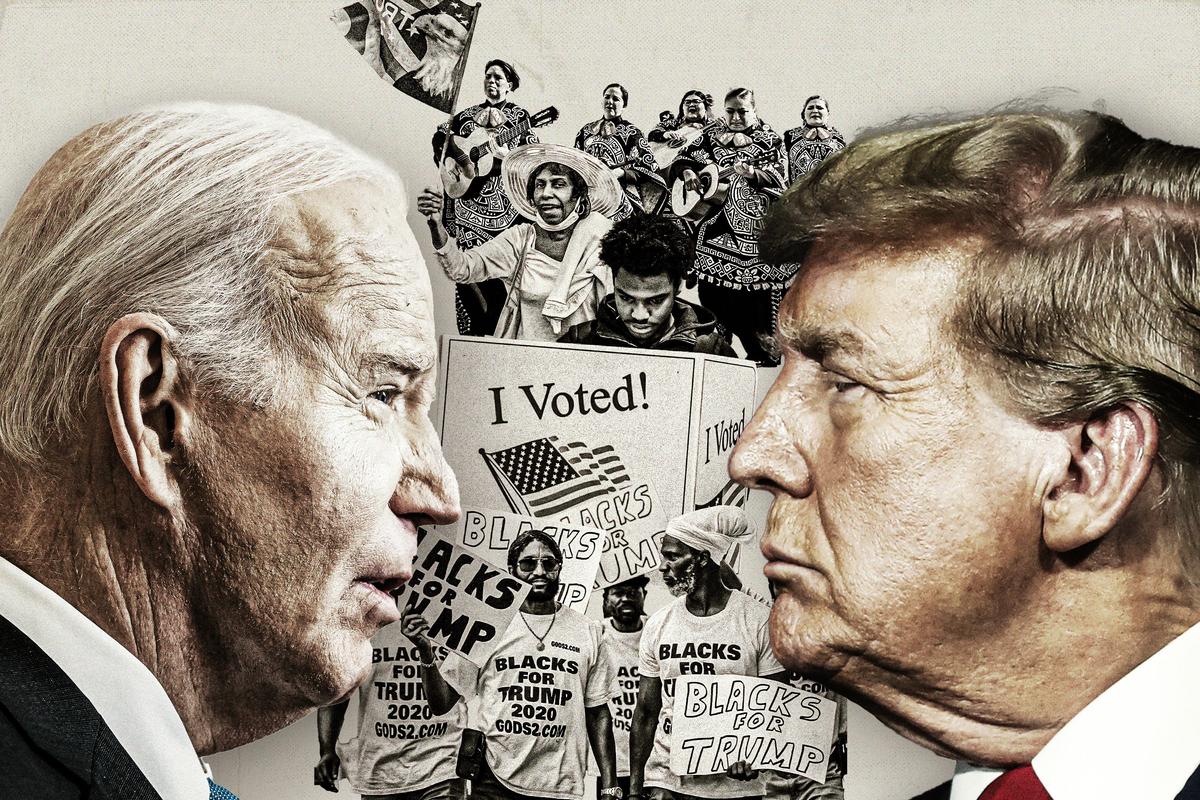

Biden’s Approval Rating Lowest Among Past 10 US Presidents: Gallup

Biden’s 13th quarter approval ranks at the bottom 12 percent of all presidential quarters since 1945.

Former Rep. Meijer Drops Out of Republican Senate Race

Rep. Meijer had voted to impeach Trump in 2021.

RFK Jr. Says Kennedy Siblings Asked Biden to Give Him Secret Service Protection

The Biden administration denial of five requests for the federal security is a “political scandal,” the independent presidential candidate believes.

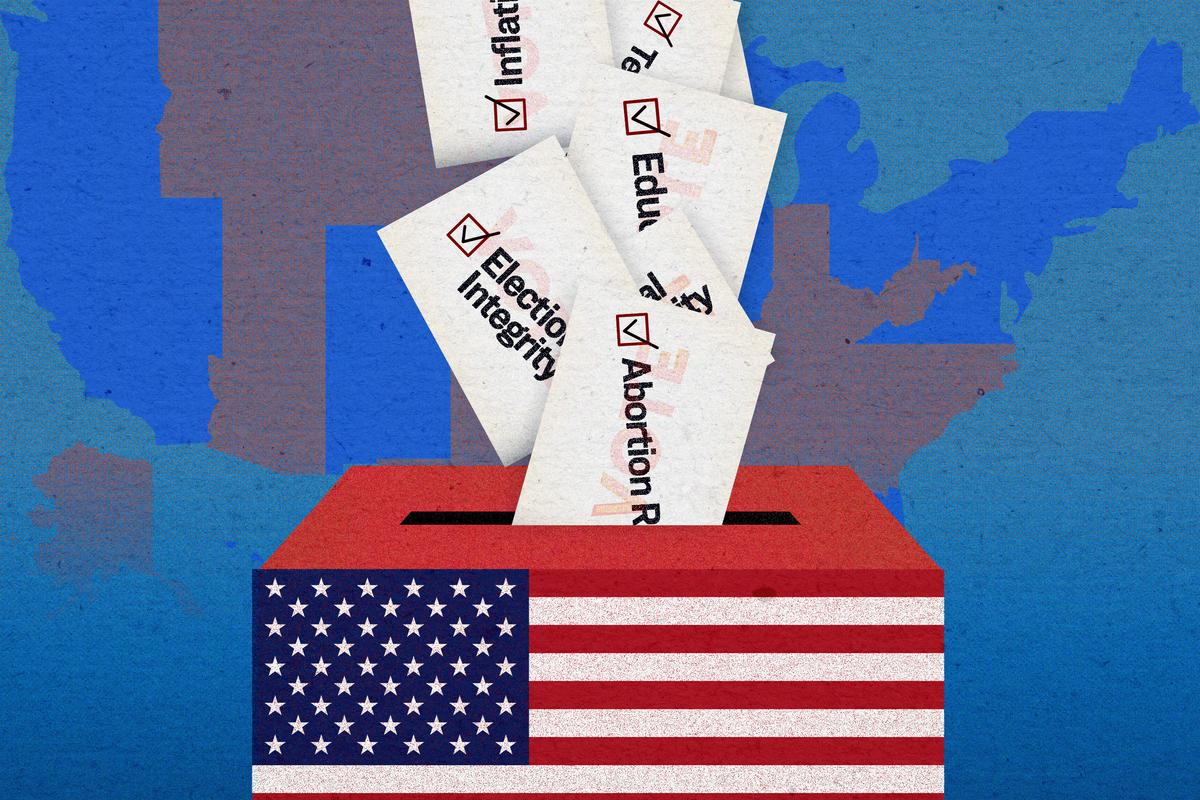

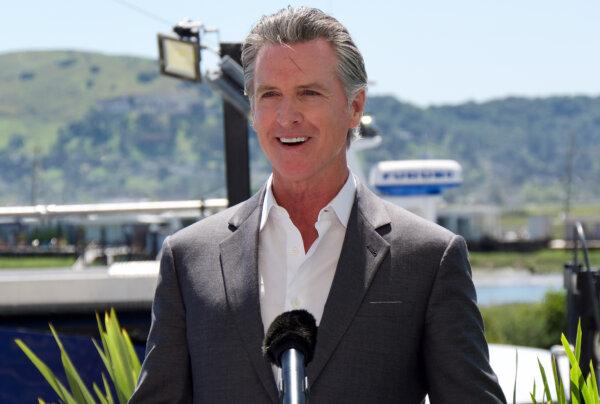

Trump Responds to Newsom’s Abortion Ads

Political leaders are at loggerheads over the abortion issue as the 2024 presidential election inches nearer.

House Republicans Call for Donors to Pull Funding From Columbia University Over Anti-Semitic Incidents

Lawmakers pushed for donors to withdraw support until there are clear changes in leadership.

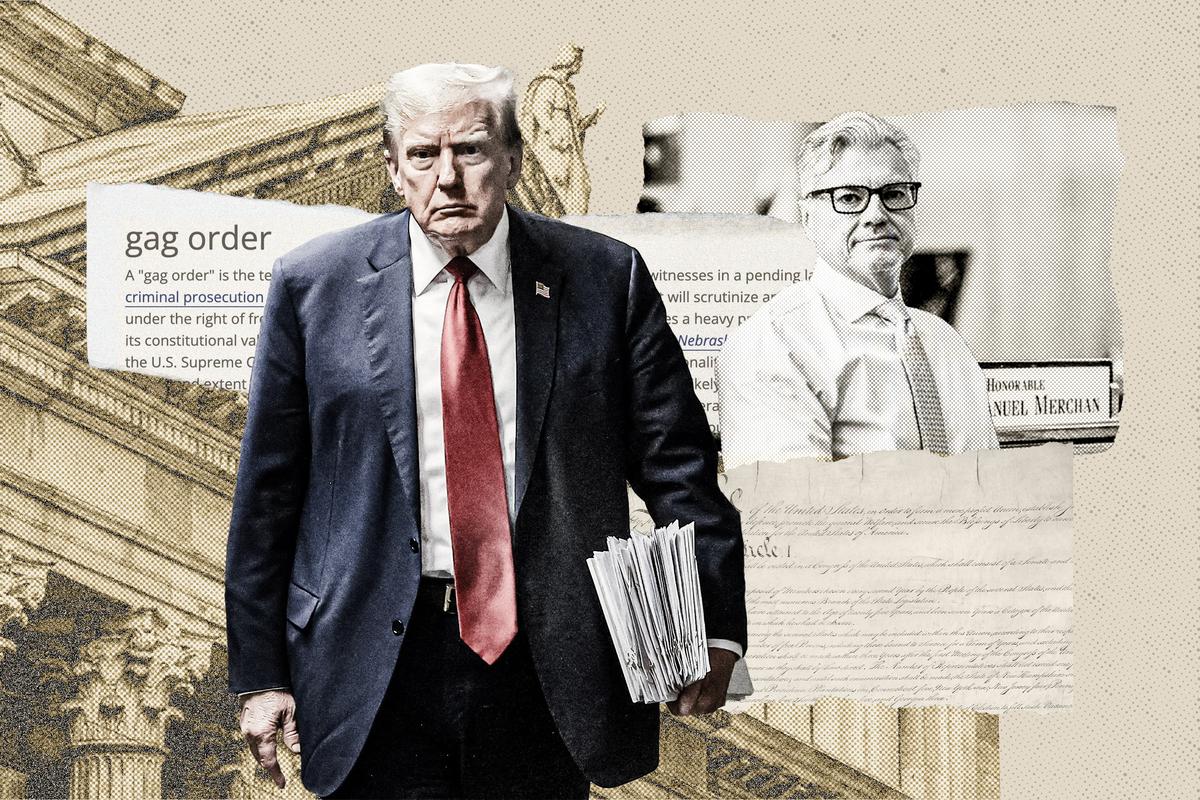

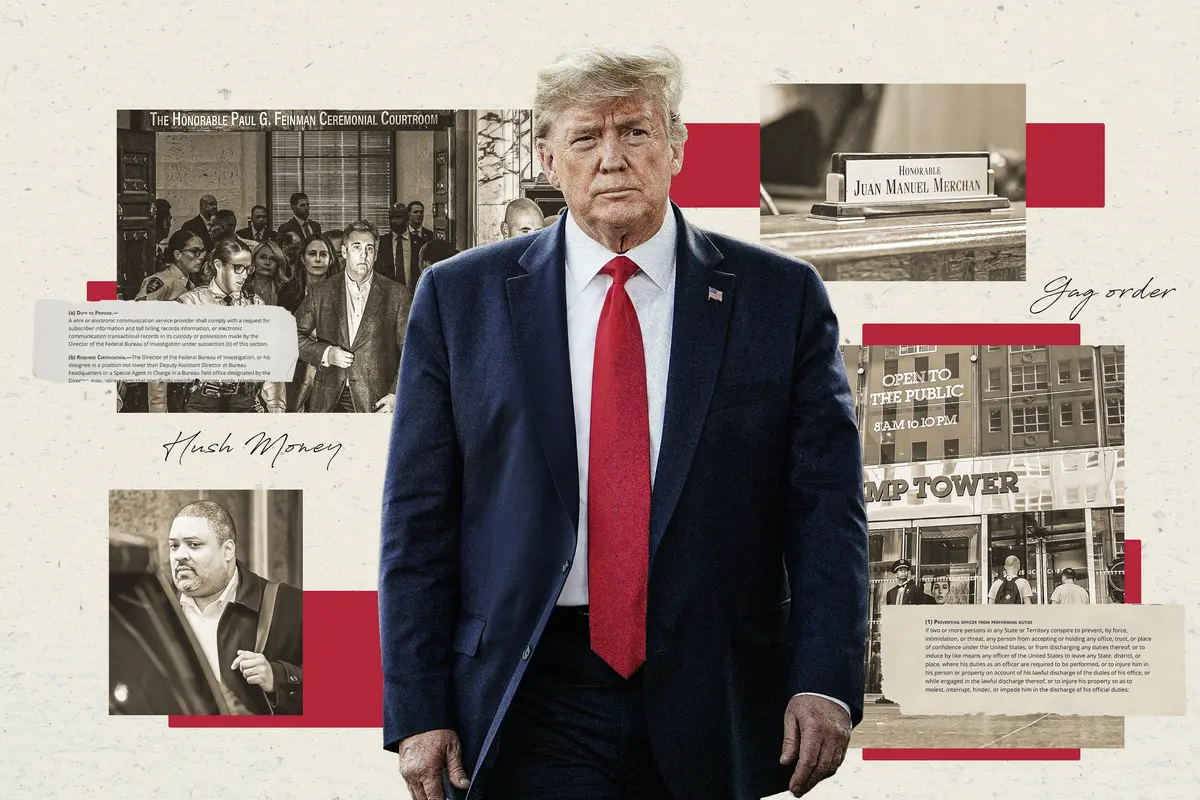

Key Witness Lays Out Saga of Deals Comprising Alleged Conspiracy in ‘Breathtaking’ Trump Trial Testimony

‘Breathtaking and amazing testimony,’ Former President Donald Trump told the press, noting that it ‘was really an incredible, an incredible day.’

Office Market Availability Rate Hits Record High in San Francisco

Much of the issue, experts say, is the city’s reliance on the tech industry, with more than 44 percent of its office space housing technology companies.

DOJ Continues to Refuse Handing Over Audio Recording of Special Counsel’s Interview With Biden

The committees have failed to articulate ‘a legitimate congressional need’ for the audio recordings, the Assistant AG said.

How the Supreme Court’s Immunity Decision Could Limit the Cases Against Trump

The eventual opinion could disrupt lower court proceedings and even result in another appeal that reaches the Supreme Court.

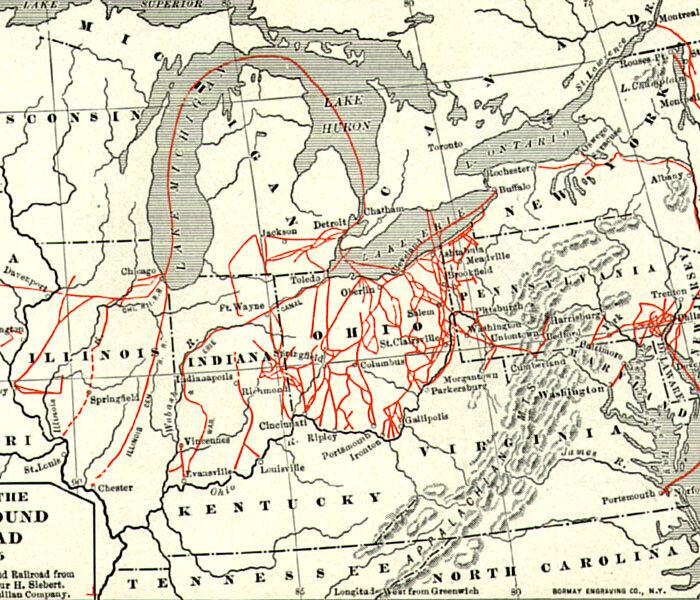

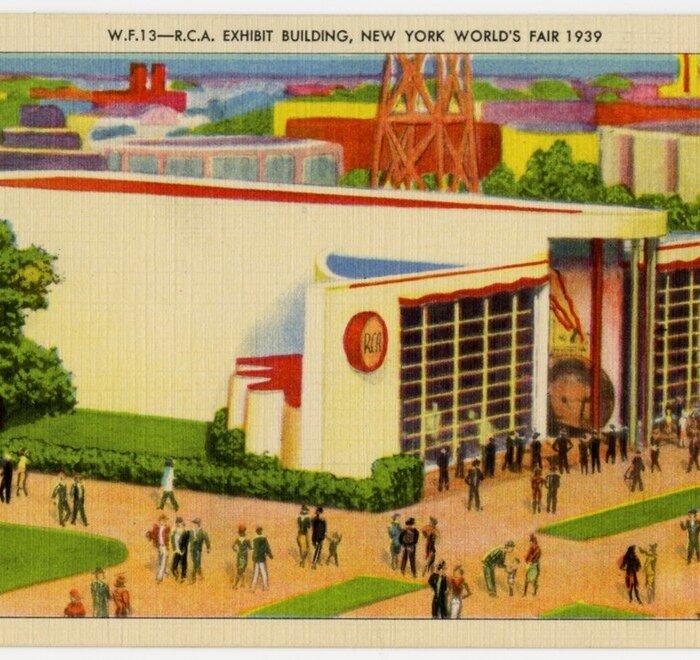

How the 1939 World’s Fair Predicted Europe’s Future

In ‘This Week in History,’ ‘a valley of ashes’ becomes the site of America’s second largest World’s Fair that presents a look at the modern city.

How the 1939 World’s Fair Predicted Europe’s Future

In ‘This Week in History,’ ‘a valley of ashes’ becomes the site of America’s second largest World’s Fair that presents a look at the modern city.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

This Artificial Sweetener May Harm the Gut: Study

Neotame can damage the intestine and cause health issues like irritable bowel syndrome (IBS) and sepsis.

This Artificial Sweetener May Harm the Gut: Study

Neotame can damage the intestine and cause health issues like irritable bowel syndrome (IBS) and sepsis.

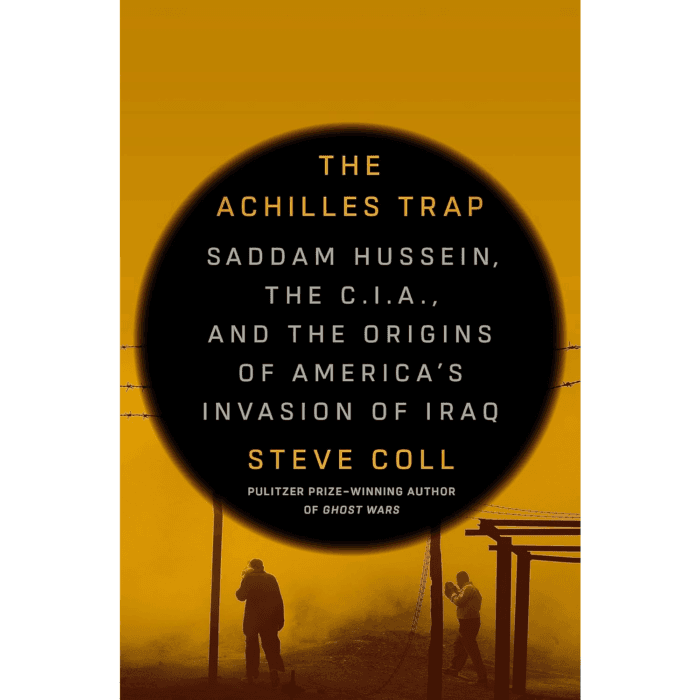

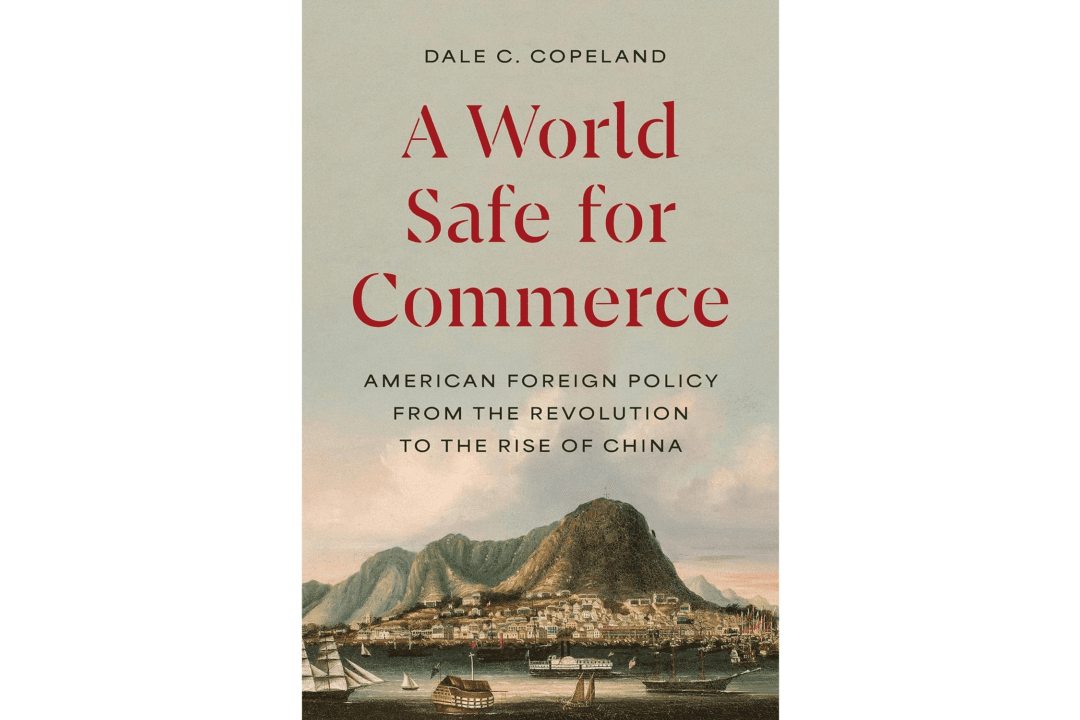

Dealing With China via America’s Commercial History

In ‘A World Safe for Commerce,’ Dale Copeland presents America’s 250-year geopolitical history to show a possible working theory for how to deal with China.

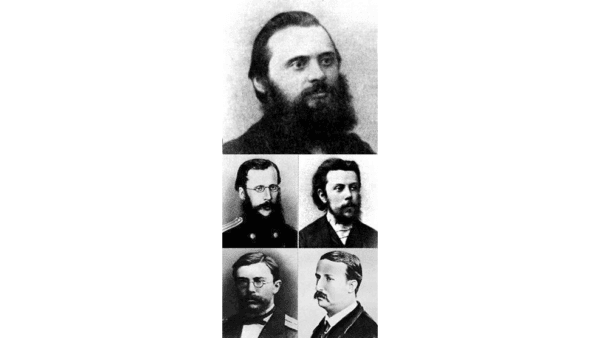

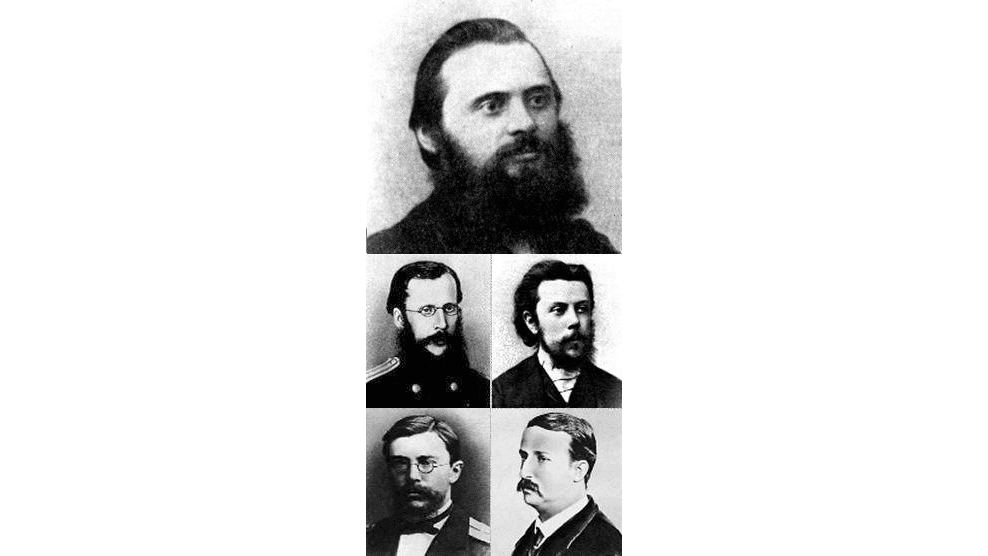

The Mighty Five and the Birth of Russian Music

How did the soulful character of Russian music, distinguishable from other European nations, evolve?

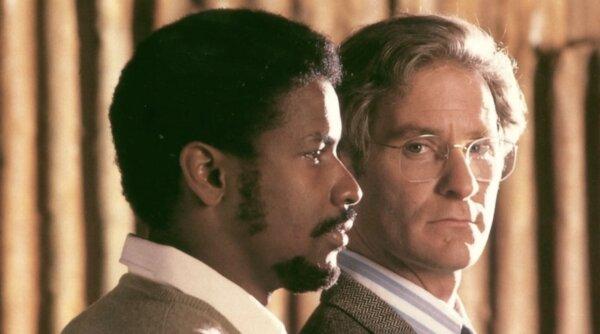

‘Cry Freedom’: A Crusade Against South Africa’s Apartheid

This biopic focuses on two South Africans who oppose their country’s apartheid.

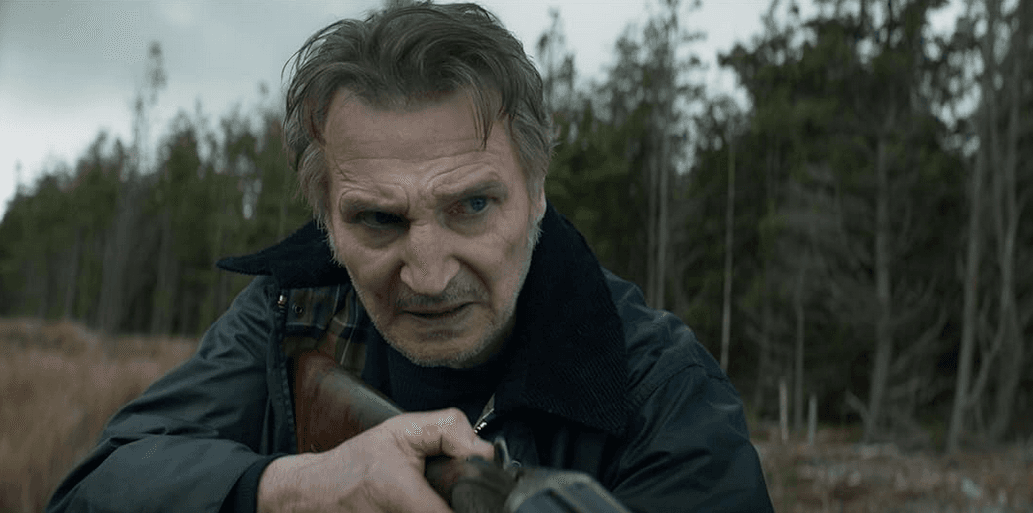

‘In the Land of Saints and Sinners’: A Powerful Irish Tale

Like Brad Pitt’s line in ‘The Devil’s Own’: ‘It’s not an American story—it’s an Irish one,’ ‘Saints and Sinners’ features an all-Irish cast doing IRA things.

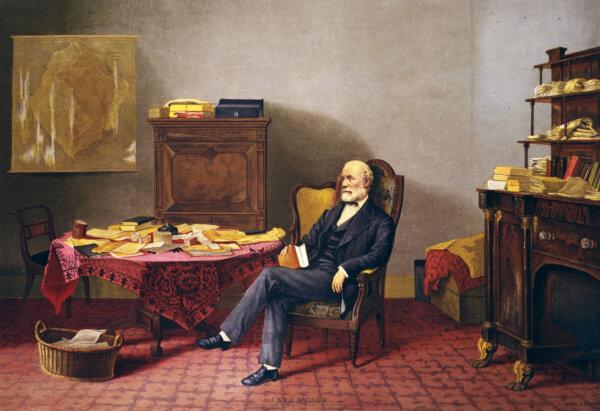

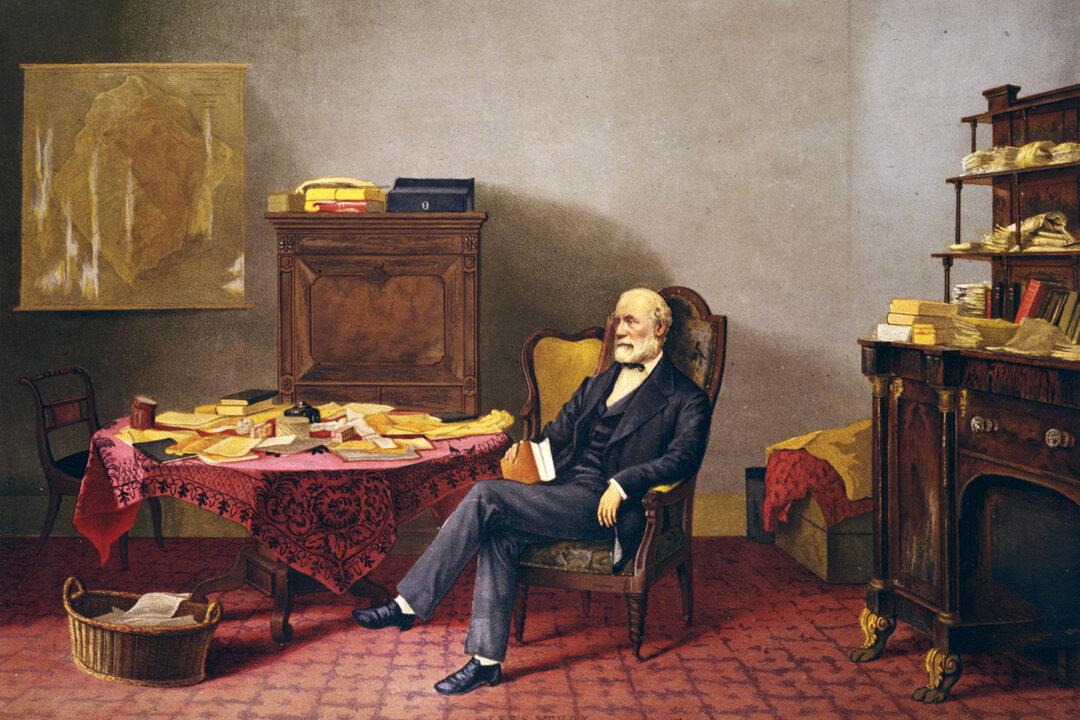

The Two Reputations of Robert E. Lee

While those in the past saw Lee’s stellar qualities, today, some cannot see that he was a man defined, like all of us, by his time.

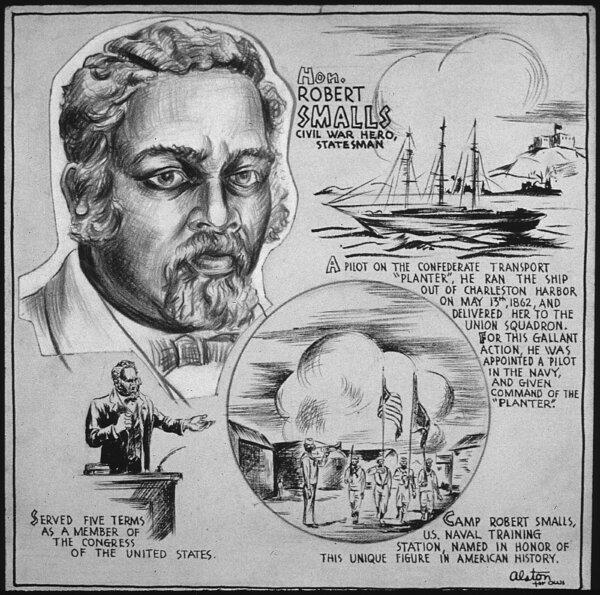

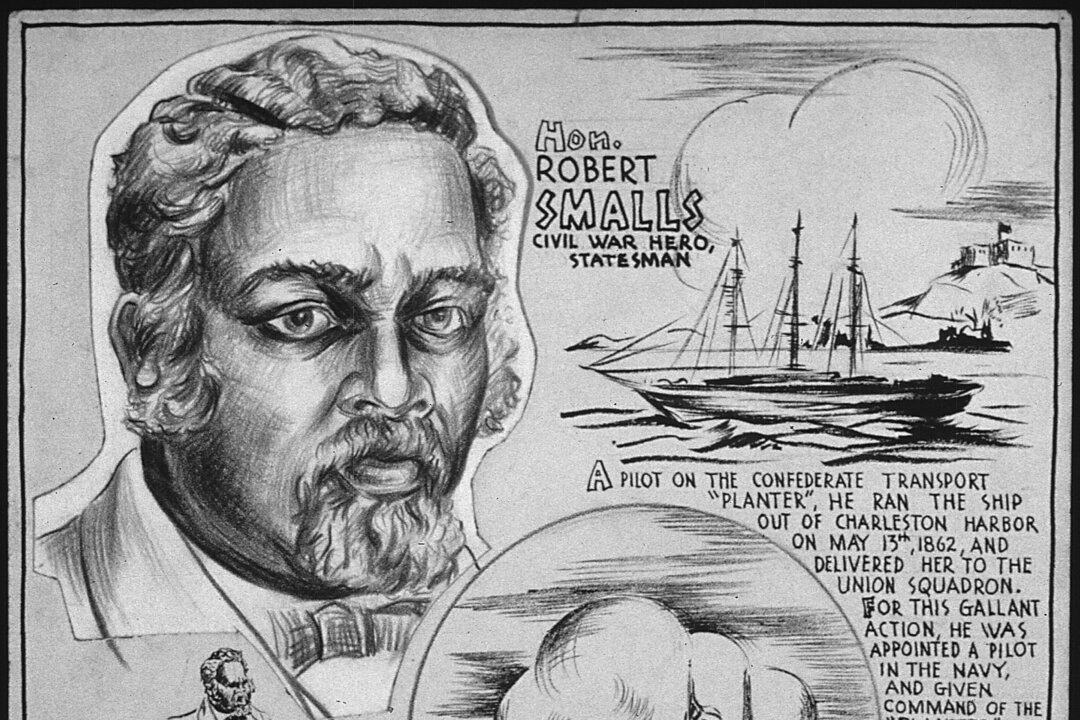

Robert Smalls: Navy Captain and Reconstruction-Era Politician

This former slave would not let anything stop him on the road to freedom.

Dealing With China via America’s Commercial History

In ‘A World Safe for Commerce,’ Dale Copeland presents America’s 250-year geopolitical history to show a possible working theory for how to deal with China.

The Best Recipes Are Made From Shopping Your Fridge

Cottage cheese in the fridge is inspiration to make cheese dumplings.

San Diego County Museums Worth a Trip

Learn about surfing, artwork, music, and more at various museums in San Diego county.

Charming Georgia Town a Treat for ‘Flanatics’ of Celebrated Southern Writer O’Connor

Andalusia farm gave O'Connor the environment to write her books.

Michigan Lawmakers Try to Put Brakes on Mackinac Island’s E-bike Riders

Mackinac Island doesn’t have cars but the speed of e-bikes are becoming a problem.

San Diego County Museums Worth a Trip

Learn about surfing, artwork, music, and more at various museums in San Diego county.

![[Premiering Now] ‘Organ Harvesting Is the Genocide Aspect’: Expert](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F23%2Fid5635552-CIF_TN-0427-ETV-copy-600x338.png&w=1200&q=75)