SPECIAL COVERAGE

Read More

Read More

Republican Contests Dominate Indiana’s May 7 Primaries

High-profile presidential and gubernatorial races have dominated the media, but congressional primaries are likely to generate high interest from voters.

Republican Contests Dominate Indiana’s May 7 Primaries

High-profile presidential and gubernatorial races have dominated the media, but congressional primaries are likely to generate high interest from voters.

Top Premium Reads

Top Stories

Most Read

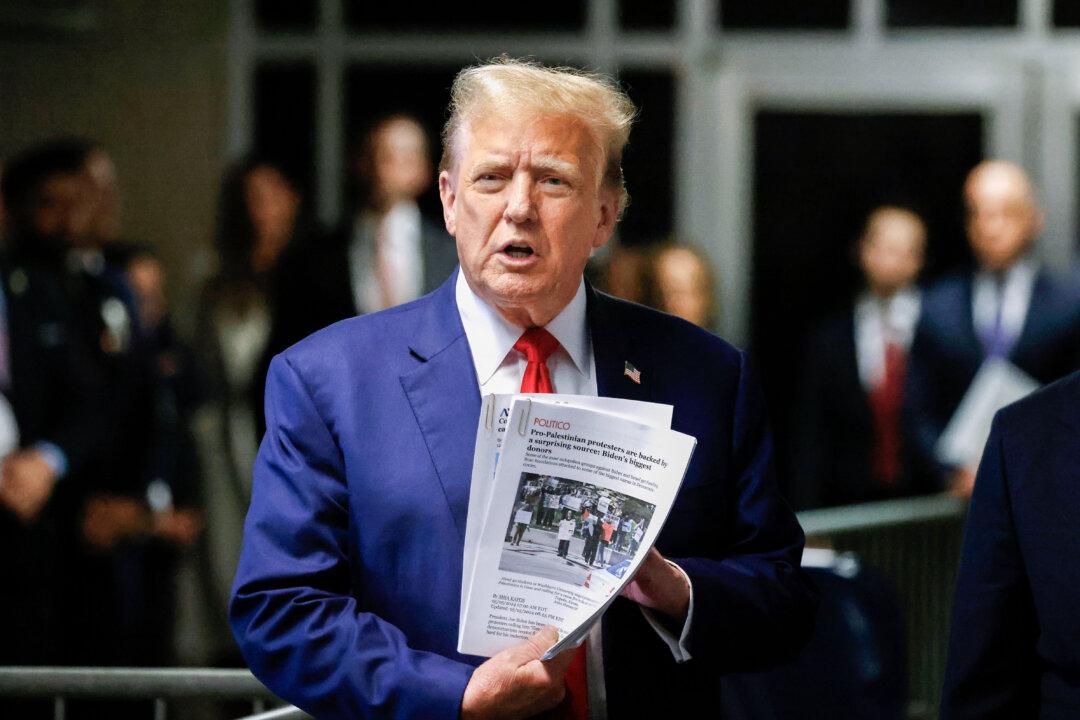

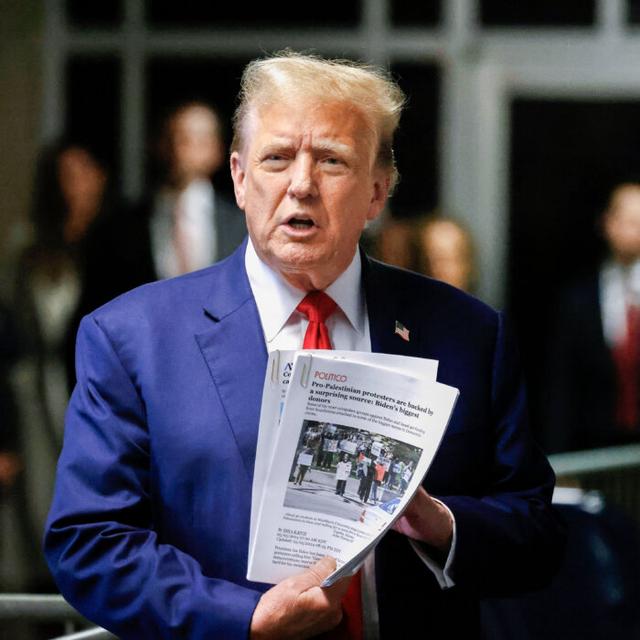

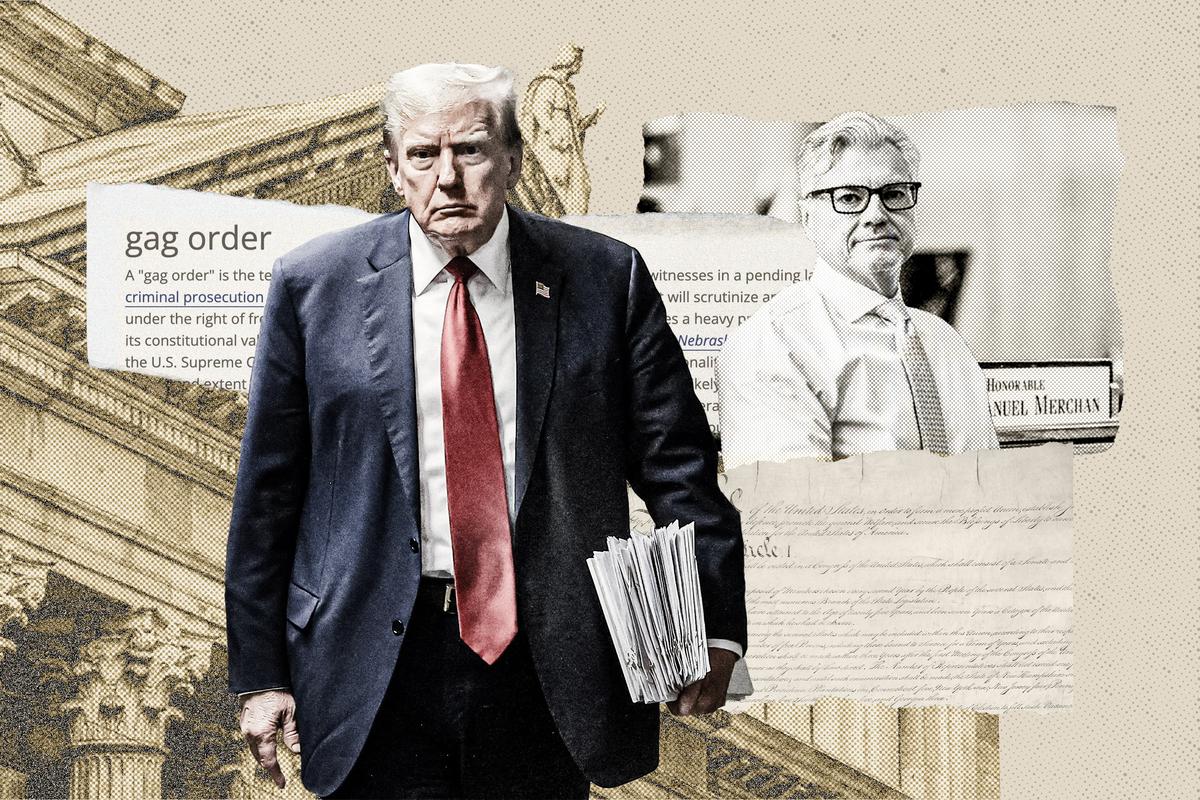

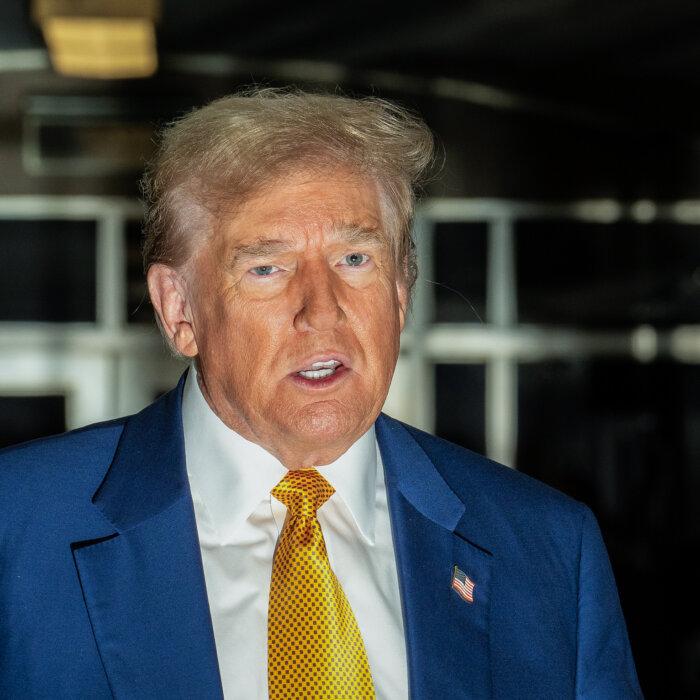

Stormy Daniels Takes Witness Stand in Trump Trial

The trial has entered its fourth week, with prosecutors estimating two or three more weeks of trial.

Woman Conceived in Gang Rape Says It’s Time to Rethink Abortion Exception

Juda Myers says every person has worth, regardless of the circumstances of their birth.

Biden to Unveil Measures to Address ‘Alarming Rise’ of Anti-Semitism on Campuses

‘All Americans must stand united against anti-Semitism and hate in all its forms.’

Federal Reserve Will ‘Eventually’ Cut Interest Rates: NY Fed’s John Williams

Patience is vital in bringing inflation back to target.

US Government, Lawmakers Condemn Russia’s Detention of Falun Gong Practitioner

US officials said they are ‘troubled and saddened’ to hear of the Moscow police raid and ‘deeply concerned’ about the persecution of Falun Gong globally.

Social Security Will Go Bankrupt In 2035, One Year Later Than Prior Projections

When the fund goes bankrupt, Social Security benefits will be cut to 83 percent of what they are now.

EU Leaders Confronts Chinese Communist Leader Over Trade at Paris Summit

‘We stand ready to make full use of our trade defense instruments if this is necessary,’ European Commission President Ursula von der Leyen said.

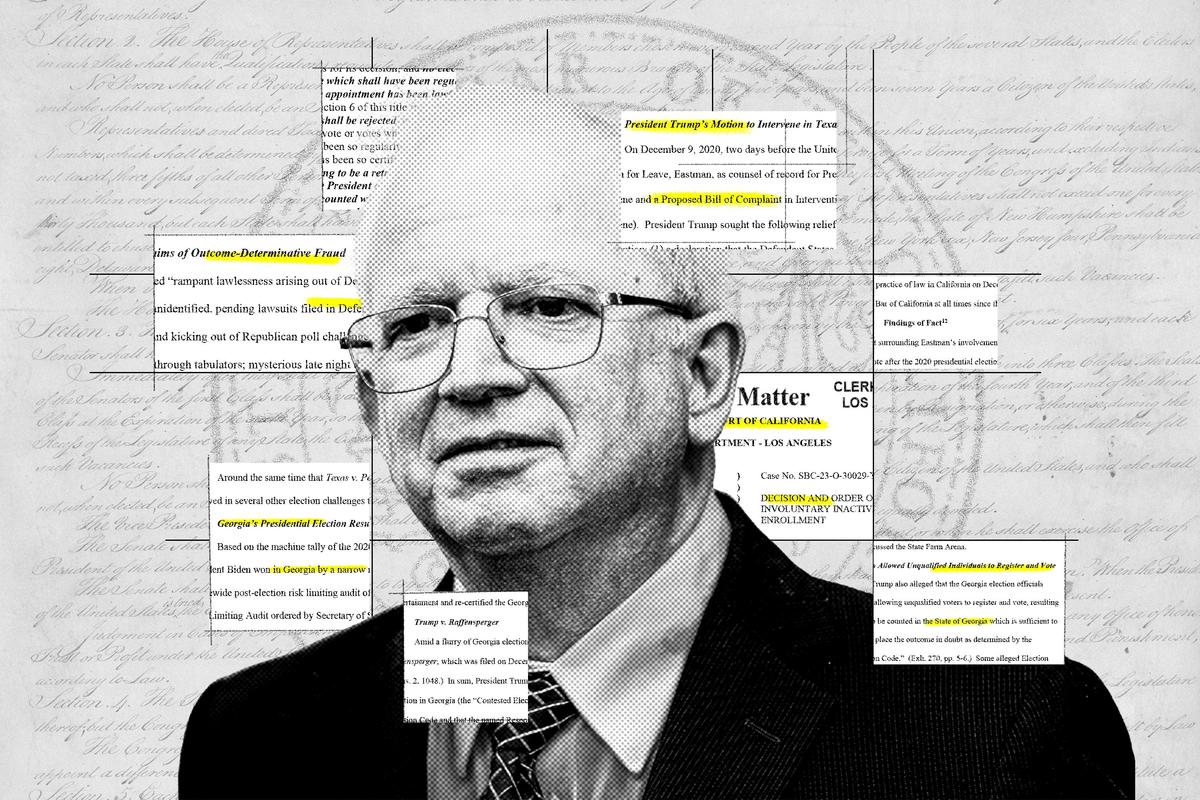

Jan. 6 Arrests Running at Nearly Double the Rate of 2023 and 2022: Report

The U.S. Department of Justice reports 1,424 people have been arrested on Jan. 6 charges—at the quickest pace since 2021.

Harvard, MIT Order Students to End Encampments or Face Suspension

Amid the turmoil and safety concerns, MIT and Harvard officials have said enough is enough.

FBI Issues Joint Warning on Hackers Targeting Email Accounts

The FBI and several other U.S. agencies issued a joint cybersecurity advisory.

Trump Fundraises Off Judge Merchan’s Contempt-of-Court Ruling

The former president sent the email out soon after Judge Merchan’s order.

Menopause Is ‘Overmedicalized,’ Experts Say, but Not All Agree

A new series from The Lancet highlights the medicalization of menopause, sparking debate between medical professionals about how menopause is treated.

Israel Approves Rafah Operation, Says Hamas Proposal Is ‘Far From Israel’s Necessary Requirements’

Israel’s war cabinet unanimously decided to continue its military operation in Hamas stronghold Rafah.

RNC Chief Counsel Charlie Spies Resigns

‘Great news for the Republican Party,’ former President Donald Trump wrote. ‘RINO lawyer Charlie Spies is out as Chief Counsel of the RNC. I wish him well!!’

A Classical Music Resurgence

Studies over the last two years indicate a rise in popularity of the classical genre and a cultural shift towards more interest in traditional music.

A Classical Music Resurgence

Studies over the last two years indicate a rise in popularity of the classical genre and a cultural shift towards more interest in traditional music.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

Long-Distance Connections Like Those on Social Media Affect ‘Social Contagion’ Spread

A new study from researchers at MIT and Harvard found that human behavior can be influenced by people beyond one’s close social circles.

Long-Distance Connections Like Those on Social Media Affect ‘Social Contagion’ Spread

A new study from researchers at MIT and Harvard found that human behavior can be influenced by people beyond one’s close social circles.

Stephen Vincent Benet’s Short Story, ‘The Blood of the Martyrs’

This story shows how a meek scientist took a stand for the truth.

‘Tokyo Olympiad’: Japan’s Homage to World Sport

Director Kon Ichikawa gives a beautiful cinematic celebration of our shared humanity.

A Trio of Moon Paintings

The most celebrated painterly moon compositions are three works by the Romantic artist Caspar David Friedrich.

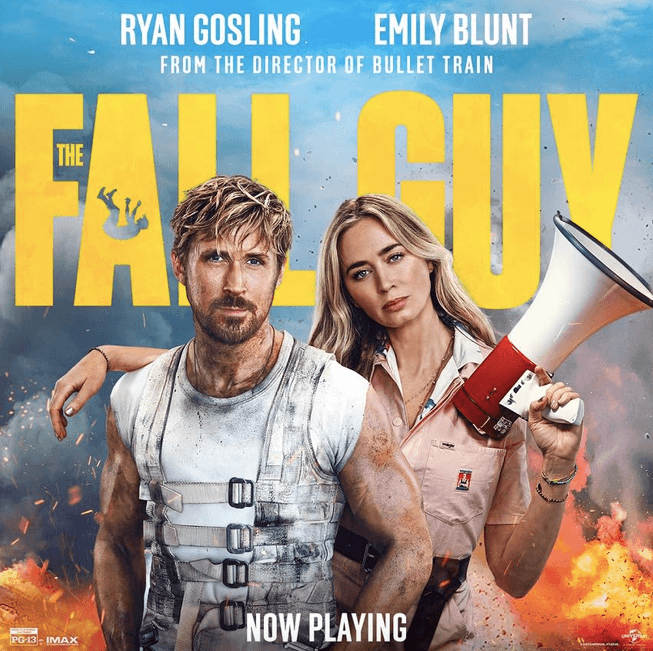

‘The Fall Guy’: 2024’s Very Fun First Summer Blockbuster

Ryan Gosling and Emily Blunt provide tremendous romcom chemistry and hilarious comedic timing in “The Fall Guy,” 2024’s first genuine summer blockbuster.

Brian Kilmeade’s Love of America and Defense of Its History

The ‘Fox & Friends’ host has written six books that highlight American heroes, establish perspective on U.S. history, and create a sense of gratitude.

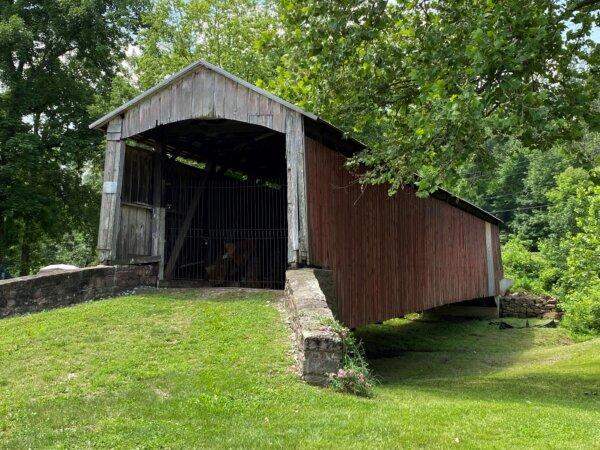

The Allure of Lancaster County’s Covered Bridges

The idyllic seasons offered in late spring through fall are the perfect time for a countryside history lesson.

How a Composer and an Industrialist Created an Iconic Music Hall

In ‘This Week in History,’ a German composer brought a grand vision to New York City and left a lasting legacy for American music.

Stephen Vincent Benet’s Short Story, ‘The Blood of the Martyrs’

This story shows how a meek scientist took a stand for the truth.

Dining Out Woes

Enjoying wine at a restaurant comes with record high prices. Consider dining at home and buying a good wine yourself.

Rick Steves’ Europe: Madrid’s Outdoor Delights

Madrid is best enjoyed on the car-less streets and after the sun sets, when the temperature is more bearable.

Why Adult Children Are Finding Benefits to Traveling With Their Parents

Adult children are giving back to their parents with trips and adventures.

Guatemala Becoming Tourism Hot Spot for Young Travelers

Guatemala is a place to go for adventure but be sure to keep safety in mind.

Rick Steves’ Europe: Madrid’s Outdoor Delights

Madrid is best enjoyed on the car-less streets and after the sun sets, when the temperature is more bearable.

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F30%2Fid5640415-1920x1080-no-epochtv.jpg&w=1200&q=75)

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F30%2Fid5640415-1920x1080-no-epochtv-1080x720.jpg&w=1200&q=75)

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F05%2F04%2Fid5643663-900x1350-600x900.jpg&w=1200&q=75)

![[PREMIERING 5/7, 9PM ET] The Giant UN Agency Hijacked by Hamas: Asaf Romirowsky](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F07%2Fid5645334-240501-ATL_Asaf-Romirowsky_HD_TN-600x338.jpg&w=1200&q=75)

![[LIVE NOW] Trump Allegedly Has Secret Plans to Federalize the Federal Reserve](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F05%2F06%2Fid5644942-CR-TN_REC_050724-600x338.jpg&w=1200&q=75)