SPECIAL COVERAGE

Read More

Read More

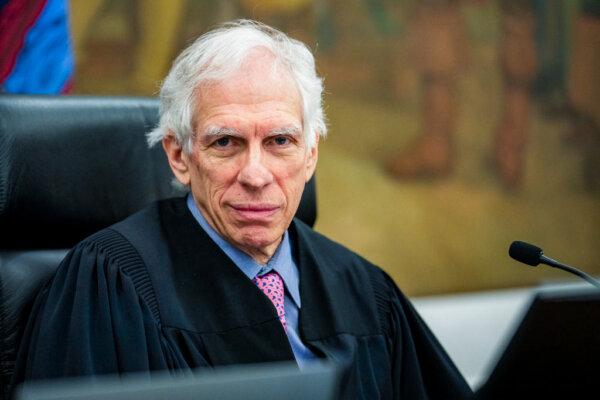

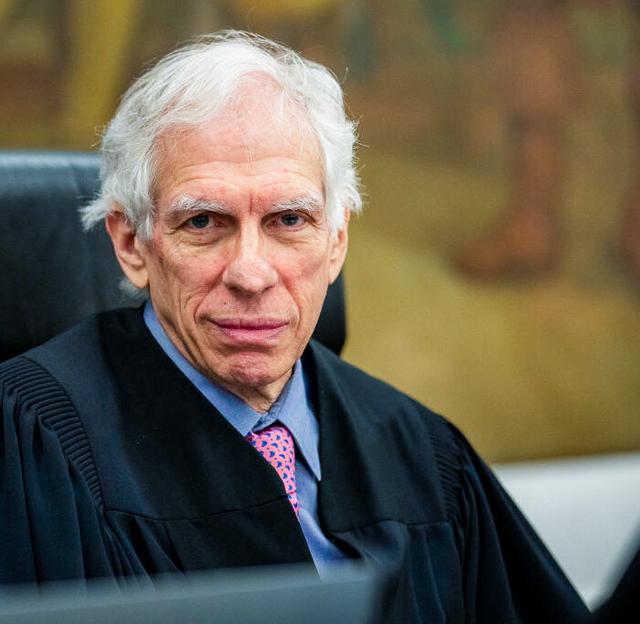

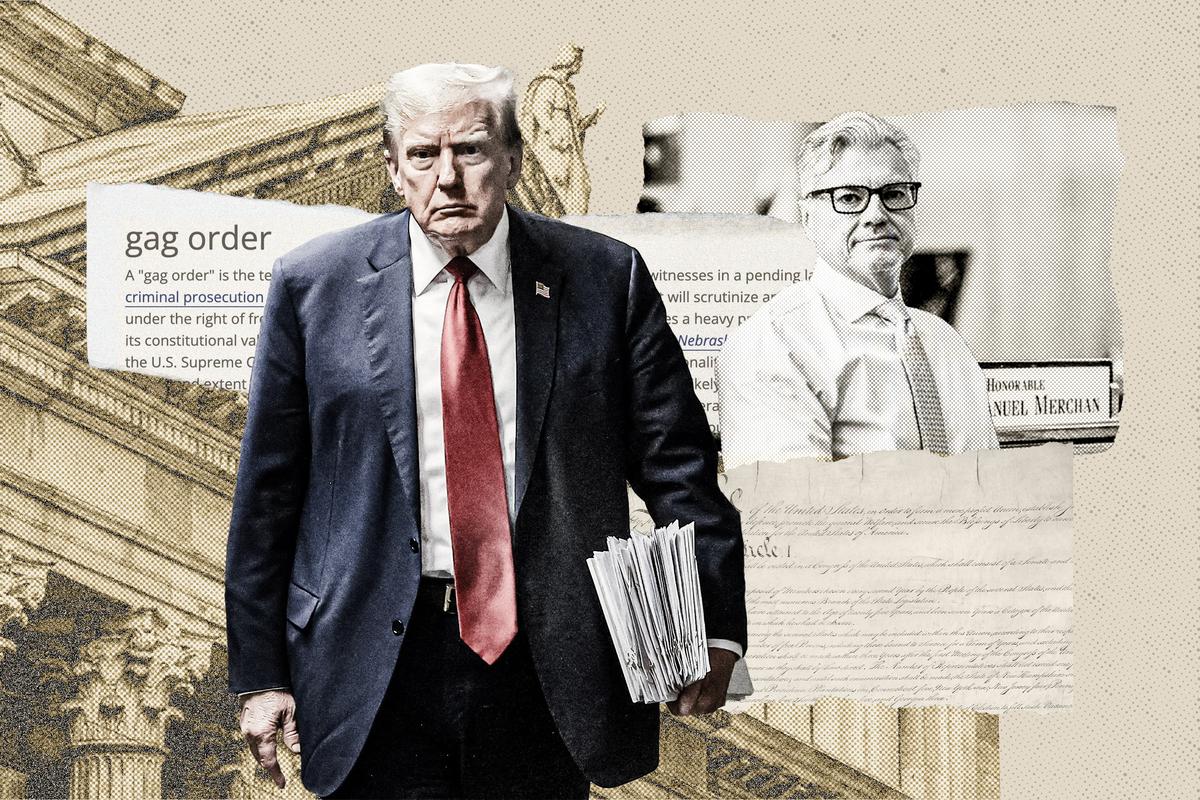

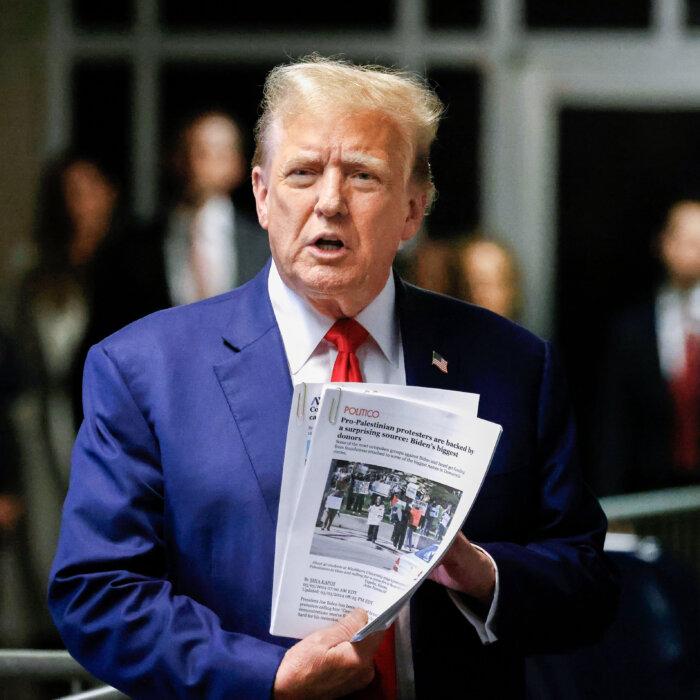

Judge Denies Trump’s Motions for Mistrial and to Modify Gag Order

‘We ask that President Trump be allowed to respond publicly to what happened in court the past day and a half,’ the defense said during Thursday’s hearing.

Judge Denies Trump’s Motions for Mistrial and to Modify Gag Order

‘We ask that President Trump be allowed to respond publicly to what happened in court the past day and a half,’ the defense said during Thursday’s hearing.

Trending Videos

Top Premium Reads

Top Stories

Most Read

Progressive Lawmakers Push for Medical Debt Relief

Among figures used by the legislators was 2018 census data, which showed 8 million Americans were pushed into poverty due to medical expenses.

Senate Passes 5-Year FAA Reauthorization as Deadline Looms

The U.S. Senate overwhelmingly passed a five-year reauthorization of the Federal Aviation Administration one day before the deadline.

Netanyahu Says Israel Will ‘Stand Alone’ If Needed as Biden Threatens to Hold Up Weapons Deliveries

‘If they go into Rafah, I’m not supplying the weapons,’ President Biden said.

Watchdog Accuses UN Agency Staff of Stealing Gaza Humanitarian Aid, Selling It for Profit

Switzerland-based UN Watch said in a May 8 report that it had reviewed numerous allegations.

California Regulators Increase Fixed Monthly Charges for Utility Customers

For most households, the charge will rise from about $10 to $24. One official says the hike will ‘help propel us toward our decarbonization goals.’

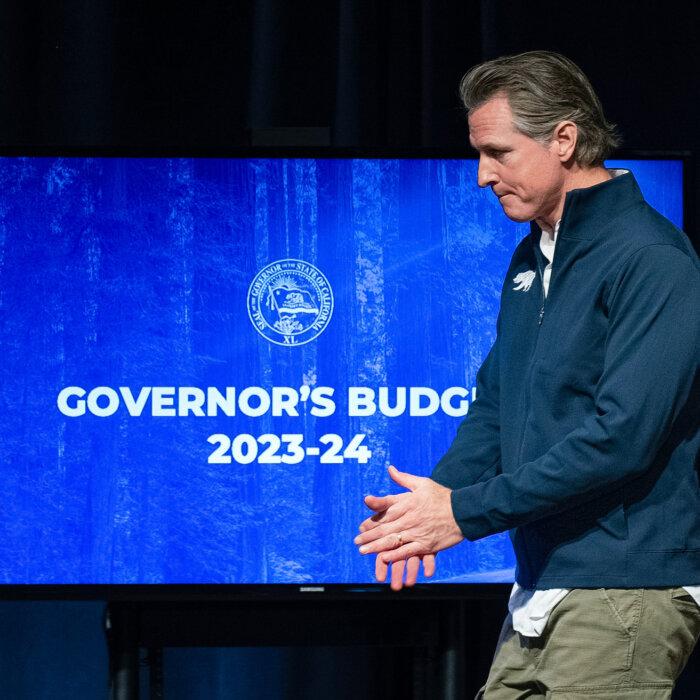

Newsom’s Budget Redo Will Tell Us What’s Getting Cut, Who’s Getting Taxed in California

The revision to be released on Friday should offer more insight into the ’tough choices’ made to tame the state’s financial woes.

How Anti-White Discrimination Became a Conservative Issue

The conversation has shifted since the Supreme Court decision on race-based admissions.

Jordan Calls on Nathan Wade to Testify About Georgia Trump Prosecution

“We write to reiterate our requests and ask again for your voluntary cooperation with our oversight.”

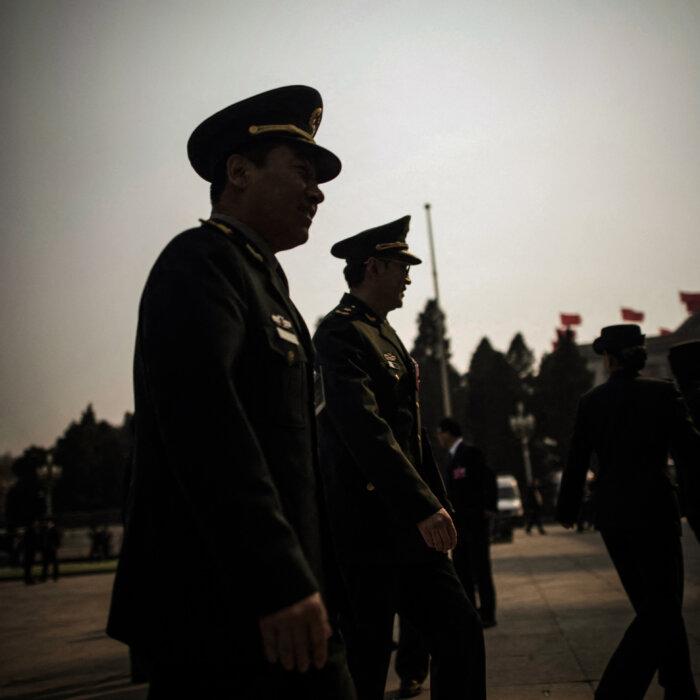

China’s New ‘5-Anti Campaign’ Will Further Purge Those Who Oppose Xi Jinping: China Analyst

In a redux of the infamous Mao-era campaign, Xi aims to sow division among CCP elites, in order to more easily purge their ranks, says a China expert.

Editors' Picks

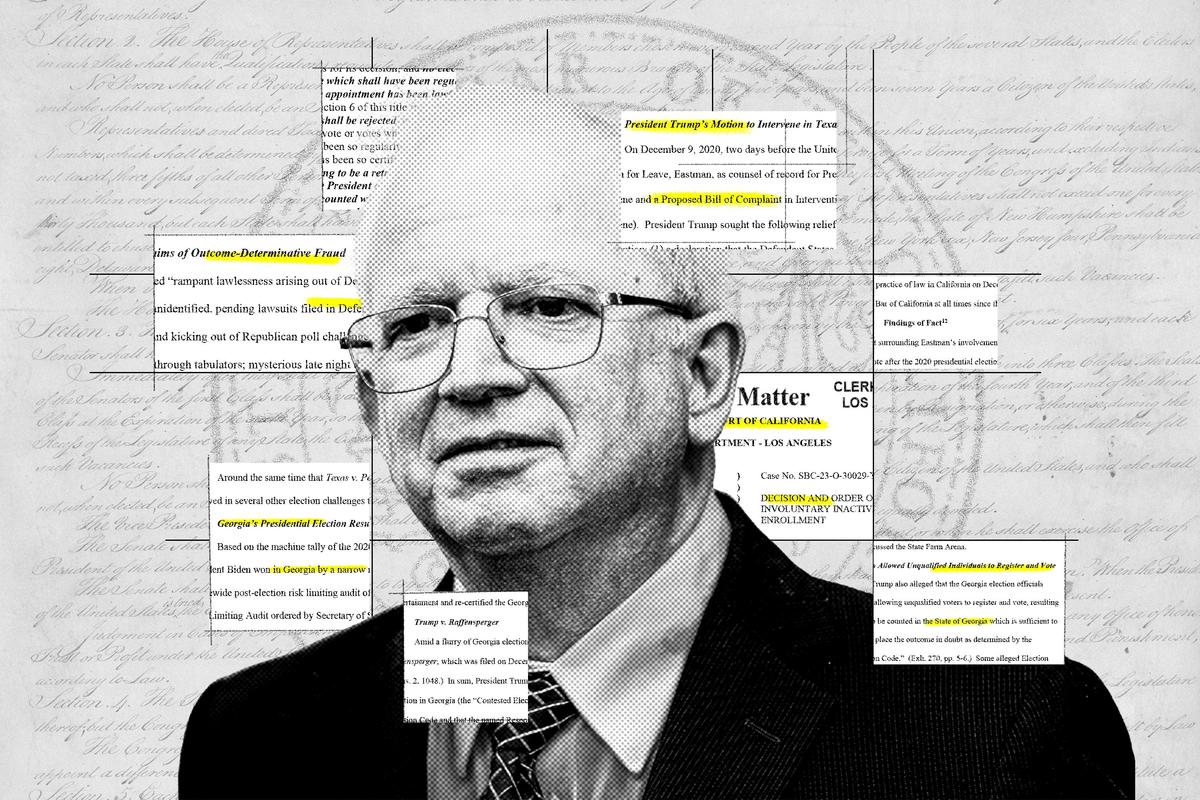

Georgia Appeals Court Agrees to Review Fani Willis Disqualification Ruling

Should Ms. Willis and her office be removed from the case, a state board would need to appoint a new prosecutor.

Federal Watchdog Scrutinizes the FAA After a Spate of Safety Incidents

‘FAA oversight of maintenance programs is paramount’ for passenger safety, the watchdog said, noting ’recent safety events’ as a reason for the audit.

Pro-Palestinian Protesters Embrace Communist Terror Group Propaganda, Leaders: Report

A new report says leaders of a Marxist-Leninist terrorist group coached Columbia and Barnard students on resistance in March.

Hunter Biden Trial Set After Court Rejects Bid to Dismiss Gun Charges

President Joe Biden’s son is now scheduled to go on trial in June.

Natural Splendor: Creating a Breathtaking Wildflower Garden

Wildflowers are beautiful and, if one chooses wisely, can be grown with significantly less maintenance than more formal plantings.

Natural Splendor: Creating a Breathtaking Wildflower Garden

Wildflowers are beautiful and, if one chooses wisely, can be grown with significantly less maintenance than more formal plantings.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

‘The Proud and Profane:’ Authentic and Intriguing

Romance highlights this excellent World War II drama.

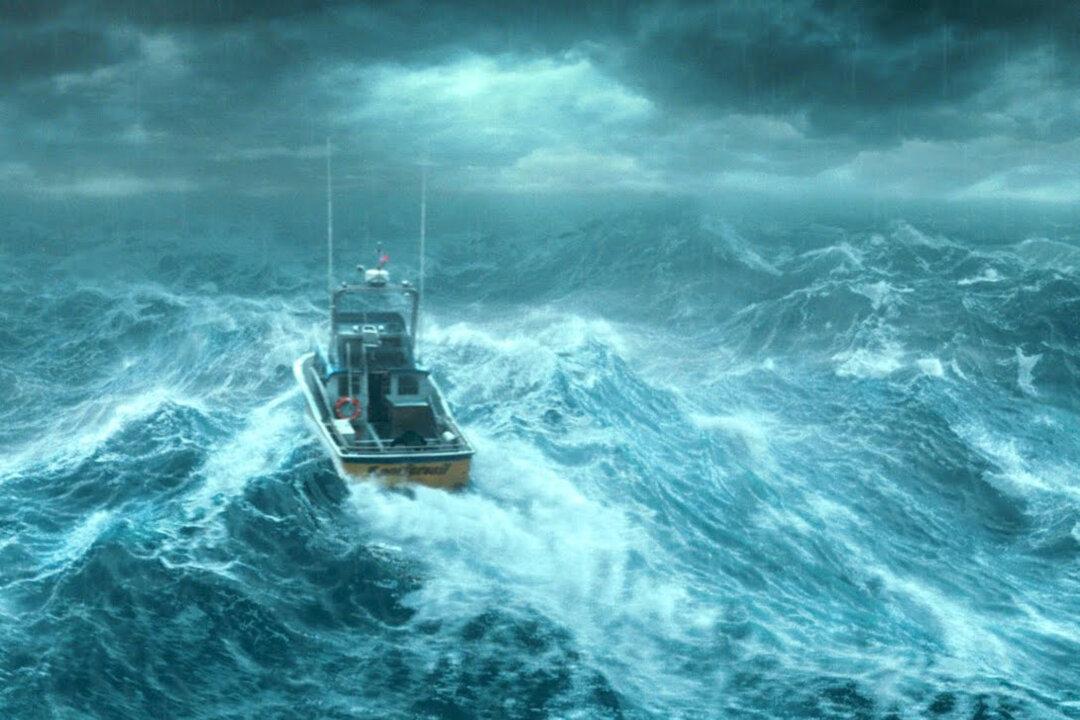

‘The Perfect Storm’: A Dangerous Job at Sea

Fishermen meet their fate in this remarkable disaster film that explores positive masculine themes.

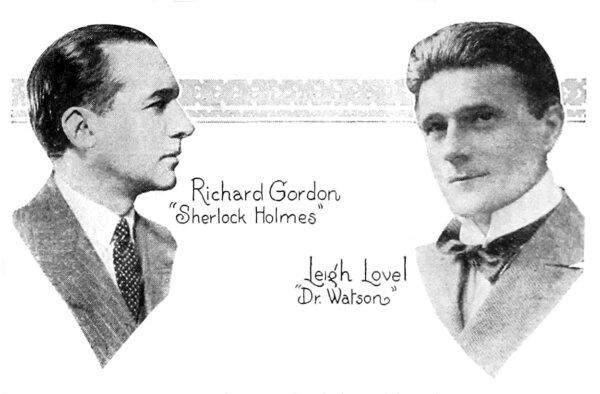

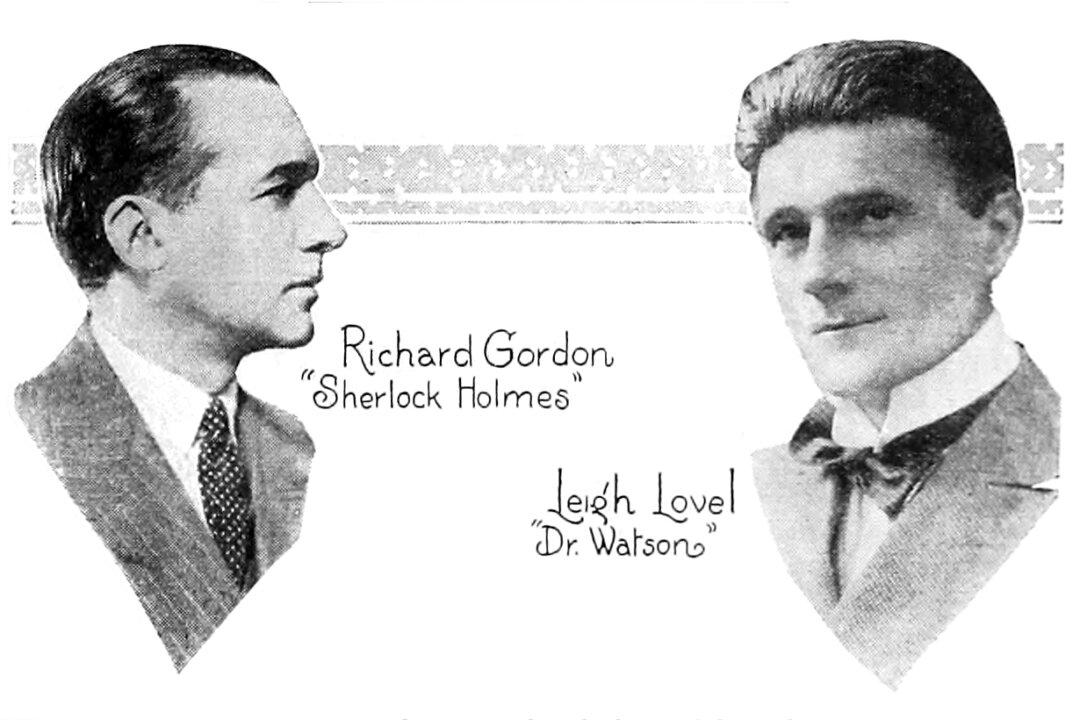

Edith Meiser: America’s Greatest Sherlockian

In this installment of ‘Profiles in History,’ we meet the writer and actress who popularized Sherlock Holmes in America via a different media.

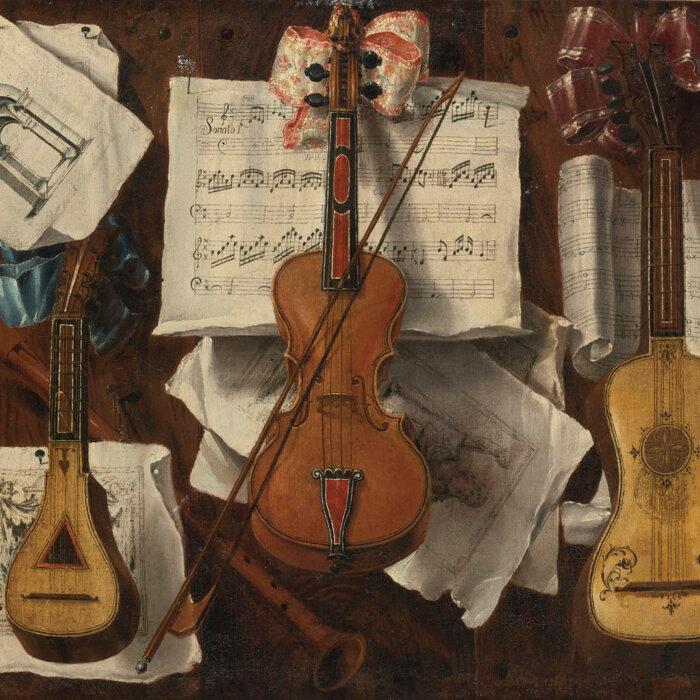

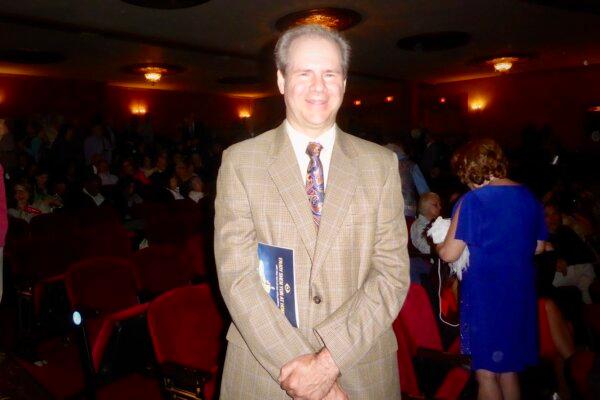

The Newberry Opera House: Music and More for 142 Years

In this installment of ‘History Off the Beaten Path,’ we visit a tiny, rural South Carolina opera house, where performers still take the stage.

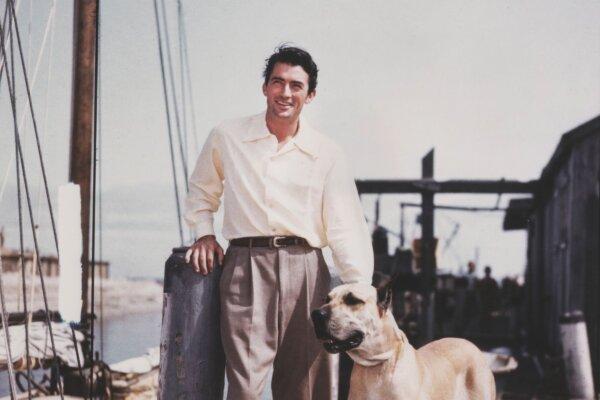

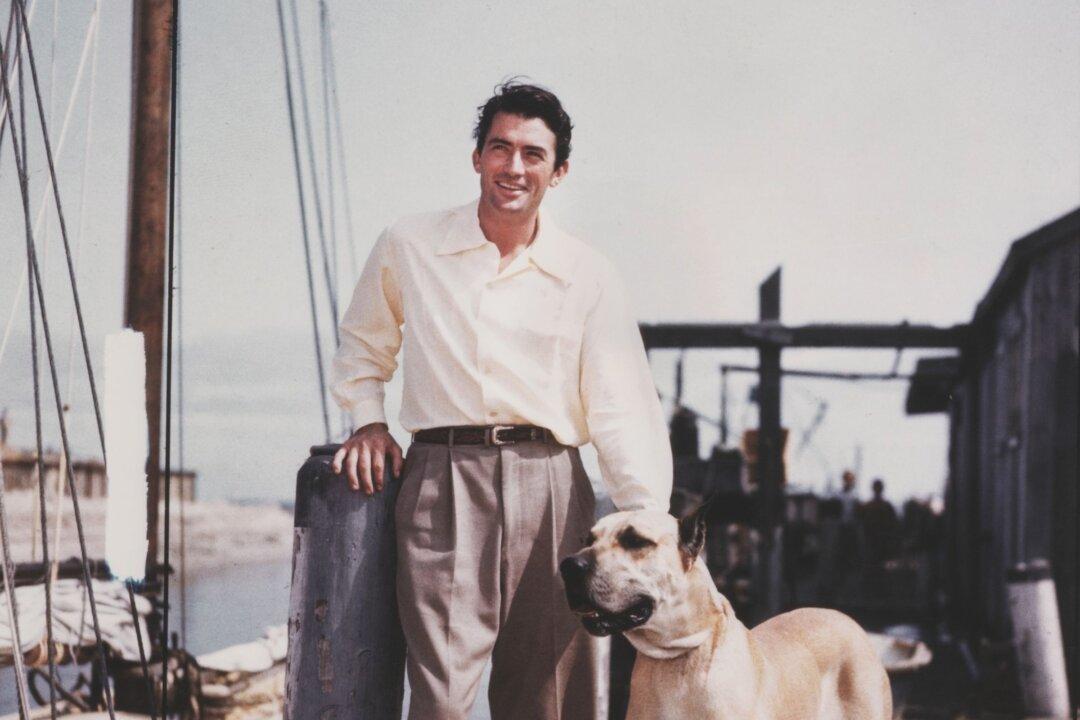

Hollywood Legend Gregory Peck: A Dignified Man On-Screen and Off-Screen

Gregory Peck’s moral convictions defined the type of roles he wanted to play on screen.

‘The Proud and Profane:’ Authentic and Intriguing

Romance highlights this excellent World War II drama.

Corn Salsa

This Corn Salsa is bursting with fresh flavors, easy to pull together, and always a crowd-pleaser.

Taking the Kids: Intro to New Cultures Through Food on a Transatlantic Cruise

Experience culture through food while exploring new places.

A Fairy-Tale Vacation Awaits at Carmel-by-the-Sea

Carmel-by-the-Sea has more restaurants per capita than other small cities in America, but be sure to get a permit before wearing high heels here.

Ed Perkins on Travel: Amtrak’s Surprise

A promising new long-haul train from Amtrak assures on time arrivals on trips between Chicago and the Twin Cities.

Taking the Kids: Intro to New Cultures Through Food on a Transatlantic Cruise

Experience culture through food while exploring new places.

![[LIVE Q&A 05/10 at 10:30AM ET] Texas Targets NGOs Accused of Exacerbating the Border Crisis](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F05%2F10%2Fid5647455-CR-TN_REC_051024_2-600x338.jpg&w=1200&q=75)