SPECIAL COVERAGE

Read More

Read More

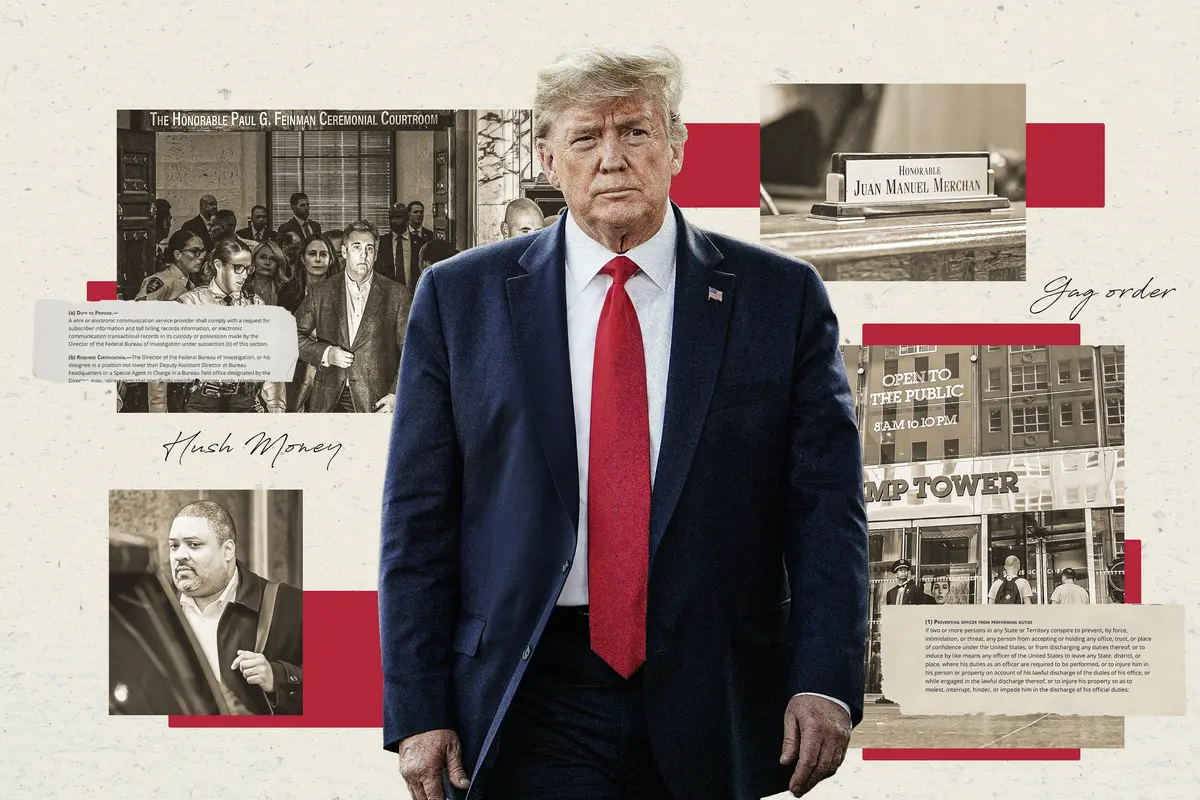

Second Witness Takes Stand in Trump Trial

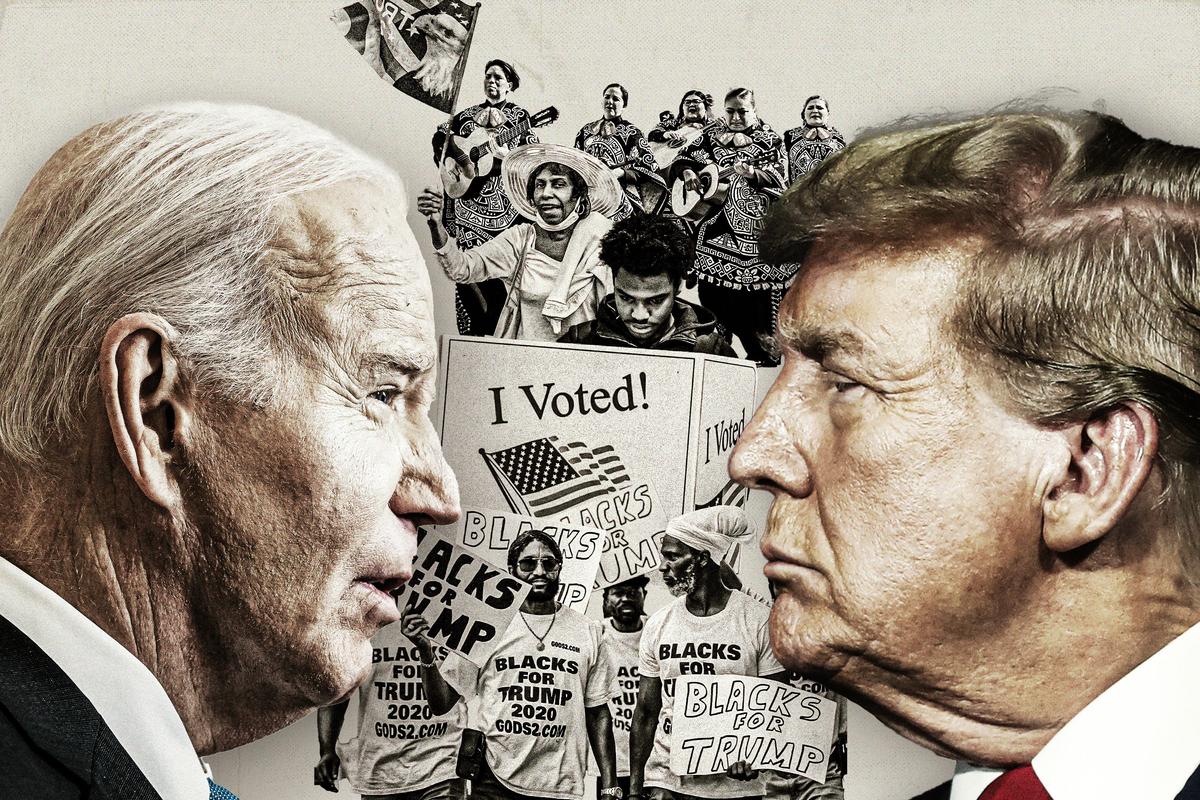

President Biden had said he would be “happy to debate” Trump before November, and Trump responded on social media.

Second Witness Takes Stand in Trump Trial

President Biden had said he would be “happy to debate” Trump before November, and Trump responded on social media.

Top Premium Reads

Top Stories

Most Read

NYC Councilman on Israel–Palestinian Campus Protests: I Never Dreamed There‘d Be a US ’Movement to Back Terrorists’

‘Many of them are products of our universities. And that’s, that’s distressing, to say the least,’ said Democrat New York City Councilman Robert Holden.

Indo-Pacific Bill Could Allow Biden to Send More Weapons to Israel, Ukraine: Lawmakers

‘If the money were truly intended for Taiwan, Congress could directly appropriate it as such,’ said Rep. Harriet Hageman.

Can California Cities Clear Homeless Camps? Depends on Supreme Court Ruling

Justices heard arguments that laws against camping violate the Constitution’s ban on ‘cruel and unusual’ punishment. Cities hope for clarity.

Group Issues Major Warning on Federal Agency’s Proposed Tax Increase

A policy group this week warned that the U.S. Department of Treasury’s proposed budget could significant increase taxes for certain Americans.

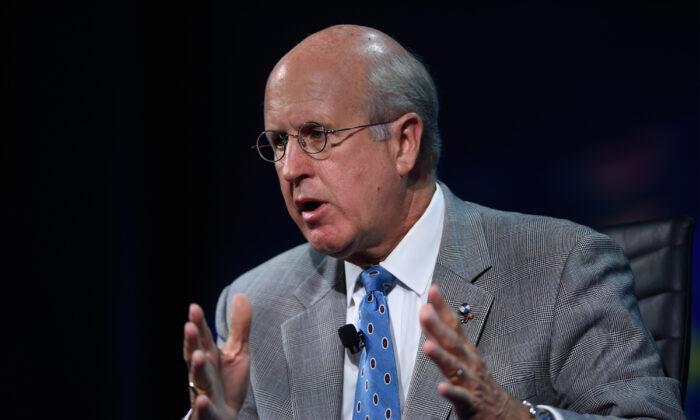

Washington’s Fiscal Mess Is Irresponsible, Unethical, Immoral: Former US Comptroller General

‘We’ve lost our sense of stewardship,’ David Walker said.

Blinken Meets CCP Leader Xi, Questions China’s Support for Russia’s War

Talks with the Chinese sides were ‘candid’ and ‘constructive,’ Mr. Blinken said at a press conference as he wrapped up his visit on April 26.

Fed’s Preferred Inflation Measure Rose More Than Expected

Next inflation stop will be the consumer price index.

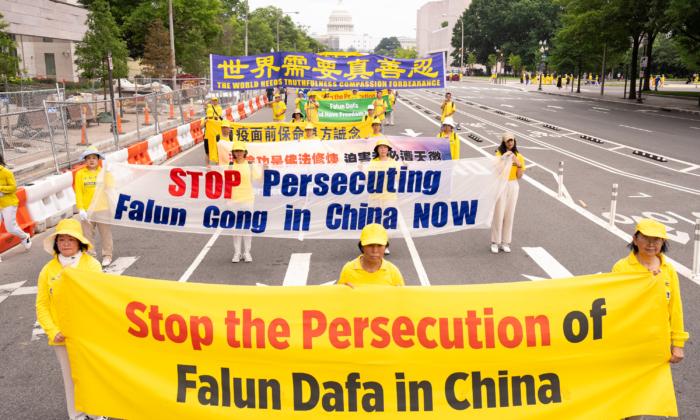

Congressional Commission Demands CCP End Decades-Long Persecution of Falun Gong

Less than three months after the appeal, on July 20, 1999, the Chinese Communist Party launched the brutal persecution of Falun Gong adherents across China.

Planes Almost Collide at 2 Major Airports as Boeing Probe Advances

Some aviation experts argue the FAA’s focus on ‘diversity’ instead of ’merit' in hiring pilots and controllers is leading to serious safety concerns.

Editors' Picks

Supreme Court Seems Open to Allowing Some Presidential Immunity, May Delay Trump Trial

Justices wrestled with how to define a president’s ‘official’ versus ‘private’ acts. A decision may delay President Trump’s trial, which would hand him a win.

Manhattan DA Accused of Politically Motivated Prosecution in Trump Trial: House Report

‘Bragg’s politically motivated prosecution of President Trump threatens to destroy this notion of blind justice,’ the committee alleges.

Pentagon Moving Ahead With Plans to Pull US Troops From Niger, Draw Down in Chad

While working to expel Western forces that have previously been stationed in the country, Niger’s junta government has begun to form partnerships with Russia.

Key Witness Lays Out Saga of Deals Comprising Alleged Conspiracy in ‘Breathtaking’ Trump Trial Testimony

‘Breathtaking and amazing testimony,’ Former President Donald Trump told the press, noting that it ‘was really an incredible, an incredible day.’

The ‘Fast and Furious’ Actor Who Left Hollywood for a Traditional Lifestyle

Lucas Black, who stars in the new film ‘Unsung Hero,’ takes his sons fishing and hunting, while instilling in them confidence and a sense of responsibility.

The ‘Fast and Furious’ Actor Who Left Hollywood for a Traditional Lifestyle

Lucas Black, who stars in the new film ‘Unsung Hero,’ takes his sons fishing and hunting, while instilling in them confidence and a sense of responsibility.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

Cultivate a Positive Mindset

This one change makes you kinder, improves relationships, boosts playfulness and joy, and makes you more goal focused.

Cultivate a Positive Mindset

This one change makes you kinder, improves relationships, boosts playfulness and joy, and makes you more goal focused.

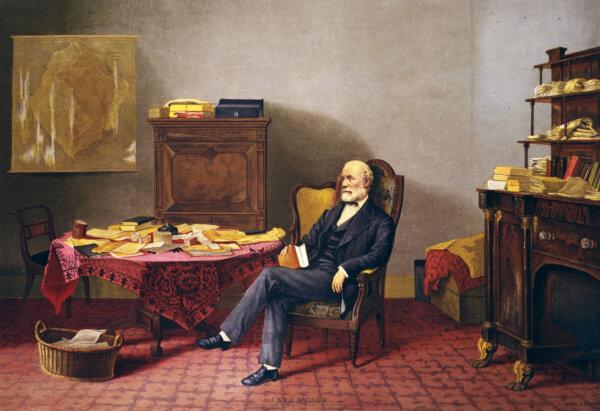

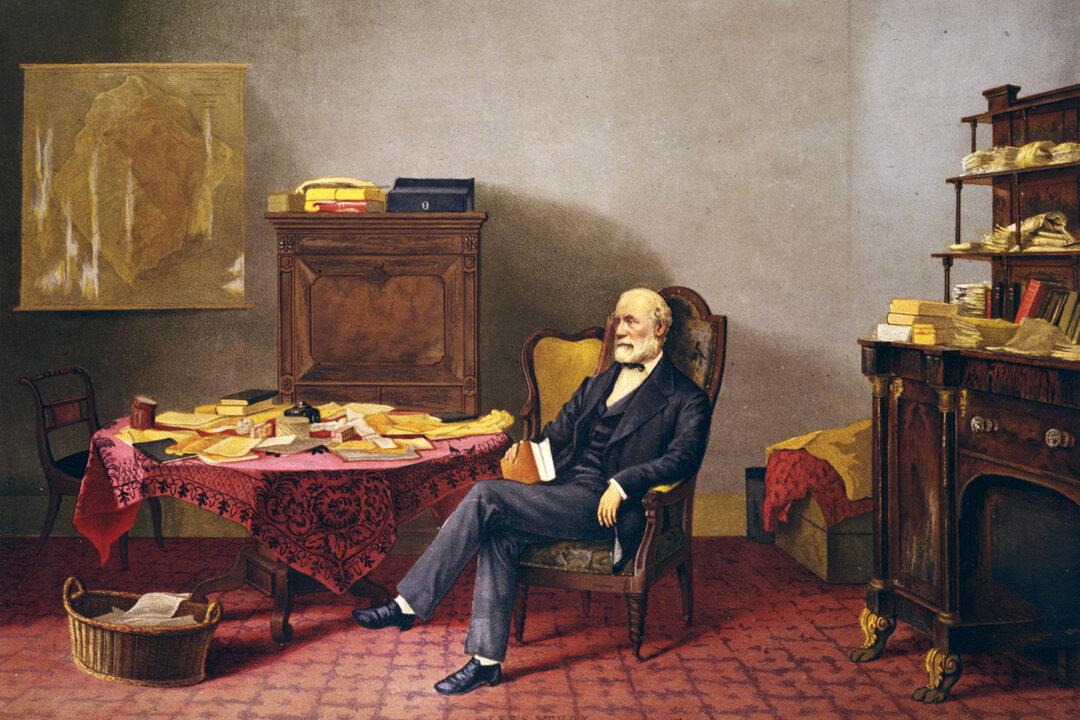

The Two Reputations of Robert E. Lee

While those in the past saw Lee’s stellar qualities, today, some cannot see that he was a man defined, like all of us, by his time.

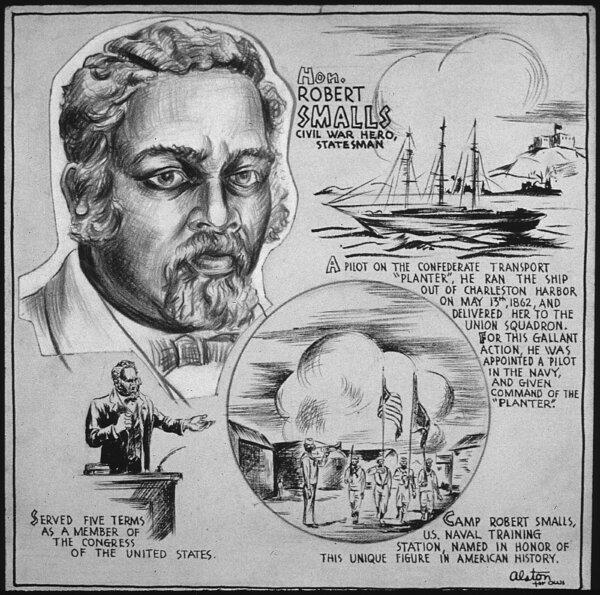

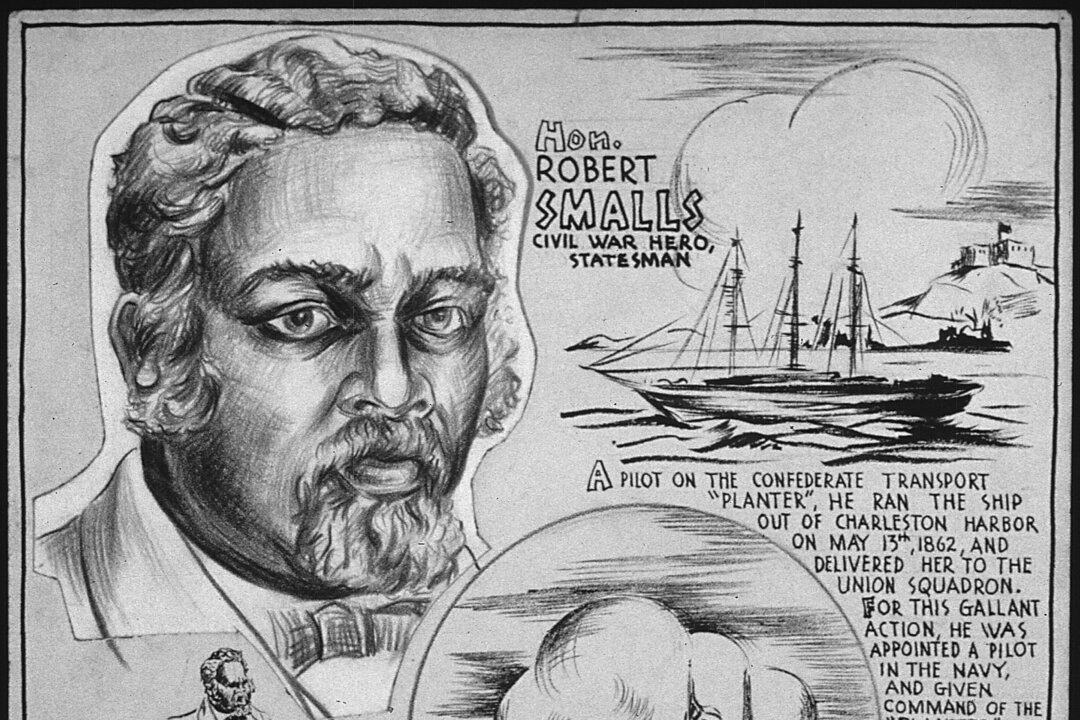

Robert Smalls: Navy Captain and Reconstruction-Era Politician

This former slave would not let anything stop him on the road to freedom.

US Shoppers Buy Less Bread in Bad News for Farmers

Cookie and cracker unit sales were down 3.4 percent from the previous year and grocery-aisle bread sales fell two percent.

Michigan Lawmakers Try to Put Brakes on Mackinac Island’s E-bike Riders

Mackinac Island doesn’t have cars but the speed of e-bikes are becoming a problem.

Taking the Kids: To the Smithsonian Museums

The Smithsonian Institution is the world’s largest museum, education and research complex.

Airbnb Rentals Could Be Harder to Come by in Hawaii. Here’s Why and When That Might Happen

New bills will give counties the power to limit short-term rentals amidst housing shortages.

Michigan Lawmakers Try to Put Brakes on Mackinac Island’s E-bike Riders

Mackinac Island doesn’t have cars but the speed of e-bikes are becoming a problem.