Ofgem has raised concerns that lower-income households are disproportionately hit by the cost of transitioning to net zero as it launched a review on energy affordability.

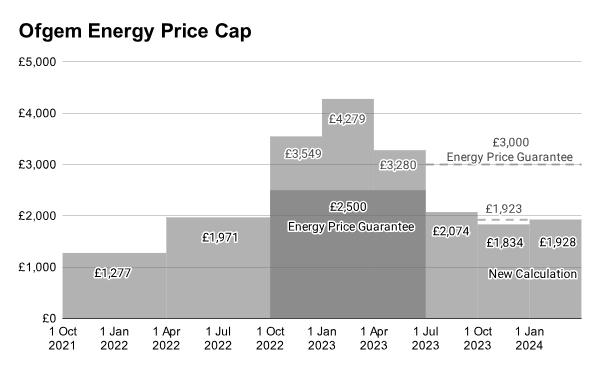

Ofgems energy price cap will fall to £1,690 per year for a typical household on April 1, down from a peak of £4,279 during the first quarter last year, but it’s still a third (32 percent) up from the price two years ago, before the spike in global energy prices.

Although the government’s Energy Price Guarantee has cushioned the worst of the impact, Ofgem said evidence shows many households have been struggling to pay for the energy and resorted to self-rationing energy or, in some cases, self-disconnecting to save money.

Meanwhile, “an increasing number of customers have been building up additional debt on top of a backlog they cannot clear,” the regulator said.

Ofgem said it’s “very concerned” that struggling households have a limited ability to cope with future price shocks.”

The cost of recovering bad debts and the increased number of consumers who are in debt could, in turn, “have serious consequences for the retail energy sector,” it warned.

The regulator also warned of the cost of net zero.

In the foreword, Tim Jarvis, director general of Ofgem, said “significant investment” is required to achieve the net zero goals in the long term.

“And to the extent these costs go on to bills, the risk is that short-term costs could disproportionately hit lower-income consumers that are not able to invest in the technologies or change behaviours to reduce costs without further action,” he said.

Mr. Jarvis said many have called on the regulator to scrap the standing charge in its previous call for input, however, that would mean an increase in unit rates, therefore benefiting some while making others worse off.

The regulator said it wants to “work out the steps we need to take to guard against the harmful impacts of future price shocks, to ensure that the debt burden doesn’t leave us with an unsustainable situation which will lead to higher bills in the future, and to look at how we can better support consumers now and in the future as the market evolves.”

Simon Francis, coordinator of the End Fuel Poverty Coalition, said, “We welcome any investigation into the affordability of energy and it is encouraging that surging levels of energy debt are now on the radar of the regulator.”

He criticised the chancellor for not further extending the Energy Price Guarantee, and called for improvements in the energy grid to be “paid for through general taxation—funded through windfall taxes on firms who have benefited from the energy crisis.”

A Department for Energy Security and Net Zero spokesman said: “Energy prices are now at their lowest in two years and down over 60 percent since their peak, when we covered half of a typical household’s energy bill.

“We are continuing to protect vulnerable people, providing significant financial support for those who need it most—backed by £108 billion. This is on top of National Insurance cuts totalling 10 percent and an increase to the living wage.

“We are also actively consulting on the future of the energy market, to ensure households and families can access the full benefits of moving to a smarter, more flexible energy system.”

The call for input will be open until May 13, 2024.