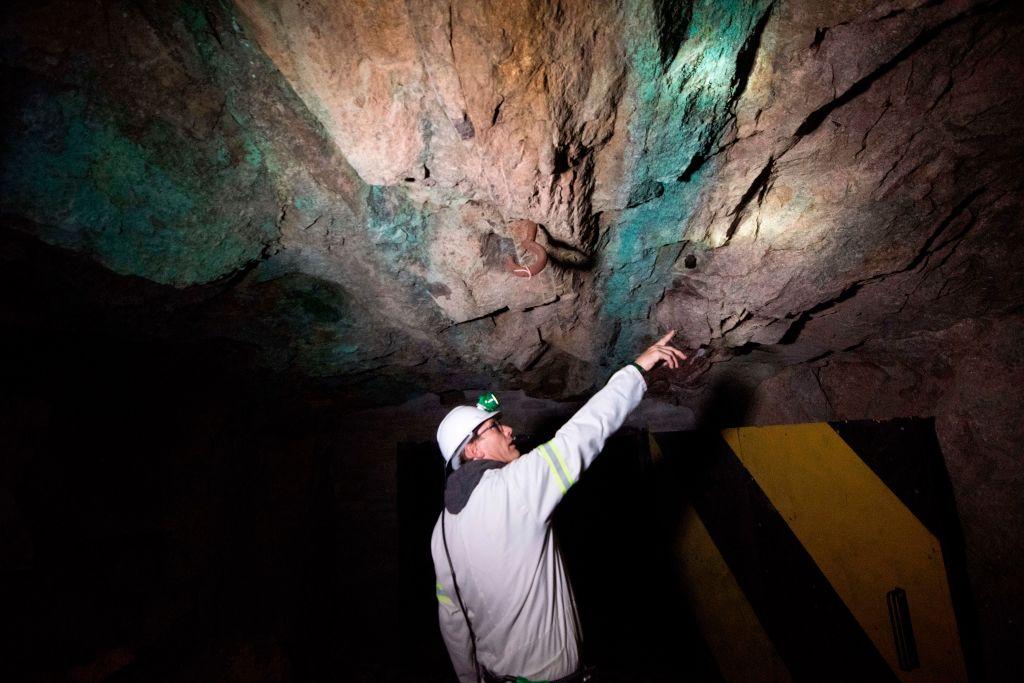

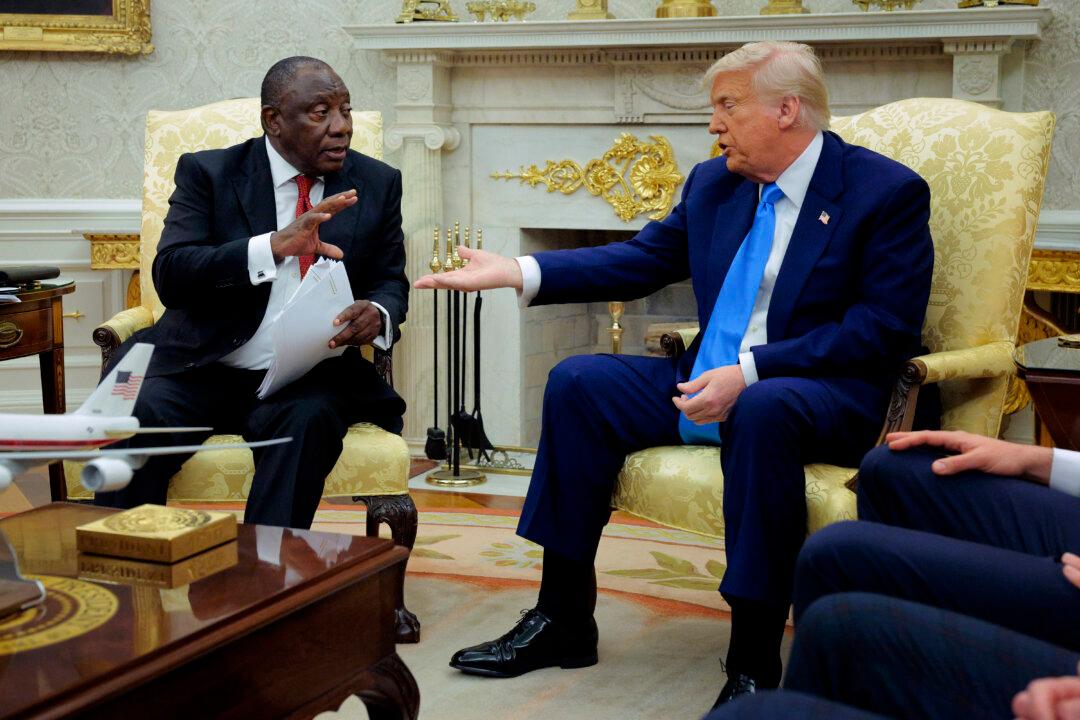

JOHANNESBURG—The United States will face an uncertain future should a Saudi Arabia-led initiative that seeks to create a minerals “Super Region” be successful, energy experts and geopolitical analysts say.

According to the Saudi plan, the world’s most mineral-rich regions—Africa, the Middle East, and South Asia—would band together to effectively control the supply of rare-earth elements fundamental to modern life and the global energy transition.