New power allowing councils in England to double taxes on empty homes will take effect next month, the government has confirmed on Monday.

From April 1, councils will be allowed to charge double council tax when a property has been vacant for one year, instead of two years, because of new rules introduced in the Levelling-up and Regeneration Act 2023.

The new rule will bring England in line with Scotland and Wales.

The law also gives councils the discretionary power to double the tax on second homes in their area from April next year. The government said the policy will raise “millions more” for councils and be “unlocking more of the homes.”

Exemptions will apply to “empty properties that are uninhabitable due to extensive renovation, second homes that are not available for use year-round due to planning restrictions, or for up to a year on homes that have been inherited to prevent families who are grieving from having to pay,” the government said.

A current exemption applies to an empty property because the owner has to live in armed forces accommodation for job-related purposes. The government said the same exemption will be mirrored to apply to second homes premium.

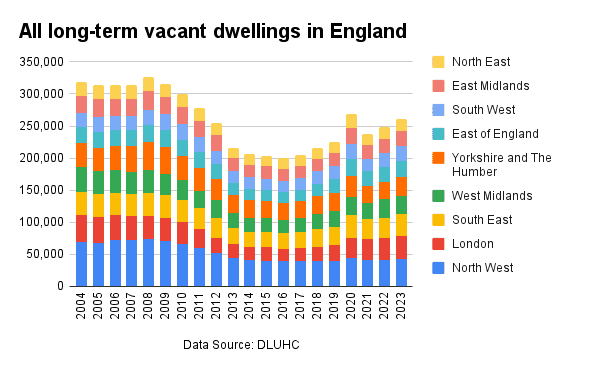

According to figures published by the Department for Levelling Up, Housing and Communities, in 2023, 261,189 homes were vacant for over six months.

Under current rules in England, councils can charge a premium of up to 200 percent for a property that’s empty between two to four years, up to 300 percent if a property is empty for more than five years, and up to 400 percent if a property is empty for ten years or over.

The clock is reset if an empty property has been occupied for at least six weeks.

Announcing the rule change, Minister for Local Government Simon Hoare said: “Long term empty properties are shutting local families and young people out of the housing market as they are being denied the opportunity to rent or buy in their community.

“So, we are taking action as part of our long-term plan for housing. That means delivering more of the right homes in the right places and giving councils more powers to help give local people the homes they need.”

Some councils have already said they will take advantage of the new rules.

According to the council, there are more than 500 properties in the area that are vacant for over a year, and 8,000 families on the council’s housing waiting list.

In Scotland and Wales, councils can charge a premium once a property is vacant for over a year.

Since April 2023, councils can charge up to 400 percent of normal rates on long-term empty homes and second homes.