The Liberal government has increased the size of the federal public service by nearly 100,000 employees since taking office in 2015, according to a new study by the Montreal Economic Institute (MEI).

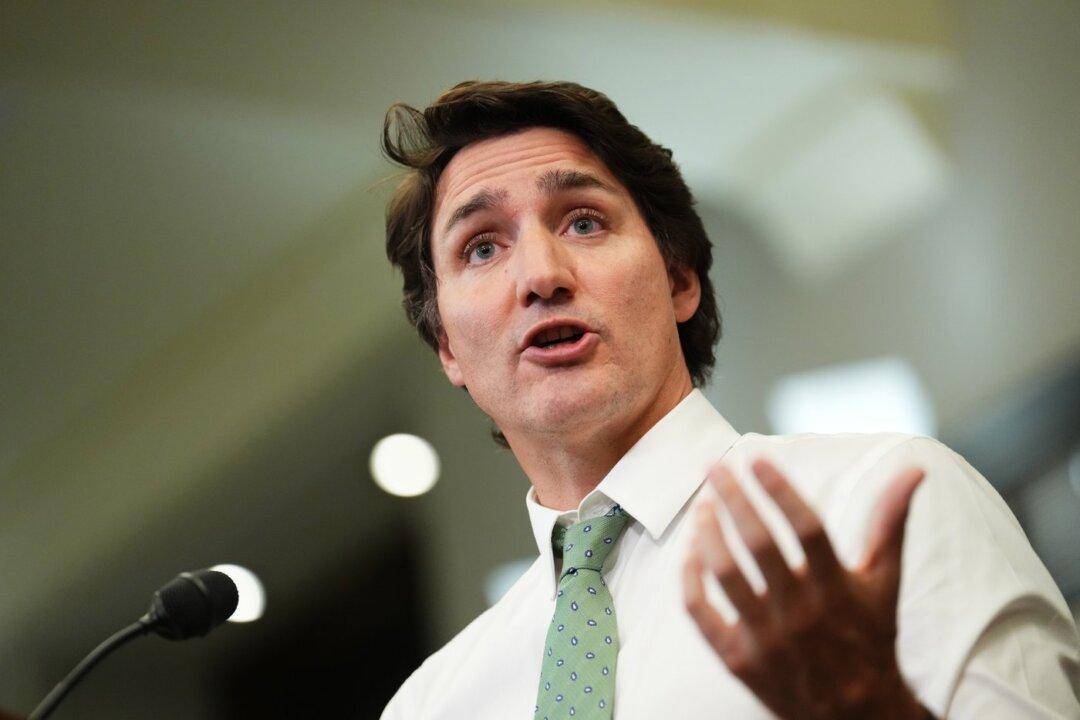

As of last March, the total number of federal employees numbered 357,247—a 38 percent increase over the number of staff when Prime Minister Justin Trudeau tabled his first budget in March 2016. To break it down further, the report indicates that the federal government currently has nine employees for every 1,000 Canadians.