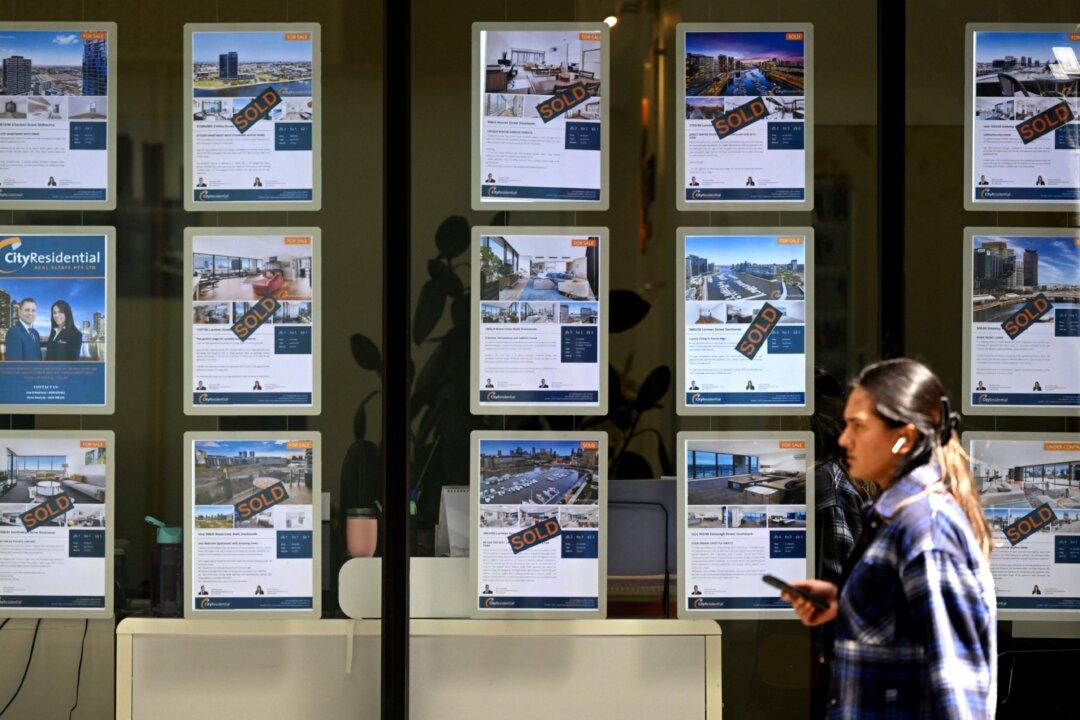

Australia’s property market is showing signs of a rebound despite a series of the largest and fastest interest rate rises in a decade, said the group that operates Australia’s leading residential and commercial property websites.

REA Group published their FY23 Investor and Analyst (pdf) results on Aug. 11 for the year financial year ending June 30, 2023, which showed residential revenue being resilient through the cyclical downturn.