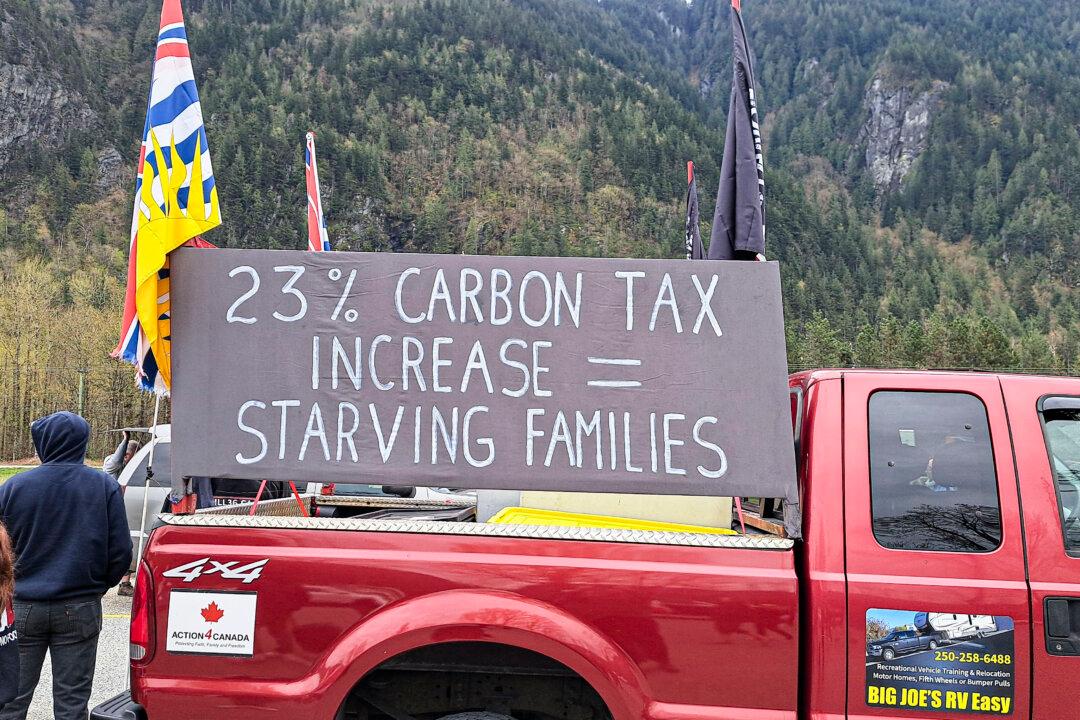

April has ushered in a series of price increases for Canadian taxpayers—from pay raises for government representatives to tax hikes on carbon emissions and alcohol.

A 23 percent carbon tax hike, a 2 percent alcohol tax increase, and a 4.2 percent pay raise for members of parliament means nearly a 30 percent climb in costs for Canadians overall, according to the Canadian Taxpayers Federation (CTF).