Commentary

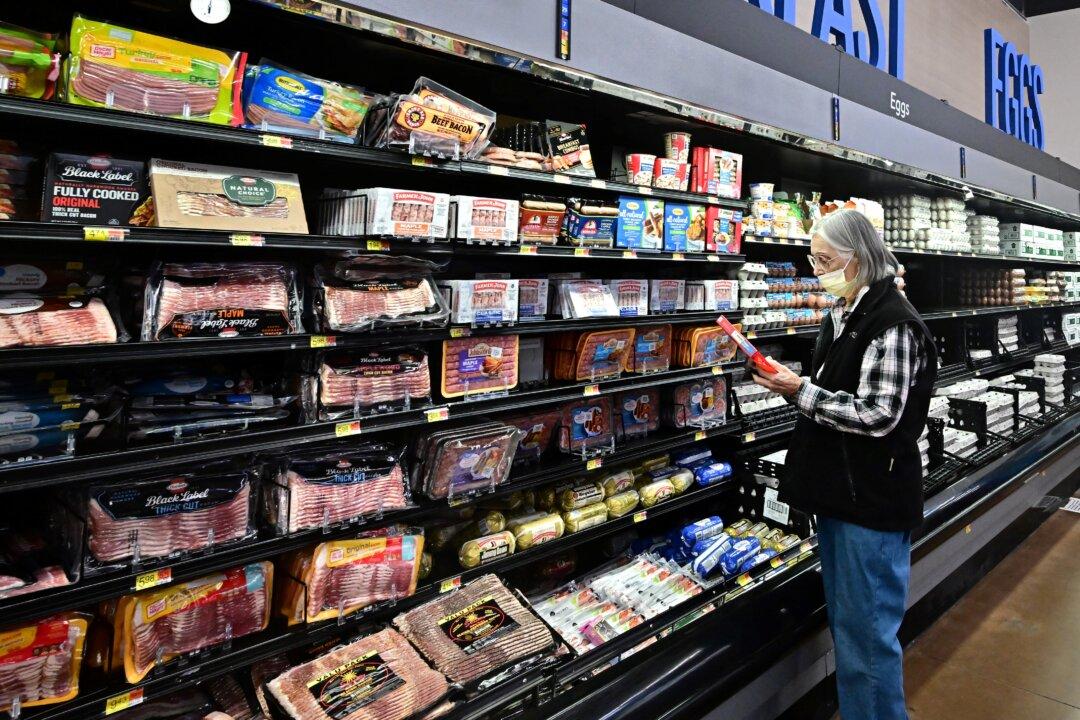

Since the second half of 2021, the economic and finance world has been focused on inflation numbers that are both high and increasing. This is the first in a series where we’ll focus on what higher inflation means to you, how and why it’s being mismeasured, and what steps you can take to protect your portfolio in a high-inflation environment.