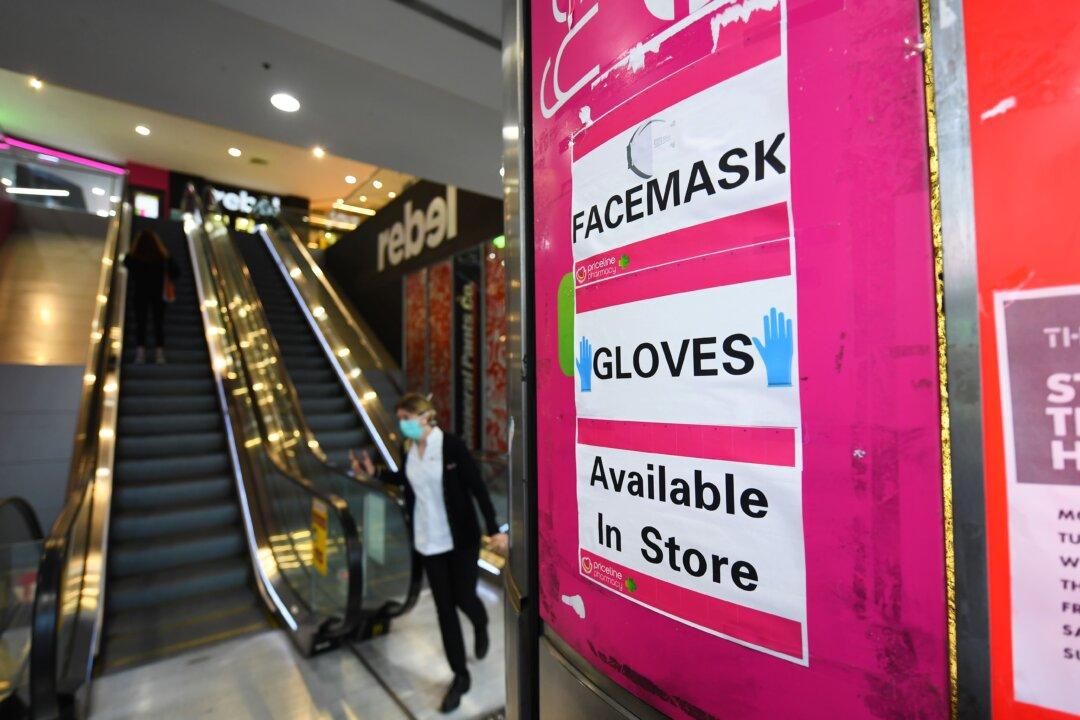

Retail and hardware conglomerate Wesfarmers has lobbed a $687 million surprise takeover bid for Australian Pharmaceutical Industries, which owns the 420-strong retail chain Priceline Pharmacy.

The bid was announced on July 12 and includes an 18.7 to 20.5 percent premium on the share price of the group.