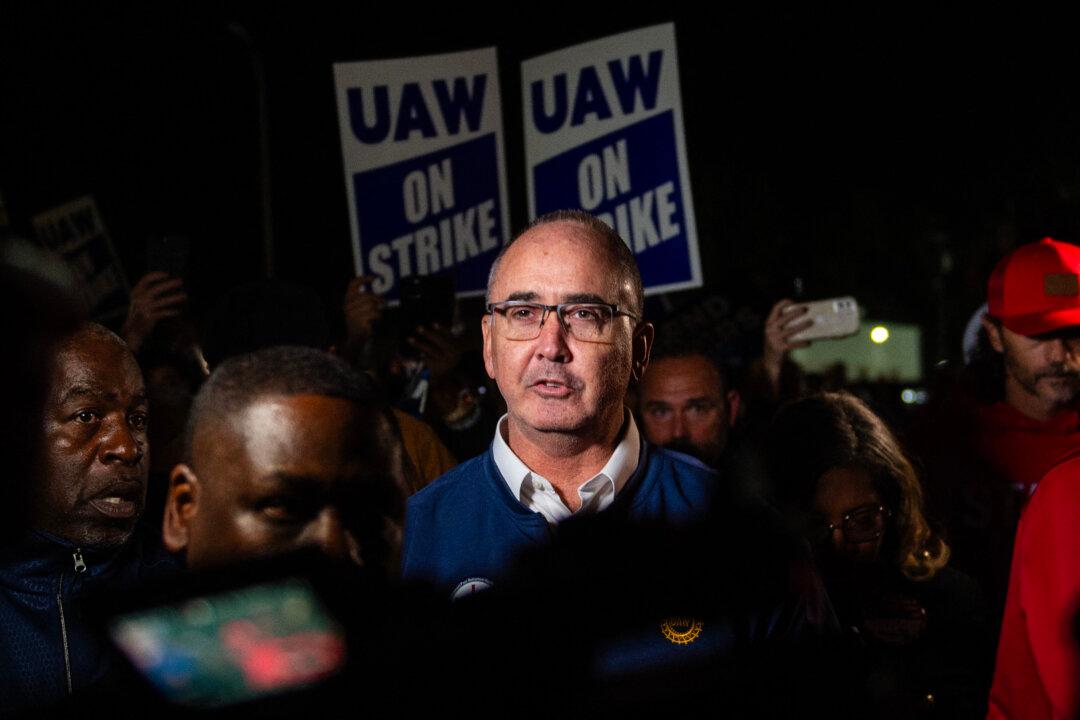

The United Auto Workers (UAW) and Detroit’s Big Three automakers remained far apart in talks on a new round of four-year labor contracts on Wednesday, as union leaders set a tight Friday deadline for “serious progress” in negotiations or they'll expand the strike with new work stoppages.

There was no sign of a breakthrough in talks on Wednesday between representatives of the UAW and Ford, General Motors, and Stellantis. The automakers seemed to become increasingly vocal in their reluctance to accept the union’s eye-watering demands for a 40-percent or so pay hike.