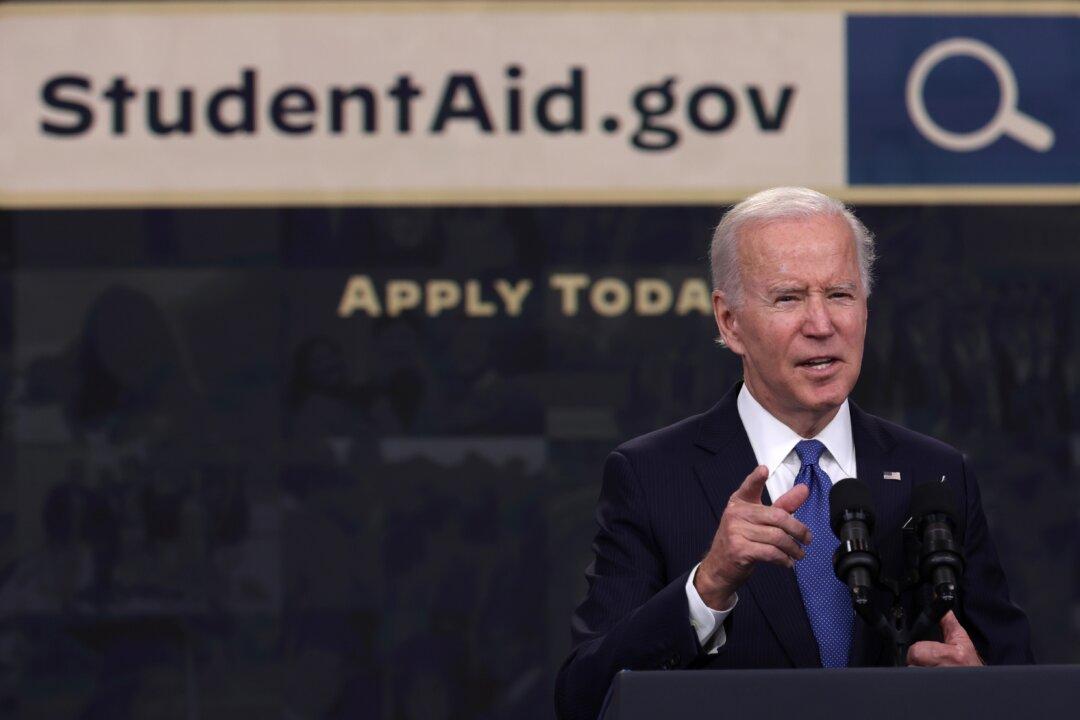

Dozens of Democrats on Capitol Hill are urging President Joe Biden to make good on his promise of student loan debt relief as interest accruement is set to resume next week.

“We are extremely disappointed and concerned that the Supreme Court substituted politics for the rule of law to deny as many as 43 million hard-working Americans life-changing relief from crushing student loan debt,” the lawmakers wrote in an Aug. 23 letter (pdf) to the president.