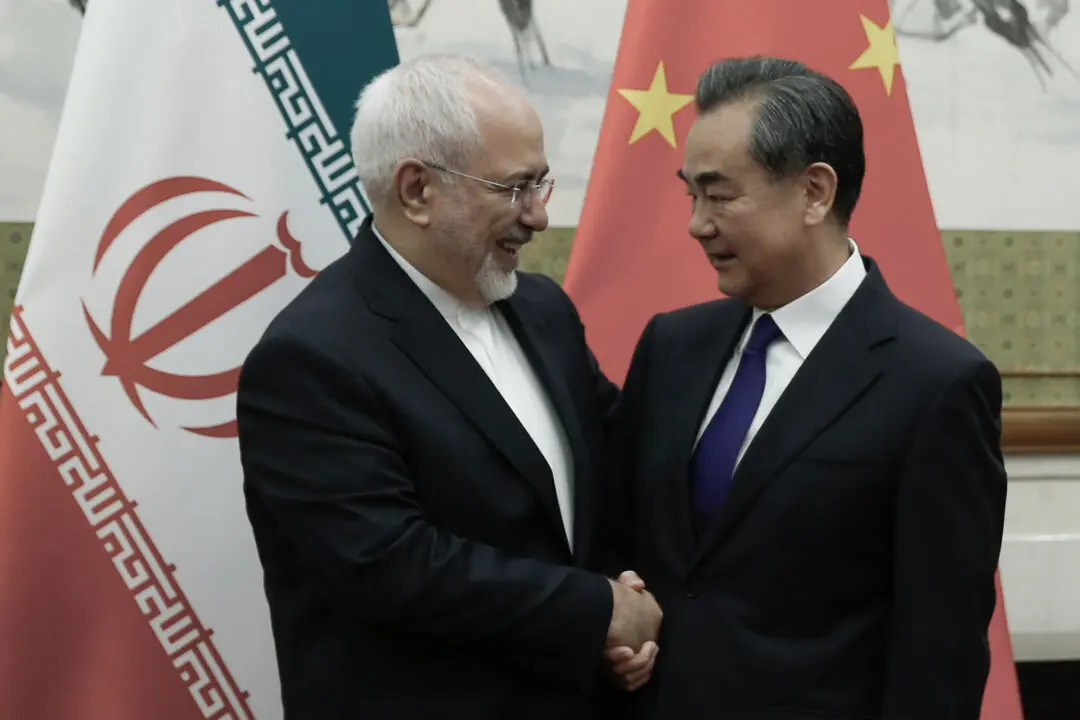

The world’s largest asset manager and a leading investment index provider are facing congressional probes for allegedly facilitating the flow of U.S. dollars into Chinese companies that the United States has deemed to be fueling China’s military or the regime’s human rights abuses.

In letters dated July 31 to BlackRock CEO Larry Fink and MSCI head Henry Fernandez, the U.S. House’s China Select Committee stated that a brief review of MSCI indexes and BlackRock funds showed that the two companies together have directed investments to more than 60 Chinese entities already on the U.S. blacklist.