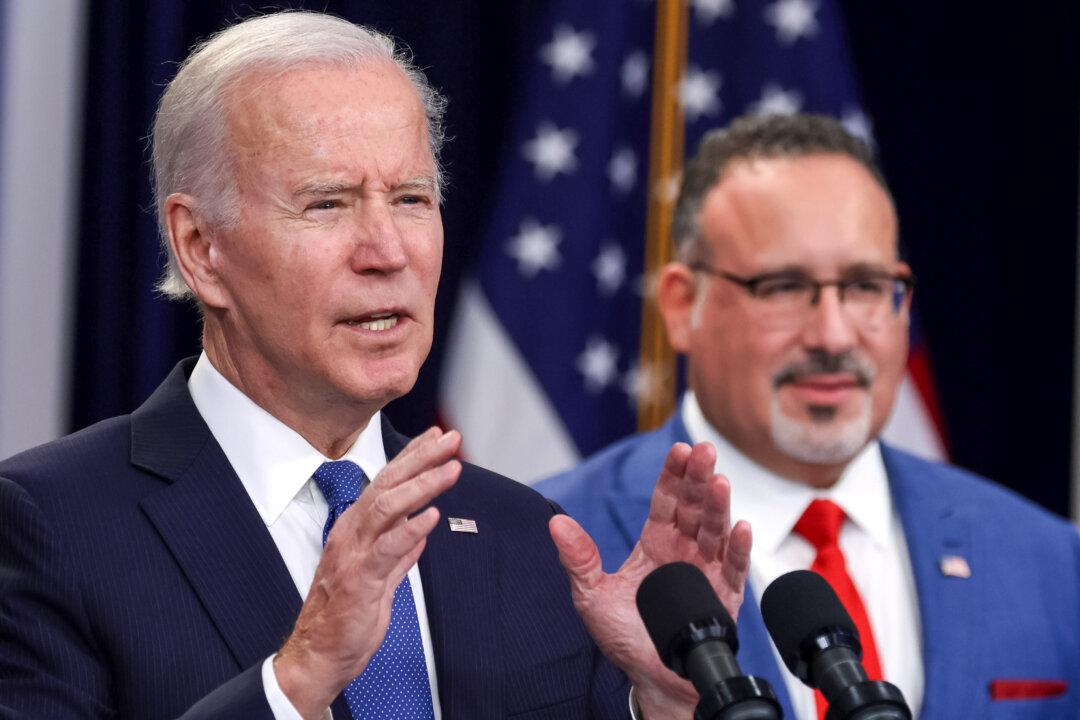

President Joe Biden is proposing to make a temporary tax benefit permanent for most federal student loan borrowers who have or would be eligible for a discharge of their debts.

The America Rescue Plan Act, a $1.9 trillion pandemic-era stimulus package that President Biden signed in 2021, exempts most types of forgiven student loans from federal income taxes. But it applies only to loans discharged between Jan. 1, 2021, and Dec. 31, 2025.