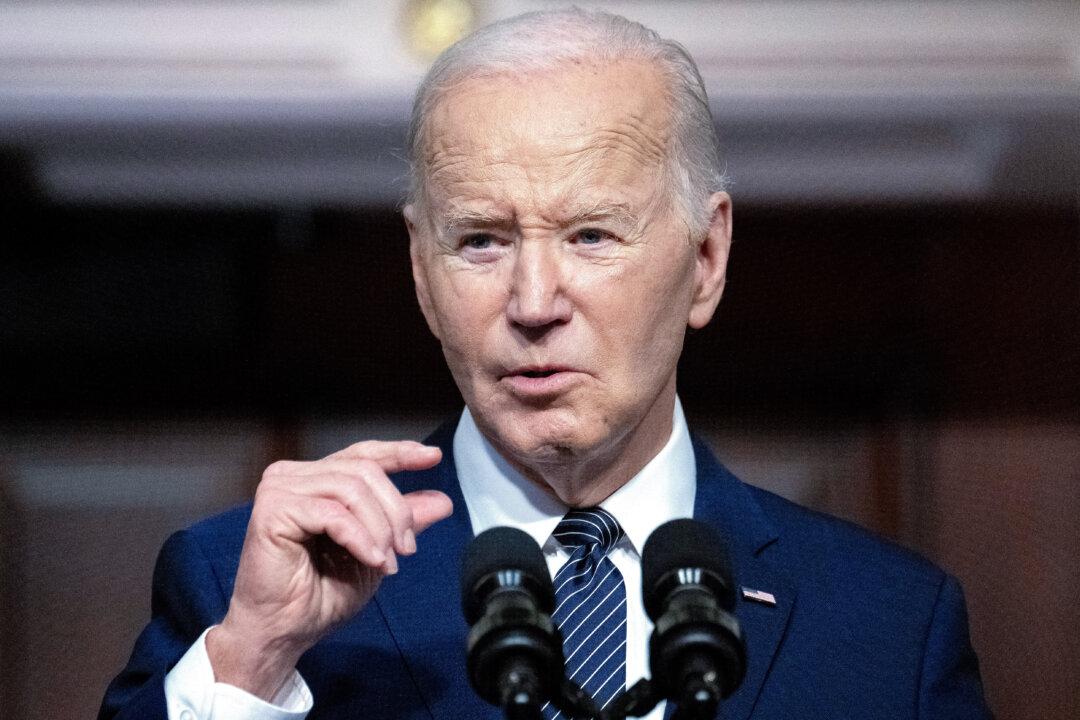

The Biden administration on Friday announced another expansion of the federal student debt relief program, declaring the cancellation of $7.4 billion in student loans for 277,000 Americans.

This initiative, unveiled on April 12, marks another move in the administration’s efforts to cancel student debt, totaling $153 billion in canceled debt for 4.3 million beneficiaries since taking office.