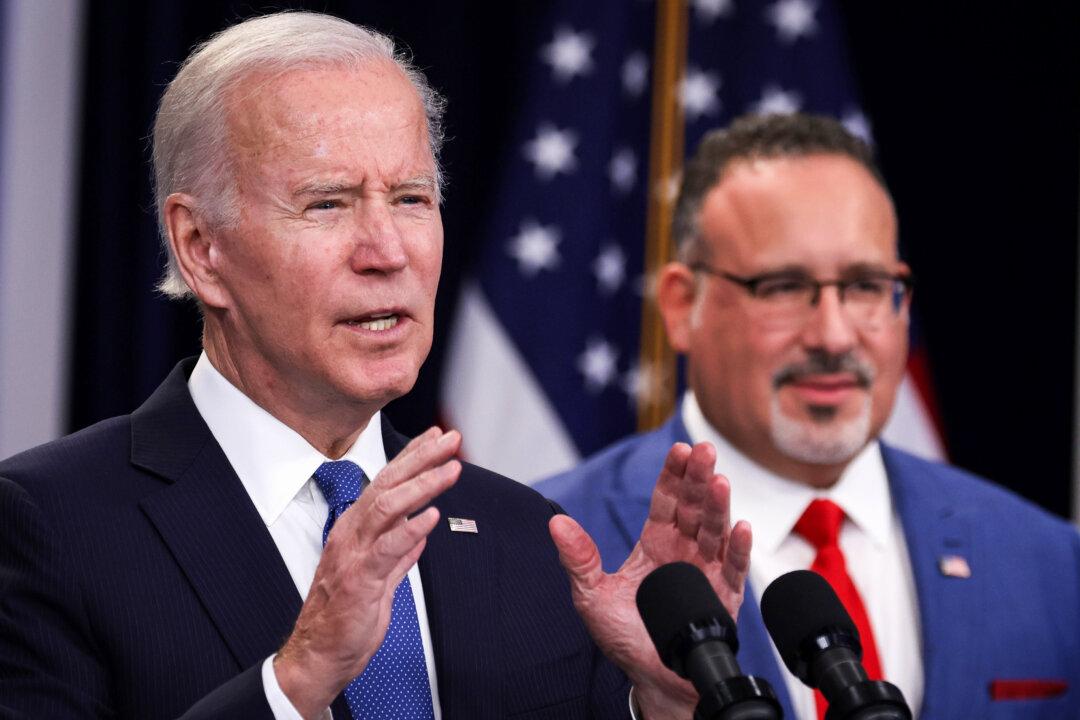

President Joe Biden announced his latest student loan forgiveness plan by canceling $7.7 billion in debts, taking the total amount of student loans canceled under his administration to $167 billion.

“Today, my Administration is canceling student debt for 160,000 more people, bringing the total number of Americans who have benefitted from our debt relief actions to 4.75 million,” President Biden said in a May 22 statement. “Each of those borrowers has received an average of over $35,000 in debt cancellation. These 160,000 additional borrowers are people enrolled in my administration’s SAVE Plan; are public service workers like teachers, nurses, or law enforcement officials; or are borrowers who were approved for relief because of fixes we made to Income-Driven Repayment (IDR).”