Overall economic activity was driven by “steady” consumer spending and stabilizing manufacturing activity following several months of contraction.

The national housing market was “subdued,” limited by “exceptionally low inventory,” although there was unexpected growth along the Eastern Seaboard, the Beige Book noted. Activity levels in the commercial real estate sector were also solid, although there was “ongoing weakness” in the office market to start the year.

In the financial market, loan demand eased while credit standards tightened. Delinquency rates also inched higher.

Energy activity was relatively unchanged, and agricultural conditions were mixed.

Looking ahead, the Beige Book didn’t anticipate a rosy economic landscape.

“Amid heightened uncertainty, contacts did not expect economic conditions to improve much in the months ahead,” the report stated.

The Fed’s Beige Book is published two weeks before the Federal Open Market Committee policy meeting. The anecdotal information in the report was collected on or before Feb. 27 from contacts outside the central banking system.

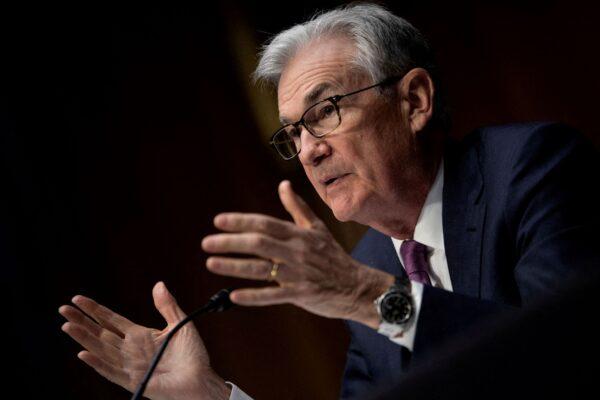

The latest edition comes after Fed Chair Jerome Powell completed two days of testimony on Capitol Hill. He told lawmakers on the Senate Banking Committee and the House Financial Services Committee that the U.S. economy had slowed last year at a significant pace, “with real gross domestic product rising at a below-trend pace of 0.9 percent.”

“Although consumer spending appears to be expanding at a solid pace this quarter, other recent indicators point to subdued growth of spending and production,” the head of the central bank noted. “Activity in the housing sector continues to weaken, largely reflecting higher mortgage rates. Higher interest rates and slower output growth also appear to be weighing on business fixed investment.”

Powell sent financial markets tumbling when he revealed that interest rates need to rise higher than officials first thought amid slowing disinflation trends.

In an exchange with Rep. Andy Barr (R-Ky.) during a hearing on March 8, Powell noted that the terminal rate would need to be higher than 5.5 percent based on “the data we’ve seen so far this year.”

But there will be plenty of data for monetary policymakers to sift through before the rate-setting committee convenes.

The February nonfarm payrolls, the Consumer Price Index, and the Producer Price Index reports will be released over the coming week.

Economists anticipate that 204,000 new jobs were created last month. The annual inflation rate is expected to slow slightly to 6.2 percent, while month-over-month producer prices are projected to rise by 0.3 percent.

On the labor front, the Beige Book confirmed Powell’s assertion that the labor market is extremely tight.

“Labor market conditions remained solid. Employment continued to increase at a modest to moderate pace in most Districts despite hiring freezes by some firms and scattered reports of layoffs. Labor availability improved slightly, though finding workers with desired skills or experience remained challenging,” the report stated.

The recent jobs data point to another month of substantial Bureau of Labor Statistics employment numbers.