Commentary

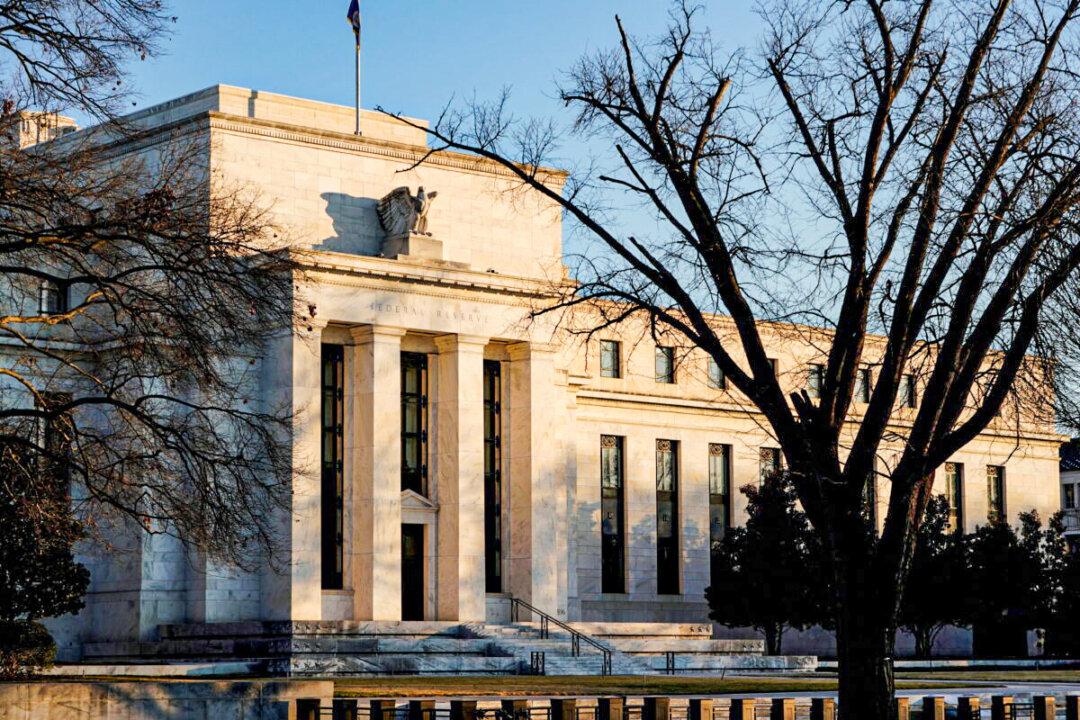

Eight times a year the Federal Open Market Committee meets to review economic and financial conditions to determine the appropriate positions for monetary policy to maintain full employment and price stability. At its recent March 2022 meeting, the FOMC voted to raise the Federal Funds Rate to reduce aggregate demand in hopes to squelch rapidly rising inflationary pressures.