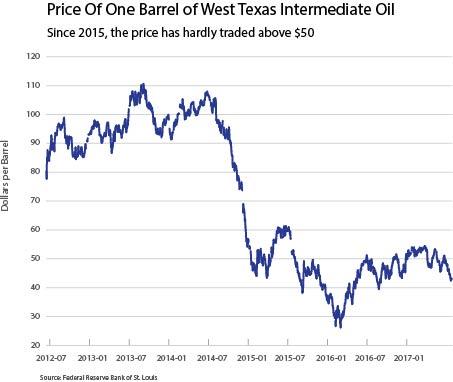

For many traders, it was a shock to see the barrel of oil collapse to 12-month lows in June, despite an agreement from producers to cut supplies. However, not many people are talking about the falling prices in other commodities, as well as the positive impact of low oil prices on global growth.

So why is a barrel of West Texas Intermediate still trading for below $50? The problem is not just due to oversupply, but also to a slowdown in the growth of Asian demand. Chinese demand has supported prices for the past decade, as demand in developed markets has reduced thanks to increases in efficiency, substitution, and technology.

However, China’s stockpiles have risen to 511 million barrels in capacity, just below the 693 million barrels the United States held in March. Chinese industrial demand is also falling, due to rebalancing away from the industrial sector and toward services.

But oil prices, in this context, are just a symptom of a much more severe illness: the excess debt and overcapacity created in China to support an unsustainable growth model.