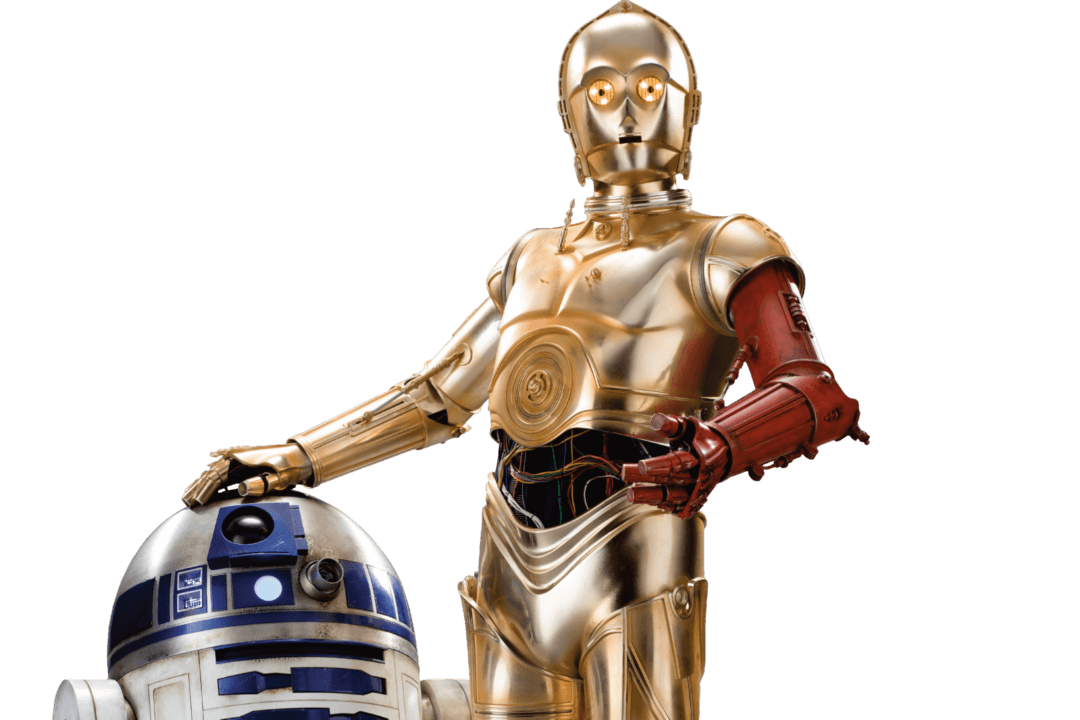

Artificial intelligence (AI) has been around for a long time, and people are still waiting for the first C-3PO (a character from “Star Wars”) to be released. Looking at the money big tech companies and venture capitalists are pouring into the sector, AI is making huge progress, although the investors are looking for different things than a talking robot.

“In the long run, I think we will evolve in computing from a mobile-first to an AI-first world. And I do think we’re at the forefront of developments,” said Sundar Pichai, CEO of Google Inc., on an earnings call with investors in April.

Google is the most active investor in AI with nine acquisitions completed since 2011.

In the long run, I think we will evolve in computing from a mobile-first to an AI-first world.

, CEO, Google Inc.