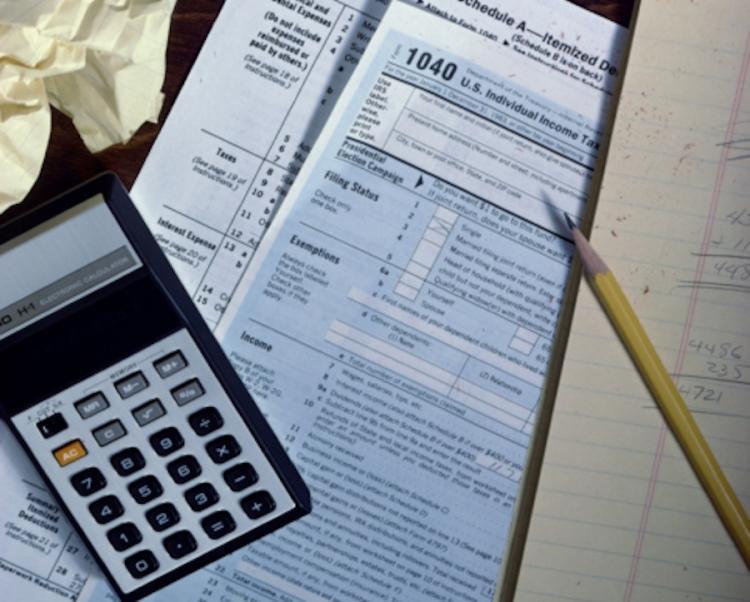

Those who itemize deductions must not file their tax returns until mid-February, according to the IRS. Congress changed tax laws at the end of 2009. The tax agency needs time to reprogram its systems to reflect the changes, it announced. Those who file the simple, 1040 EZ form may go ahead and file as soon as they have the information they need, such as W-2 forms from their employers.

Multiple tax provisions were set to expire at the end of 2009. Two were the higher education tuition and fees deduction, which allows people to deduct up to $4,000 of postsecondary school tuition, and the educator expense deduction, for teachers who pay out of pocket for classroom supplies. People claiming these deductions, among others, must wait to file their returns until the tax law changes are reflected in the tax agency’s software and procedures.

Taxpayers have an extra three days to file their returns and pay any taxes due this year. Emancipation Day, which is celebrated in the District of Columbia, will fall on Friday, April 15. As a result, the whole country gets a small extension.

More than 140 million tax returns should be filed this year, said the IRS in a statement. The agency warned people with offshore accounts and income to file and pay taxes properly, or face tough penalties. “The IRS has made important strides at stopping tax avoidance using offshore accounts,” said IRS Commissioner Doug Shulman in a statement. “We continue to focus on offshore tax compliance and people with offshore accounts need to pay taxes on income from those accounts.”

Multiple tax provisions were set to expire at the end of 2009. Two were the higher education tuition and fees deduction, which allows people to deduct up to $4,000 of postsecondary school tuition, and the educator expense deduction, for teachers who pay out of pocket for classroom supplies. People claiming these deductions, among others, must wait to file their returns until the tax law changes are reflected in the tax agency’s software and procedures.

Taxpayers have an extra three days to file their returns and pay any taxes due this year. Emancipation Day, which is celebrated in the District of Columbia, will fall on Friday, April 15. As a result, the whole country gets a small extension.

More than 140 million tax returns should be filed this year, said the IRS in a statement. The agency warned people with offshore accounts and income to file and pay taxes properly, or face tough penalties. “The IRS has made important strides at stopping tax avoidance using offshore accounts,” said IRS Commissioner Doug Shulman in a statement. “We continue to focus on offshore tax compliance and people with offshore accounts need to pay taxes on income from those accounts.”