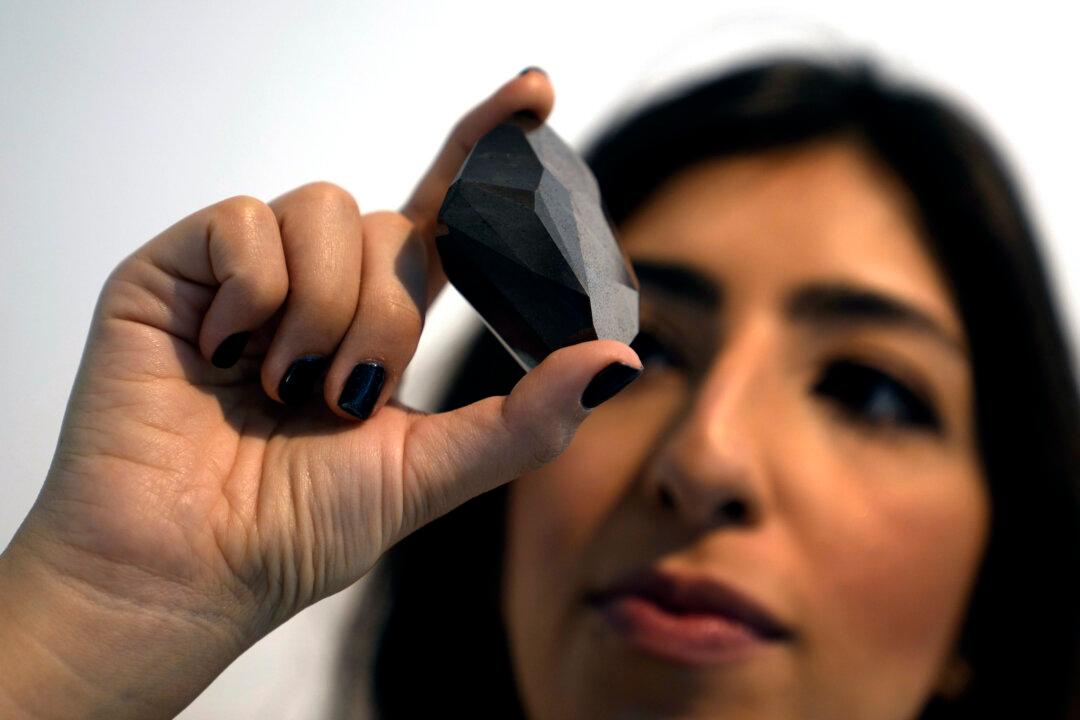

The British auction house Sotheby’s announced that they will be accepting payment in Bitcoin, Ethereum, or U.S. dollars for a rare black diamond known as “The Enigma.”

The 555.55-karat diamond is currently on show in Dubai, from whence it will travel to Los Angeles and London before going on a seven-day auction on Feb. 3. The Enigma, which holds the Guinness world record for the world’s largest cut diamond, is crafted to resemble the hamsa, an ancient North African symbol of protection associated with the number five. The Enigma draws upon the number as a motif, with 55 faces and the aforementioned karatage designed to reflect the concept.